Super Micro's Stock Future: An Investor's Perspective On Potential Setbacks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro's Stock Future: Navigating Potential Setbacks for Investors

Super Micro Computer, Inc. (SMCI) has enjoyed a significant surge in its stock price, fueled by the booming demand for AI and high-performance computing. However, investors need to look beyond the current hype and consider potential setbacks that could impact SMCI's future performance. This article provides an in-depth analysis, offering investors a balanced perspective on the company's prospects and the challenges it faces.

H2: The Current Landscape: A Boom in Demand, but…

Super Micro's success is undeniably linked to the explosive growth of the artificial intelligence (AI) market. Their servers, known for their efficiency and scalability, are in high demand from major cloud providers and data centers worldwide. This has led to impressive revenue growth and a positive market outlook for the company. Recent financial reports highlight strong earnings and promising future projections. However, relying solely on this narrative would be a mistake.

H2: Potential Setbacks to Consider:

While the future looks bright, several factors could significantly impact Super Micro's stock performance:

-

Increased Competition: The server market is intensely competitive. Established players like Dell, HP, and Lenovo, along with rising competitors specializing in AI hardware, constantly challenge Super Micro's market share. Innovation and maintaining a competitive edge are crucial for long-term success.

-

Supply Chain Disruptions: The global supply chain remains fragile. Any unforeseen disruptions, such as geopolitical instability or natural disasters, could impact component availability and production timelines, affecting SMCI's ability to meet demand and potentially impacting its bottom line. This is a significant risk for any hardware manufacturer.

-

Economic Slowdown: A global economic slowdown could reduce capital expenditures by data centers and cloud providers, directly affecting demand for Super Micro's products. Economic uncertainty always casts a shadow on growth stocks.

-

Dependence on Specific Customers: While Super Micro boasts a diverse clientele, over-reliance on a few key customers could make them vulnerable to shifts in those customers' purchasing decisions. Diversification of its customer base is crucial for mitigating this risk.

-

Technological Advancements: The rapid pace of technological change in the computing industry means that Super Micro needs to continuously innovate and adapt to maintain its competitive advantage. Failure to do so could lead to obsolescence and decreased market share.

H2: Investor Strategies for Navigating Uncertainty:

Given the potential setbacks, investors should adopt a cautious yet optimistic approach:

-

Diversification: Don't put all your eggs in one basket. Diversify your portfolio to mitigate the risk associated with investing in a single stock, particularly one in a volatile sector.

-

Fundamental Analysis: Thoroughly research Super Micro's financial statements, paying close attention to its debt levels, profitability, and cash flow. Understand the company's long-term strategy and its ability to execute it effectively.

-

Long-Term Perspective: The tech sector is prone to cyclical fluctuations. A long-term investment horizon is often more suitable for navigating these ups and downs. Consider the company's potential for growth over several years, rather than focusing solely on short-term price movements.

-

Stay Informed: Keep abreast of industry news, financial reports, and analyst opinions to stay informed about Super Micro's performance and the broader market trends.

H3: Seeking Professional Advice:

Before making any investment decisions, consult with a qualified financial advisor. They can help you assess your risk tolerance and develop an investment strategy that aligns with your financial goals.

H2: Conclusion:

Super Micro's stock presents both significant opportunities and inherent risks. By carefully considering the potential setbacks and adopting a well-informed investment strategy, investors can position themselves to navigate the uncertainties and potentially benefit from Super Micro's continued growth in the exciting world of AI and high-performance computing. However, remember that past performance is not indicative of future results. Due diligence is paramount.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro's Stock Future: An Investor's Perspective On Potential Setbacks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Spectator Experience Drives Roland Garros Night Session Scheduling Confirms French Tennis Federation

May 28, 2025

Spectator Experience Drives Roland Garros Night Session Scheduling Confirms French Tennis Federation

May 28, 2025 -

Mlb Milestone Broken Jacob De Groms Strikeout Less Start

May 28, 2025

Mlb Milestone Broken Jacob De Groms Strikeout Less Start

May 28, 2025 -

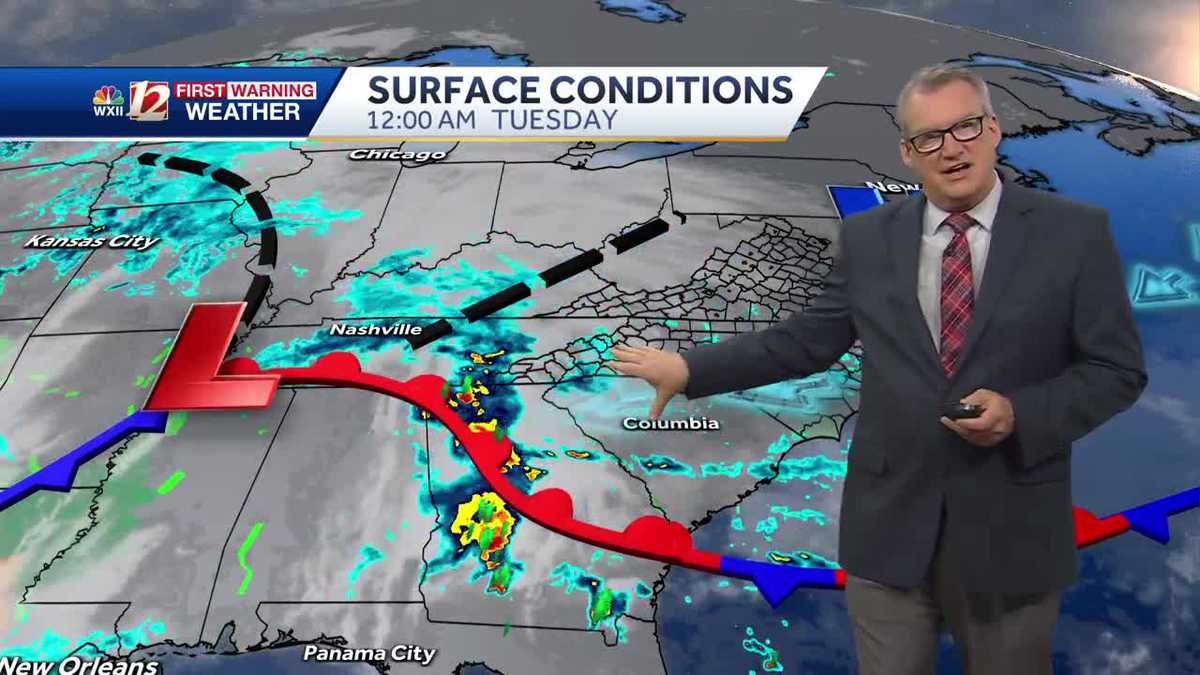

Brace For A Cool Wet Tuesday Weather Update

May 28, 2025

Brace For A Cool Wet Tuesday Weather Update

May 28, 2025 -

Aj Coles 2025 Contract Analyzing The Raiders Investment In The Nfls Top Punter

May 28, 2025

Aj Coles 2025 Contract Analyzing The Raiders Investment In The Nfls Top Punter

May 28, 2025 -

Nba Playoffs Will Karl Anthony Towns Knicks Boost Continue Against Pacers

May 28, 2025

Nba Playoffs Will Karl Anthony Towns Knicks Boost Continue Against Pacers

May 28, 2025