Super Micro: Investor Sees Limited Upside, Potential For Stock Underperformance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro: Investor Warns of Limited Upside, Potential Stock Underperformance

Super Micro Computer, Inc. (SMCI), a leading provider of high-performance computing solutions, is facing a cautious outlook from at least one investor. Recent analyses suggest limited upside potential for the company's stock, raising concerns about potential underperformance in the near future. This news comes as a surprise to some, given Super Micro's strong position in the rapidly expanding data center and AI markets. But what are the specific concerns driving this bearish sentiment? Let's delve into the details.

Concerns Regarding Super Micro's Future Growth

The primary concern revolves around Super Micro's valuation and the potential for slower-than-expected growth. While the company has consistently reported strong revenue growth in recent quarters, fuelled by the booming demand for AI infrastructure and high-performance computing (HPC), some analysts believe this growth may not be sustainable at its current pace. The increasing competition in the server market, coupled with potential macroeconomic headwinds, is contributing to this cautious outlook.

Analyst Predictions and Market Reaction

One prominent investment firm recently downgraded Super Micro's stock, citing concerns about valuation and the potential for a slowdown in revenue growth. This sparked a negative market reaction, with the SMCI stock price experiencing a dip following the announcement. The analyst report highlighted several factors contributing to their bearish prediction, including:

- High Valuation: Some believe Super Micro's stock is currently overvalued relative to its peers and future growth prospects.

- Supply Chain Challenges: Ongoing supply chain disruptions and potential component shortages could impact the company's production capacity and profitability.

- Increased Competition: The server market is becoming increasingly competitive, with major players vying for market share. This could put pressure on Super Micro's pricing and margins.

Super Micro's Response and Future Outlook

Super Micro has not yet publicly responded to these concerns. However, the company's consistent track record of innovation and its strong presence in key growth markets suggest a capacity for resilience. Their focus on green computing and energy-efficient solutions positions them well for the long term, even amidst short-term challenges.

What this Means for Investors

The current situation presents a complex scenario for investors. While Super Micro operates in a high-growth sector with significant long-term potential, the near-term outlook appears less certain. Investors should carefully consider the risks and rewards before making any investment decisions. Conduct thorough due diligence and consider consulting with a financial advisor to assess your personal risk tolerance and investment goals.

Further Research and Resources:

For more detailed financial information on Super Micro Computer, Inc., you can visit their investor relations website: [Link to Super Micro Investor Relations Website]. You can also access financial news and analysis from reputable sources such as the Wall Street Journal, Bloomberg, and Reuters. Remember to always rely on multiple sources when conducting your own research.

Disclaimer: This article provides general information and commentary only and does not constitute investment advice. The information presented here should not be interpreted as a recommendation to buy or sell any securities. Investing involves risk, and past performance is not indicative of future results. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro: Investor Sees Limited Upside, Potential For Stock Underperformance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unstoppable Paolini Seventh Straight Win At Roland Garros Yuan Falls

May 28, 2025

Unstoppable Paolini Seventh Straight Win At Roland Garros Yuan Falls

May 28, 2025 -

Anthony Edwards Julius Randle Struggle As Thunder Wins Game 4

May 28, 2025

Anthony Edwards Julius Randle Struggle As Thunder Wins Game 4

May 28, 2025 -

Survey Reveals Portugal As The Most Popular European Destination For American Expats

May 28, 2025

Survey Reveals Portugal As The Most Popular European Destination For American Expats

May 28, 2025 -

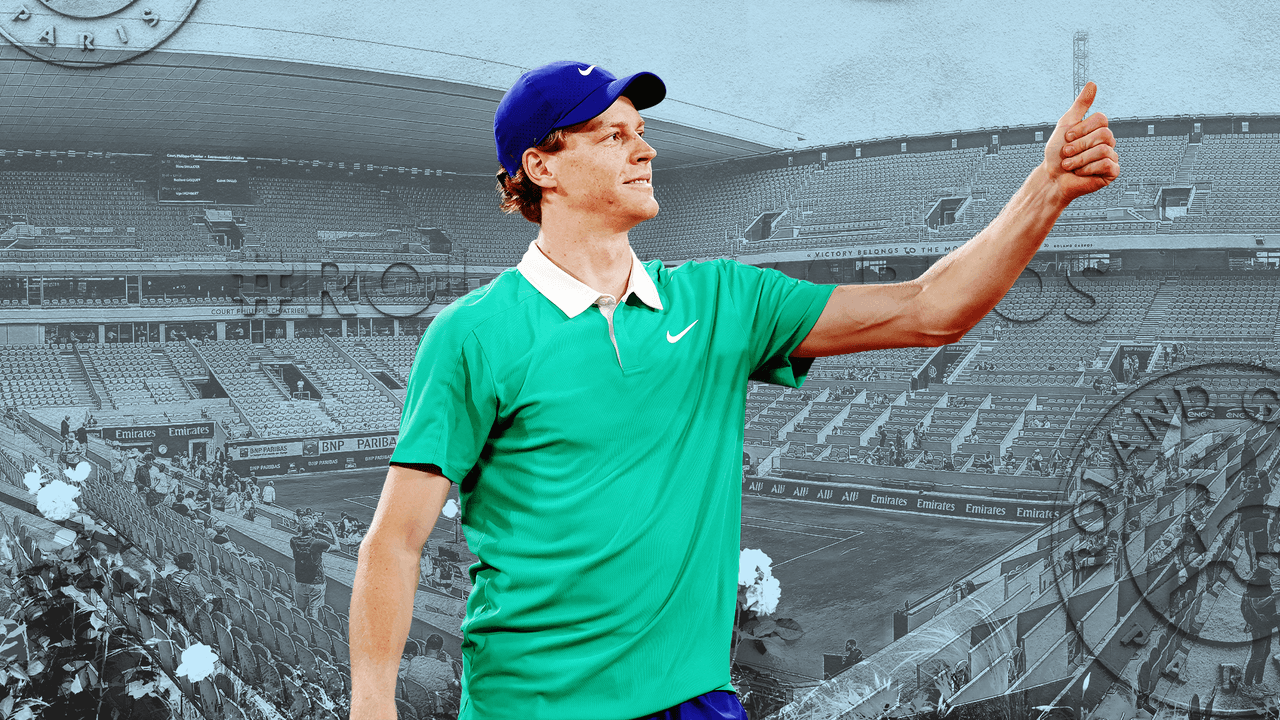

Sinner Al Roland Garros 2025 Streaming Live Del Secondo Turno Contro Richard Gasquet E Successivi Incontri

May 28, 2025

Sinner Al Roland Garros 2025 Streaming Live Del Secondo Turno Contro Richard Gasquet E Successivi Incontri

May 28, 2025 -

Alex Palous Triumph A Historic Indy 500 Win For Spain

May 28, 2025

Alex Palous Triumph A Historic Indy 500 Win For Spain

May 28, 2025