Super Micro Computer's Stock Price: Potential For A Correction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro Computer's Stock Price: Potential for a Correction?

Super Micro Computer (SMCI) has enjoyed a remarkable run, fueled by strong growth in the data center and cloud computing markets. However, recent market performance and analyst predictions suggest the possibility of a stock price correction. This article delves into the factors contributing to this potential downturn, examining both the positive and negative aspects of SMCI's current trajectory.

SMCI's Recent Success: A Closer Look

Super Micro Computer's success is undeniable. The company has consistently delivered strong financial results, driven by increasing demand for its high-performance computing (HPC) solutions. Their focus on green computing and sustainable solutions has also resonated with environmentally conscious businesses, further solidifying their market position. This growth has been reflected in a significant rise in SMCI's stock price over the past few years. However, this impressive growth trajectory raises questions about its sustainability and the potential for a market correction.

Factors Suggesting a Potential Correction

Several factors point towards a potential SMCI stock price correction:

-

Overvaluation: Some analysts argue that SMCI's current stock price is overvalued compared to its fundamental performance and future growth projections. This valuation gap often precedes a correction, as the market adjusts to a more realistic price. Understanding the price-to-earnings (P/E) ratio and other key valuation metrics is crucial in assessing this risk. [Link to reputable financial analysis site explaining P/E ratios]

-

Market Volatility: The broader tech sector has experienced significant volatility recently, impacting even the most robust companies. Geopolitical uncertainty, inflation concerns, and rising interest rates all contribute to this market instability, making SMCI vulnerable to a downturn.

-

Competition: The high-performance computing market is fiercely competitive. Established players and emerging startups constantly challenge Super Micro Computer's dominance, putting pressure on margins and potentially slowing growth. Understanding the competitive landscape is key to assessing SMCI's long-term prospects. [Link to industry analysis report on HPC market competition]

-

Supply Chain Issues: While easing, lingering supply chain disruptions could still impact SMCI's production capabilities and delivery timelines. These issues can negatively affect revenue and profitability, impacting investor confidence.

Should You Sell? A Cautious Approach

Predicting market corrections with certainty is impossible. While the factors mentioned above suggest a potential correction for SMCI, it's crucial to adopt a cautious, long-term perspective. Investors should carefully analyze their risk tolerance and investment goals before making any decisions.

Long-Term Prospects Remain Positive (with caveats)

Despite the potential for a correction, Super Micro Computer's long-term prospects remain positive. The continued growth of the data center and cloud computing markets provides a strong foundation for future growth. However, investors should closely monitor SMCI's financial performance, competitive landscape, and the overall market conditions.

Conclusion: Informed Decisions are Key

The potential for a Super Micro Computer stock price correction warrants close attention. Investors should conduct thorough due diligence, considering both the positive and negative factors discussed above. Informed decision-making, based on a comprehensive understanding of the company's performance and the broader market dynamics, is crucial for navigating this potential period of volatility. Remember to consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro Computer's Stock Price: Potential For A Correction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Portugal E Mocambique Acordo De Credito Impulsiona Cooperacao Bilateral

May 28, 2025

Portugal E Mocambique Acordo De Credito Impulsiona Cooperacao Bilateral

May 28, 2025 -

2025 Social Security Check Dates Your Complete Payment Calendar

May 28, 2025

2025 Social Security Check Dates Your Complete Payment Calendar

May 28, 2025 -

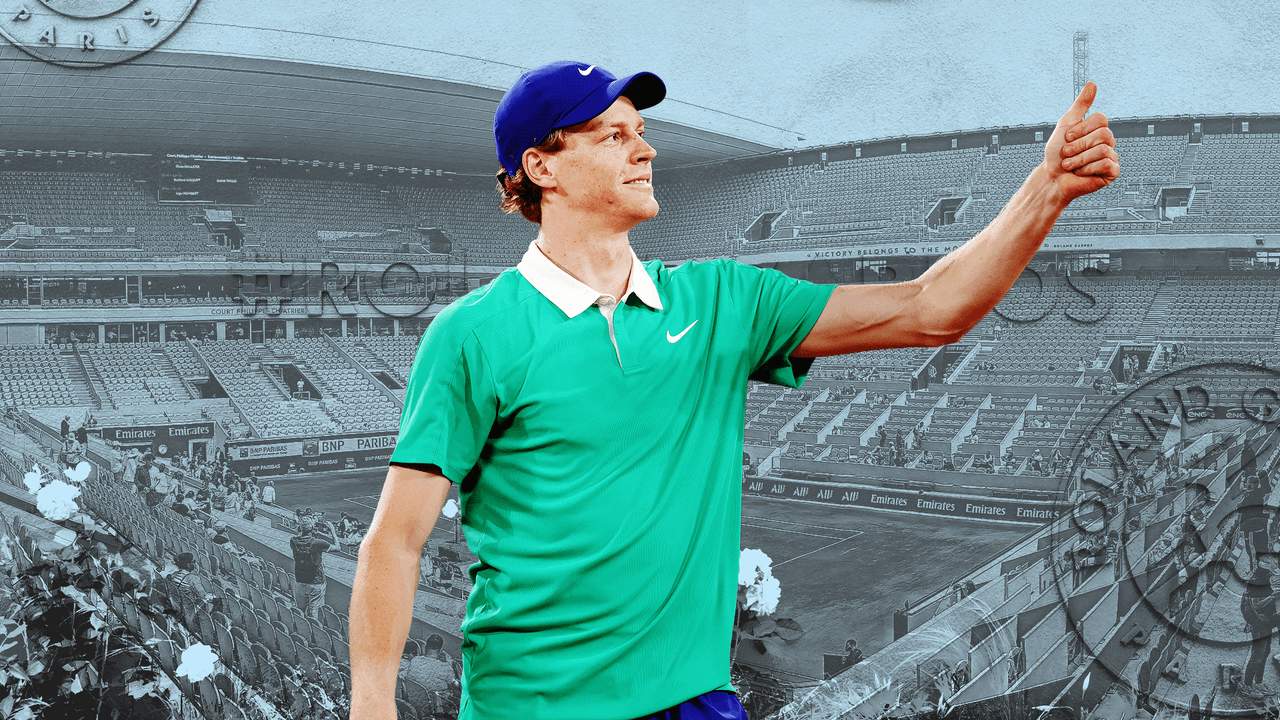

Sinner Al Roland Garros 2025 Dove Vedere In Streaming Tutte Le Partite Inclusi Gli Incontri Del Secondo Turno Con Gasquet

May 28, 2025

Sinner Al Roland Garros 2025 Dove Vedere In Streaming Tutte Le Partite Inclusi Gli Incontri Del Secondo Turno Con Gasquet

May 28, 2025 -

French Open A Look At The Womens Singles First Round Matches

May 28, 2025

French Open A Look At The Womens Singles First Round Matches

May 28, 2025 -

Action And Emotion Capturing The 109th Indy 500 Through Photography

May 28, 2025

Action And Emotion Capturing The 109th Indy 500 Through Photography

May 28, 2025