Swiss Banking Under Scrutiny: Stricter Capital Rules Target UBS

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Swiss Banking Under Scrutiny: Stricter Capital Rules Target UBS

Switzerland's financial landscape is bracing for significant change as stricter capital rules are set to impact its largest bank, UBS. The move comes amidst growing international pressure on global financial institutions to bolster their resilience against future economic shocks. This intensified scrutiny follows the tumultuous collapse of Credit Suisse, highlighting vulnerabilities within the Swiss banking system and prompting regulators to act decisively.

The Swiss Financial Market Supervisory Authority (FINMA) has announced a series of measures aimed at strengthening the capital base of systemically important banks, with UBS, as the country's largest institution, bearing the brunt of these new regulations. These stricter capital requirements are intended to ensure that UBS can withstand significant losses without jeopardizing the stability of the entire Swiss financial system. This proactive approach aims to prevent a repeat of the Credit Suisse crisis and maintain Switzerland's reputation as a stable and secure financial hub.

Increased Capital Buffers and Enhanced Scrutiny

The new rules will necessitate UBS holding substantially higher capital buffers than previously required. This translates to a larger pool of readily available funds to absorb potential losses, safeguarding depositors and maintaining market confidence. The precise details of the increased capital requirements are still being finalized, but industry analysts predict a substantial rise, potentially impacting UBS's lending capacity and profitability in the short term.

Beyond increased capital reserves, FINMA is also implementing enhanced supervisory oversight of UBS's risk management practices. This includes more rigorous stress tests, designed to simulate extreme market conditions and evaluate UBS's preparedness to navigate such scenarios. The heightened scrutiny reflects a broader global trend of increased regulatory oversight of systemically important financial institutions.

Impact on UBS and the Broader Swiss Economy

The implications of these stricter capital rules for UBS are considerable. The bank will likely need to adjust its strategic priorities, potentially reducing dividends or slowing down certain investment activities to meet the new capital requirements. This could, in turn, impact shareholder returns and the overall performance of the Swiss stock market.

However, the long-term benefits for the Swiss economy could outweigh the short-term challenges. By ensuring the stability of its largest bank, Switzerland aims to protect its reputation as a safe haven for investors and maintain its position as a global financial center. This stability will, in the long run, attract further foreign investment and boost economic growth.

Global Implications and Future of Banking Regulation

The stricter regulations imposed on UBS are not isolated to Switzerland. Globally, regulators are reassessing banking regulations in the wake of recent banking sector instability. This suggests a broader shift towards a more cautious and conservative approach to banking supervision, with a stronger focus on capital adequacy and risk management. The Basel Committee on Banking Supervision, the international standard-setter for banking regulation, is also expected to introduce further reforms in the coming years.

In conclusion, the increased scrutiny of Swiss banking, particularly the stricter capital rules targeting UBS, reflects a necessary response to the challenges faced by the global financial system. While the short-term implications for UBS may be significant, the long-term benefits for the stability of the Swiss economy and the broader global financial system are undeniable. The future of banking regulation will likely be shaped by events such as the Credit Suisse collapse and the resulting changes impacting institutions like UBS. Further developments will be closely monitored by investors and regulators worldwide.

Keywords: Swiss banking, UBS, capital rules, FINMA, Credit Suisse, banking regulation, Basel Committee on Banking Supervision, financial stability, risk management, global finance, Swiss economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Swiss Banking Under Scrutiny: Stricter Capital Rules Target UBS. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Find The Nike Air Max 95 Og Bright Mandarin Retailer List And Availability

Jun 07, 2025

Find The Nike Air Max 95 Og Bright Mandarin Retailer List And Availability

Jun 07, 2025 -

Resilient England New Generation Emerges After Key Retirements In Womens Football

Jun 07, 2025

Resilient England New Generation Emerges After Key Retirements In Womens Football

Jun 07, 2025 -

Steve Guttenbergs Shocking Transformation A Serial Killer On Lifetime

Jun 07, 2025

Steve Guttenbergs Shocking Transformation A Serial Killer On Lifetime

Jun 07, 2025 -

Dallas Stars Announce New Head Coach Coachs Name Takes The Helm

Jun 07, 2025

Dallas Stars Announce New Head Coach Coachs Name Takes The Helm

Jun 07, 2025 -

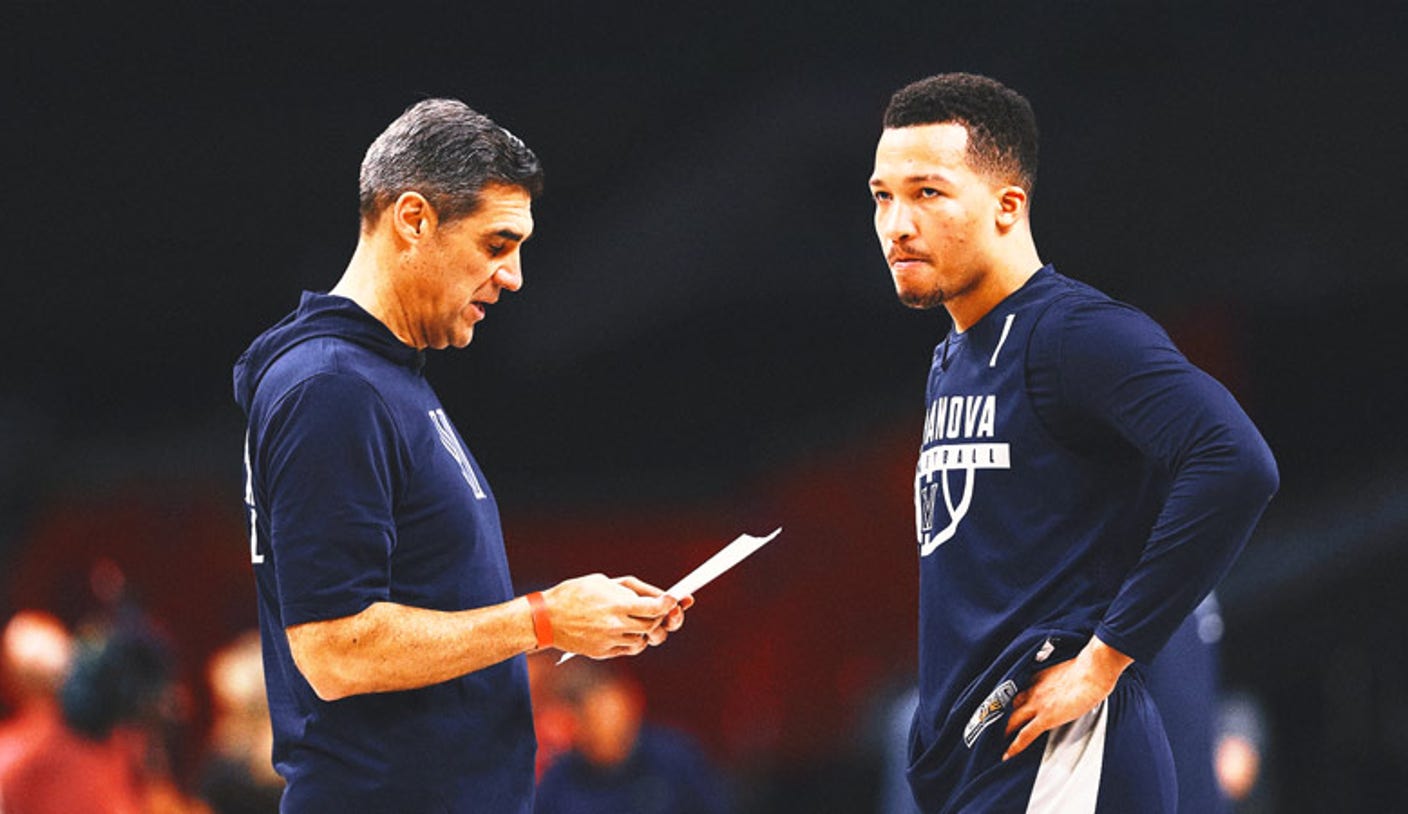

Would Top Coaches Hurley And Wright Consider The Knicks

Jun 07, 2025

Would Top Coaches Hurley And Wright Consider The Knicks

Jun 07, 2025