Tech Stock Dip: Smart Buys Or Risky Investments?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tech Stock Dip: Smart Buys or Risky Investments? Navigating the Current Market Volatility

The tech sector has experienced a significant downturn recently, leaving many investors wondering: are these discounted prices a smart buying opportunity, or a sign of further risk? The recent volatility has shaken confidence, but understanding the underlying factors can help determine the best course of action. This article will explore the current situation, analyzing the potential benefits and drawbacks of investing in tech stocks during this dip.

Understanding the Dip: Why are Tech Stocks Falling?

Several factors contribute to the current tech stock slump. Firstly, rising interest rates significantly impact high-growth companies, many of which rely on future earnings projections rather than current profitability. Higher interest rates increase borrowing costs, making expansion more expensive and reducing the present value of future earnings. This is particularly relevant for tech companies that often reinvest heavily in research and development.

Secondly, inflation and a potential recession are casting a shadow on consumer spending. With tighter budgets, discretionary spending on tech products and services may decline, hitting revenue projections for many tech companies. This uncertainty fuels investor hesitation.

Finally, geopolitical instability and supply chain disruptions further complicate the picture. These factors contribute to overall economic uncertainty, impacting investor confidence across various sectors, but particularly those sensitive to global market fluctuations like the tech industry.

Is This a Buying Opportunity? Analyzing the Potential Rewards

While the risks are undeniable, the current downturn also presents potential opportunities for savvy investors. Many tech giants are trading at significantly lower valuations than they were just a few months ago. This presents a chance to acquire shares of established companies at discounted prices. For long-term investors, this could mean substantial returns once the market recovers.

- Strong Fundamentals: Many tech companies boast strong fundamentals, including substantial cash reserves and innovative product pipelines. A temporary downturn doesn't necessarily negate their long-term growth potential.

- Discounted Valuations: The current market correction has lowered the price-to-earnings (P/E) ratios of many tech stocks, making them more attractive from a valuation perspective.

- Potential for Growth: The tech sector remains a powerful driver of innovation and economic growth. A recovery is likely, although the timing remains uncertain.

The Risks Remain: Considering the Potential Downsides

Before jumping into the market, it's crucial to acknowledge the persistent risks:

- Further Market Decline: The possibility of further declines in the tech sector cannot be ignored. Economic headwinds could persist, leading to prolonged market weakness.

- Company-Specific Risks: Not all tech companies are created equal. Some may be more vulnerable to economic downturns than others. Thorough due diligence is crucial.

- Volatility: The tech sector is inherently volatile. Investors should be prepared for significant price swings, even in the context of a recovery.

Navigating the Market: Strategies for Informed Decision-Making

Investing during market volatility requires a cautious and strategic approach. Consider these points:

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio across different sectors and asset classes to mitigate risk.

- Long-Term Perspective: Tech stocks are typically better suited for long-term investors with a horizon of five years or more. Short-term fluctuations should be viewed within the context of a longer-term investment strategy.

- Due Diligence: Thoroughly research individual companies before investing. Analyze their financial statements, competitive landscape, and long-term growth prospects. Consult with a financial advisor if needed.

- Dollar-Cost Averaging: Consider a dollar-cost averaging strategy, investing a fixed amount at regular intervals regardless of market fluctuations. This helps mitigate the risk of investing a lump sum at a market low.

Conclusion:

The current tech stock dip presents a complex investment landscape. While the potential for rewards exists, investors must carefully weigh the associated risks. Thorough research, diversification, and a long-term perspective are crucial for navigating this uncertain market. Remember, this information is for general knowledge and doesn't constitute financial advice. Always consult with a qualified financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tech Stock Dip: Smart Buys Or Risky Investments?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Bears To Steelers Analyzing Rodgers Latest Comments

May 27, 2025

From Bears To Steelers Analyzing Rodgers Latest Comments

May 27, 2025 -

From Worst To First Ross Chastains Dramatic Coca Cola 600 Triumph

May 27, 2025

From Worst To First Ross Chastains Dramatic Coca Cola 600 Triumph

May 27, 2025 -

Roland Garros 2025 Can Haddad Maia Beat Baptiste Match Prediction And Betting Tips

May 27, 2025

Roland Garros 2025 Can Haddad Maia Beat Baptiste Match Prediction And Betting Tips

May 27, 2025 -

Hadthh Ejyb Njat Psr 14 Salh Az Byn Dw Dywar

May 27, 2025

Hadthh Ejyb Njat Psr 14 Salh Az Byn Dw Dywar

May 27, 2025 -

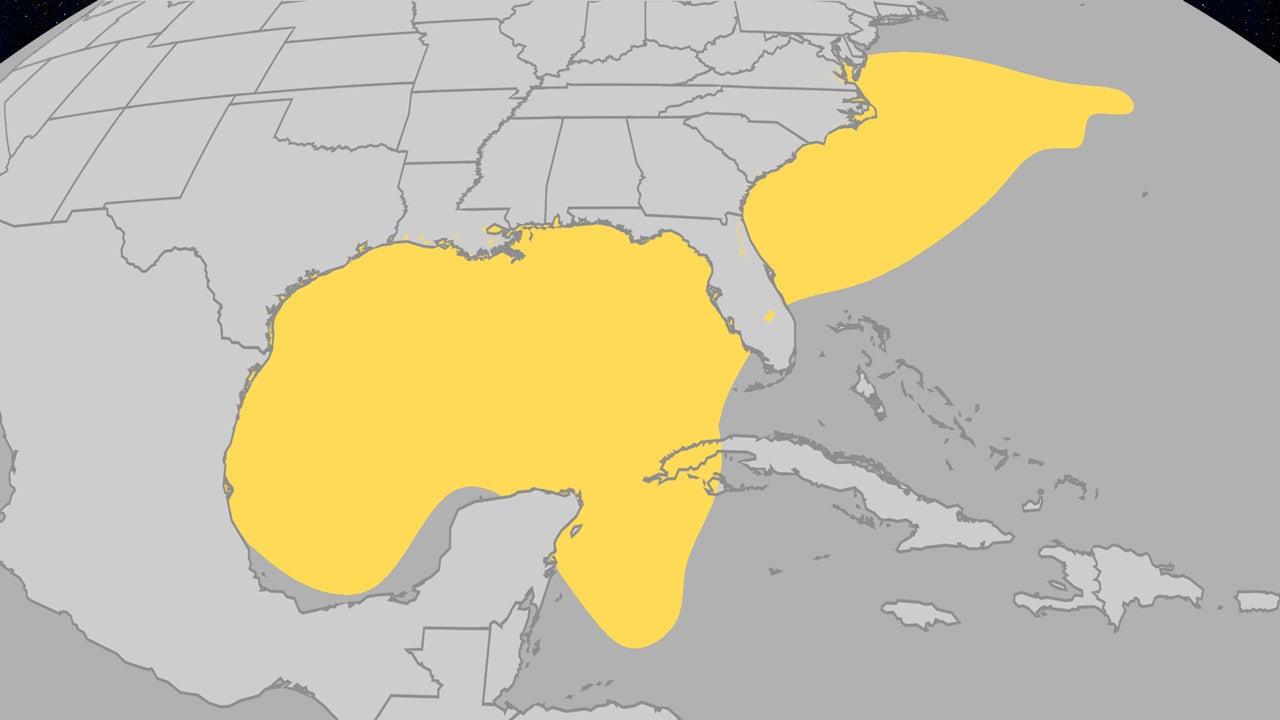

Where Do Atlantic Hurricanes Form In June Examining Recent Storm Development

May 27, 2025

Where Do Atlantic Hurricanes Form In June Examining Recent Storm Development

May 27, 2025