Super Micro: Predicting And Preparing For A Stock Market Correction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro: Predicting and Preparing for a Stock Market Correction

The tech sector, and particularly high-growth companies, has seen significant volatility recently. Super Micro Computer, Inc. (SMCI), a leading provider of data center, cloud computing, and enterprise storage solutions, is not immune to the broader market trends. While SMCI enjoys a strong position in its market, understanding and preparing for potential stock market corrections is crucial for investors. This article delves into predicting and preparing for such a correction, focusing on Super Micro's unique position within the tech landscape.

<h3>Understanding the Current Market Climate</h3>

The current market is characterized by several factors that contribute to uncertainty and the possibility of a correction. High inflation, rising interest rates, and geopolitical instability all play significant roles. While Super Micro's strong fundamentals – including consistent revenue growth and innovation in areas like AI and high-performance computing – provide a buffer, external factors can still impact its stock price. Analyzing macroeconomic indicators like the Consumer Price Index (CPI) and the Federal Reserve's monetary policy decisions is vital for predicting potential market shifts. [Link to reputable financial news source discussing macroeconomic indicators].

<h3>Super Micro's Strengths and Vulnerabilities</h3>

Super Micro's robust product portfolio and focus on cutting-edge technologies position it favorably for long-term growth. Its strong presence in the rapidly expanding data center and cloud computing markets is a significant advantage. However, the company is not without vulnerabilities. Supply chain disruptions, increased competition, and potential shifts in customer demand could impact its financial performance. Understanding these factors is crucial in assessing its resilience during a market correction.

<h3>Predicting a Correction: Key Indicators</h3>

Predicting a stock market correction with certainty is impossible. However, several indicators can suggest an increased likelihood. These include:

- Inverted Yield Curve: When short-term interest rates exceed long-term rates, it often signals an impending recession.

- High Valuation Ratios: Overvalued stocks are more susceptible to price drops during corrections. Analyzing Super Micro's Price-to-Earnings (P/E) ratio and other key valuation metrics is crucial.

- Increased Volatility: Sharp fluctuations in the stock market can indicate underlying uncertainty and potential for a correction.

- Economic Slowdown: Signs of a weakening economy, such as declining consumer spending or manufacturing output, can precede a market downturn.

<h3>Preparing for a Correction: Strategies for SMCI Investors</h3>

Investors should employ a diversified investment strategy to mitigate risk. For Super Micro investors specifically, consider these strategies:

- Diversify your portfolio: Don't put all your eggs in one basket. Holding a mix of stocks across different sectors can help cushion the impact of a correction in any single sector.

- Reassess your risk tolerance: Are you comfortable with the potential for significant price fluctuations? Adjust your investment strategy accordingly.

- Dollar-cost averaging: Instead of investing a lump sum, gradually invest smaller amounts over time. This strategy can reduce the impact of market volatility.

- Long-term perspective: Remember that market corrections are a normal part of the investment cycle. Focusing on the long-term prospects of Super Micro can help you weather short-term fluctuations.

<h3>Conclusion: Navigating Uncertainty with SMCI</h3>

While predicting a market correction with precision is challenging, understanding the potential risks and implementing appropriate strategies is essential for investors in Super Micro Computer. By carefully analyzing market indicators, assessing SMCI's strengths and weaknesses, and adopting a well-diversified investment approach, investors can navigate market uncertainty and potentially capitalize on long-term growth opportunities. Remember to consult with a financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro: Predicting And Preparing For A Stock Market Correction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Emlyat Amdad W Njat Psr 14 Salh Mhbws Dr Myan Dw Dywar

May 27, 2025

Emlyat Amdad W Njat Psr 14 Salh Mhbws Dr Myan Dw Dywar

May 27, 2025 -

Mets Juan Soto Ends Hitting Skid Xbh Signals Potential Turnaround

May 27, 2025

Mets Juan Soto Ends Hitting Skid Xbh Signals Potential Turnaround

May 27, 2025 -

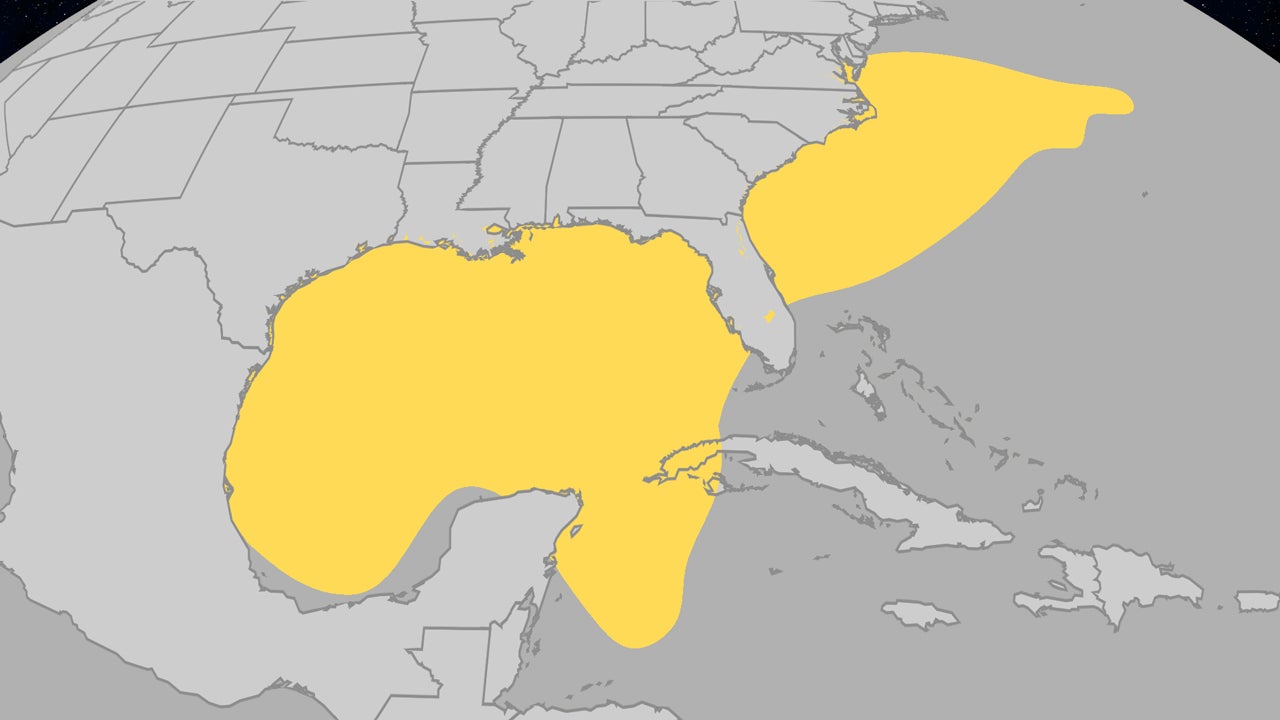

Where Do Atlantic Hurricanes Form In June Understanding The Seasons Start

May 27, 2025

Where Do Atlantic Hurricanes Form In June Understanding The Seasons Start

May 27, 2025 -

Smart Investment 2 S And P 500 Stocks To Buy During Market Correction

May 27, 2025

Smart Investment 2 S And P 500 Stocks To Buy During Market Correction

May 27, 2025 -

Super Micro Analyzing The Potential For A Stock Market Correction

May 27, 2025

Super Micro Analyzing The Potential For A Stock Market Correction

May 27, 2025