Super Micro: Is There Room For Disappointment In The Stock's Future?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro: Is There Room for Disappointment in the Stock's Future?

Super Micro Computer, Inc. (SMCI) has enjoyed a remarkable run, fueled by the explosive growth of the data center and artificial intelligence (AI) markets. However, with the stock price reaching new heights, many investors are wondering: is there room for disappointment? This article delves into Super Micro's current position, future prospects, and the potential risks that could impact its stock performance.

Super Micro's Strengths: A Solid Foundation for Growth

Super Micro's success stems from its position as a leading provider of high-performance computing (HPC) solutions. Their server systems are highly sought after for their energy efficiency, scalability, and support for cutting-edge technologies like AI and machine learning. This specialization has allowed them to capitalize on the booming demand for data center infrastructure, a market projected to experience continued significant growth in the coming years.

- Dominant Market Share: Super Micro holds a substantial market share in specific server segments, giving them a competitive edge.

- Technological Innovation: Continuous investment in R&D ensures they stay ahead of the curve, offering advanced solutions to meet evolving customer needs.

- Strategic Partnerships: Collaborations with key players in the technology industry further solidify their market position.

- Strong Financial Performance: Super Micro has consistently delivered robust financial results, demonstrating its ability to translate market demand into profitability.

Potential Headwinds: Navigating the Challenges Ahead

While the outlook for Super Micro remains positive, several factors could potentially dampen future growth and investor sentiment.

- Increased Competition: The server market is increasingly competitive, with larger players vying for market share. This competition could pressure margins and limit growth potential.

- Supply Chain Disruptions: Global supply chain issues could impact production and delivery timelines, affecting revenue and profitability. [Link to an article about global supply chain issues]

- Economic Slowdown: A broader economic slowdown could reduce demand for data center infrastructure, impacting Super Micro's sales.

- Valuation Concerns: With the stock price reaching significant heights, some analysts express concerns about its current valuation, suggesting potential for a correction.

Analyzing the Risks: A Balanced Perspective

It's crucial to approach Super Micro's future with a balanced perspective. While the company faces challenges, its strengths are significant. The continued growth of the data center and AI markets presents a substantial opportunity for Super Micro to expand its business. However, investors should carefully consider the potential risks mentioned above before making any investment decisions.

What to Watch For:

Keep an eye on the following key indicators to gauge Super Micro's future performance:

- Revenue growth in key market segments: Sustained growth in AI and HPC segments is crucial.

- Gross margin trends: Maintaining healthy margins amidst competition is vital.

- Supply chain improvements: Addressing supply chain vulnerabilities will be key to consistent performance.

- Guidance from management: Pay close attention to management's outlook and expectations for future quarters.

Conclusion: A Promising Future with Inherent Risks

Super Micro's future prospects remain promising, driven by the explosive growth of the data center and AI markets. However, investors should be aware of the potential risks, including increased competition, supply chain disruptions, and economic headwinds. A thorough understanding of these factors is crucial for making informed investment decisions. Thorough due diligence and monitoring of key performance indicators are essential for navigating the complexities of this exciting, yet volatile, sector.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro: Is There Room For Disappointment In The Stock's Future?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Renegades Vs Showboats Ufl Week 9 Game Delayed Due To Inclement Weather

May 27, 2025

Renegades Vs Showboats Ufl Week 9 Game Delayed Due To Inclement Weather

May 27, 2025 -

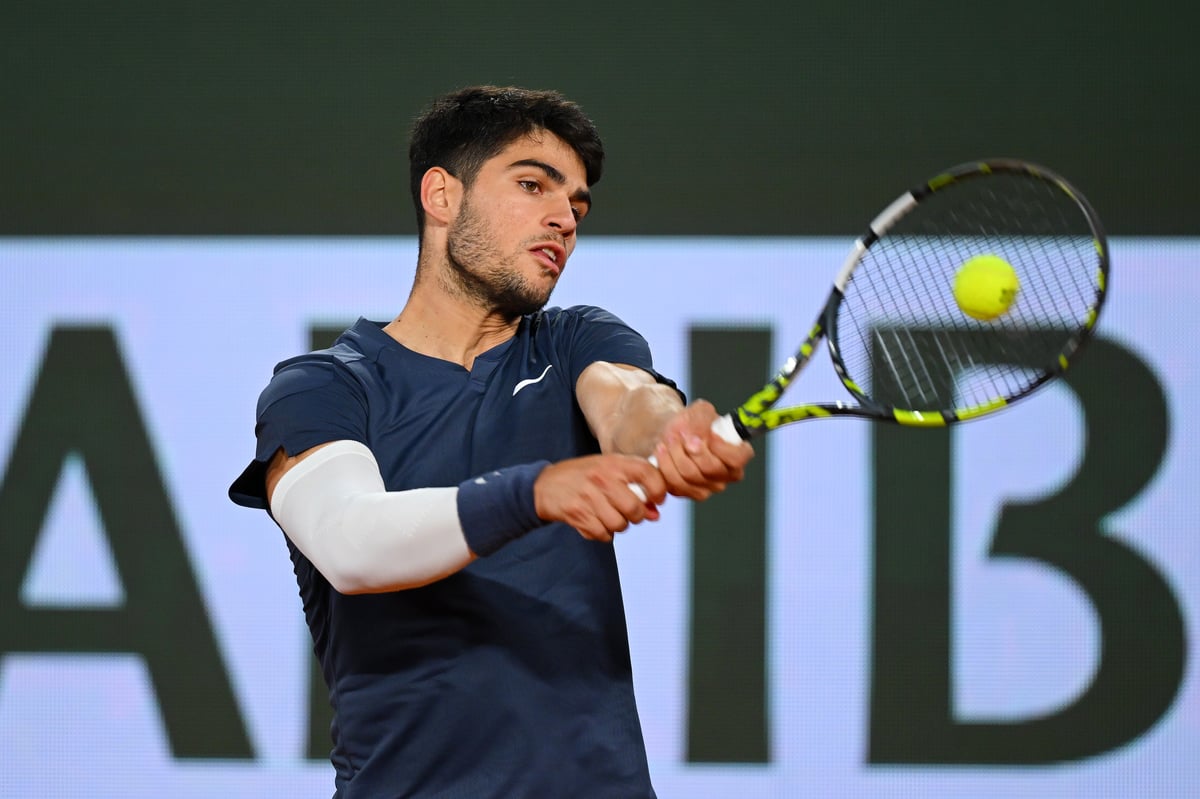

Watch The French Open 2025 On Tv And Online A Uk Viewers Guide

May 27, 2025

Watch The French Open 2025 On Tv And Online A Uk Viewers Guide

May 27, 2025 -

Alex Palous Dominant Indy 500 Performance A Masterclass In Oval Racing

May 27, 2025

Alex Palous Dominant Indy 500 Performance A Masterclass In Oval Racing

May 27, 2025 -

Against The Odds Oregon Man Sails To Hawaii With His Cat Phoenix

May 27, 2025

Against The Odds Oregon Man Sails To Hawaii With His Cat Phoenix

May 27, 2025 -

Chastain Edges Out Byron For Thrilling Coca Cola 600 Win

May 27, 2025

Chastain Edges Out Byron For Thrilling Coca Cola 600 Win

May 27, 2025