Super Micro Stock Outlook: Investor Sees Limited Upside Potential

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro Stock Outlook: Investor Sees Limited Upside Potential

Super Micro Computer (SMCI) has been a tech darling, riding the wave of surging demand for data center infrastructure. However, a recent analyst report casts a shadow on the company's future, suggesting limited upside potential for investors. This cautious outlook, while surprising to some, highlights potential challenges looming on the horizon for the data center hardware giant.

Analyst Concerns and Market Sentiment Shift:

The bearish sentiment stems from a recent analysis by [Name of Analyst Firm/Analyst], who pointed to several key factors dampening their enthusiasm for SMCI stock. These include:

-

Increased Competition: The data center hardware market is becoming increasingly competitive, with established players like Dell Technologies and Hewlett Packard Enterprise, as well as newer entrants, vying for market share. This heightened competition could squeeze Super Micro's profit margins.

-

Supply Chain Challenges: While the acute phase of the global chip shortage seems to be easing, lingering supply chain disruptions and potential geopolitical instability could still impact Super Micro's production and delivery timelines.

-

Valuation Concerns: Some analysts believe that SMCI's current stock price reflects a somewhat optimistic view of its future growth prospects. The valuation may be stretched, considering the aforementioned challenges.

-

Economic Slowdown: The potential for a global economic slowdown could significantly impact demand for data center infrastructure, negatively affecting Super Micro's revenue growth. Concerns about a recession are weighing heavily on investor sentiment across various sectors.

Super Micro's Strengths and Counterarguments:

Despite the bearish outlook, Super Micro possesses several strengths that could mitigate some of these risks:

-

Strong Market Position: Super Micro holds a strong position in the market, particularly in niche segments. Their focus on energy-efficient solutions and customized designs gives them a competitive edge.

-

Innovation and R&D: The company invests significantly in research and development, consistently introducing innovative products to meet evolving market needs. This commitment to innovation is crucial for maintaining competitiveness.

-

Growth in Specific Sectors: While overall market growth may slow, Super Micro could continue to see growth in specific sectors like AI and high-performance computing (HPC), where demand remains strong.

What This Means for Investors:

The analyst's prediction of limited upside potential doesn't necessarily signal an immediate collapse in SMCI's stock price. However, it suggests that investors should approach the stock with caution. Investors should carefully consider the potential risks before making any investment decisions. Diversification within a broader investment portfolio is always recommended.

Looking Ahead:

Super Micro's future performance will largely depend on its ability to navigate the increased competition, manage supply chain complexities, and maintain its innovative edge. Keeping a close eye on the company's earnings reports and industry trends will be crucial for investors. Further analysis of the company's financial statements and market positioning is recommended before making any investment decisions. Consider consulting with a financial advisor for personalized guidance.

Disclaimer: This article provides general information and should not be considered as financial advice. Investment decisions should be based on thorough research and consultation with a qualified financial advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro Stock Outlook: Investor Sees Limited Upside Potential. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Updated Ufl Power Rankings 2025 Battlehawks And Stallions Rise Defenders And Panthers Fall

May 28, 2025

Updated Ufl Power Rankings 2025 Battlehawks And Stallions Rise Defenders And Panthers Fall

May 28, 2025 -

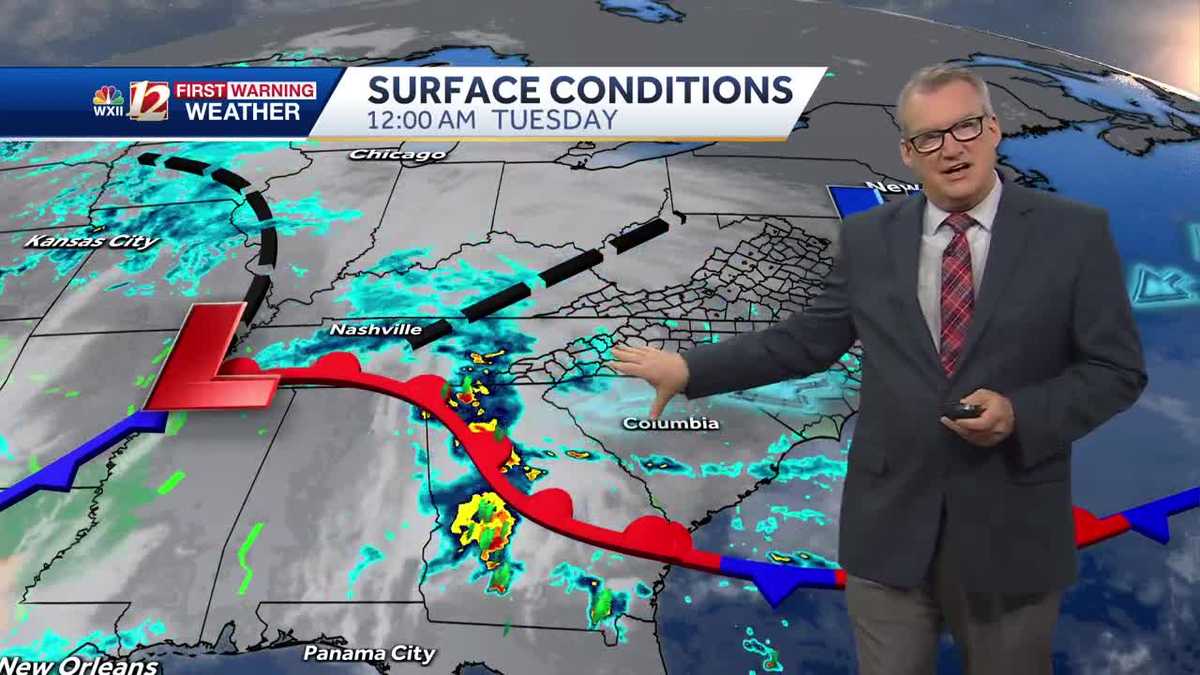

Cool And Wet Tuesday Expect Downpours And Chilly Temperatures

May 28, 2025

Cool And Wet Tuesday Expect Downpours And Chilly Temperatures

May 28, 2025 -

Investor Skepticism Casts Shadow On Super Micro Computers Future Growth

May 28, 2025

Investor Skepticism Casts Shadow On Super Micro Computers Future Growth

May 28, 2025 -

French Open Womens Singles First Round A Photo Recap

May 28, 2025

French Open Womens Singles First Round A Photo Recap

May 28, 2025 -

Shift In Us Policy Tougher Immigration Rules For Cubans Under Trump Administration

May 28, 2025

Shift In Us Policy Tougher Immigration Rules For Cubans Under Trump Administration

May 28, 2025