Super Micro Computer Stock Outlook: An Investor's Cautious Assessment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro Computer Stock Outlook: An Investor's Cautious Assessment

Super Micro Computer (SMCI) has seen a significant surge in its stock price recently, fueled by the burgeoning demand for AI hardware. But is this growth sustainable? This article offers a cautious assessment of Super Micro Computer's stock outlook, examining the factors driving its current performance and the potential risks investors should consider.

The AI Boom: Fueling Super Micro's Growth

The undeniable driver of Super Micro's recent success is the explosive growth of the artificial intelligence (AI) market. The company's server systems, particularly those equipped with high-performance computing (HPC) capabilities, are crucial for powering AI data centers and cloud infrastructure. This increased demand has translated into substantial revenue growth for SMCI, leading to investor optimism. Major cloud providers like [link to relevant news article about cloud providers' AI investments], are significant customers, highlighting the strategic importance of Super Micro in the AI ecosystem.

Positive Financials, But Challenges Remain

Super Micro's recent financial reports paint a positive picture, with impressive year-over-year revenue growth. However, investors need to look beyond the headline numbers. Supply chain disruptions, though easing, remain a concern. Furthermore, increased competition from established tech giants like [mention competitors like Dell, HP, etc. with links] presents a significant challenge to maintaining its market share. The company's dependence on the volatile AI market also poses a risk; a slowdown in AI investment could significantly impact Super Micro's future performance.

Analyzing the Risks: A Balanced Perspective

While the AI boom presents a compelling growth story for Super Micro, several factors warrant a cautious approach:

- Valuation: With the recent stock price surge, Super Micro's valuation may be becoming stretched. Investors need to carefully assess whether the current price reflects the company's long-term growth potential.

- Competition: The server market is fiercely competitive. Maintaining a competitive edge requires continuous innovation and investment in research and development.

- Geopolitical Risks: Global economic uncertainty and geopolitical tensions could impact supply chains and demand for Super Micro's products.

- Dependence on AI: Over-reliance on the AI sector exposes Super Micro to the risks inherent in a rapidly evolving and potentially volatile market.

H3: What Should Investors Do?

Given these factors, a cautious approach is recommended. While Super Micro's position in the AI market is undeniably strong, investors should carefully consider the risks before making significant investments. Diversification is crucial, and thorough due diligence, including analyzing competitor strategies and future market projections, is essential.

H3: Long-Term Outlook: A Measured Optimism?

The long-term outlook for Super Micro remains somewhat positive, driven by the continued growth of the AI market. However, the company's success hinges on its ability to navigate the challenges outlined above. Continuous innovation, strategic partnerships, and effective management of supply chain risks will be crucial for sustaining its growth trajectory. Investors should monitor key performance indicators (KPIs) closely and reassess their investment strategy regularly.

Conclusion:

Super Micro Computer's stock presents both opportunities and risks. While the AI boom offers a strong tailwind, investors need a balanced perspective, considering the competitive landscape, valuation, and geopolitical factors. Careful analysis and a diversified investment strategy are paramount for navigating the complexities of this compelling but uncertain market. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro Computer Stock Outlook: An Investor's Cautious Assessment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Edwards Steals The Show Timberwolves Respond With Game 3 Victory

May 27, 2025

Edwards Steals The Show Timberwolves Respond With Game 3 Victory

May 27, 2025 -

Roland Garros 2025 Raducanu And Wang Match Live Tennis Scores And Updates

May 27, 2025

Roland Garros 2025 Raducanu And Wang Match Live Tennis Scores And Updates

May 27, 2025 -

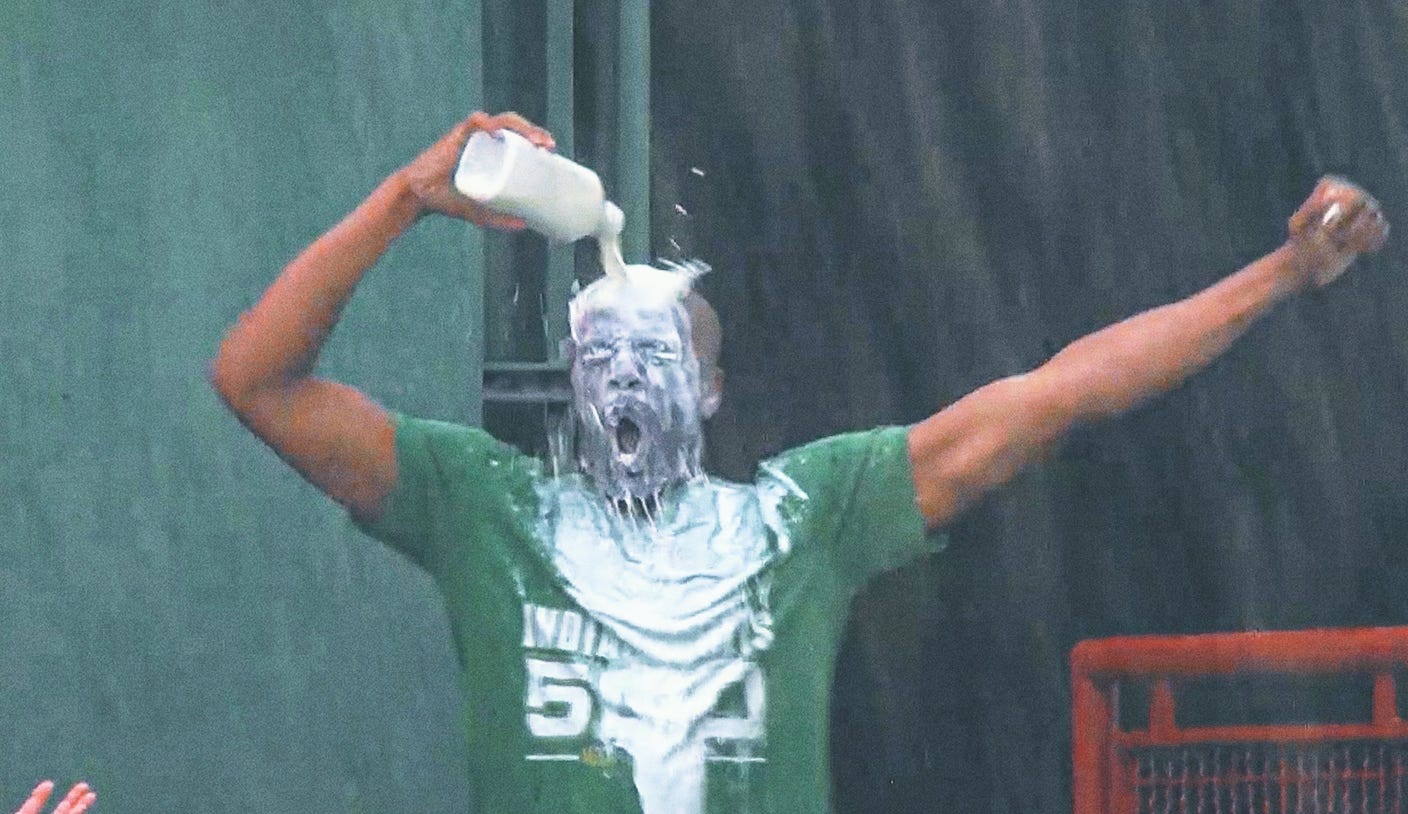

From Indy 500 To Baseball The Rise Of The Milk Bath Celebration

May 27, 2025

From Indy 500 To Baseball The Rise Of The Milk Bath Celebration

May 27, 2025 -

Teslas Robotaxi End Of A Dark Chapter Beginning Of Autonomous Dominance

May 27, 2025

Teslas Robotaxi End Of A Dark Chapter Beginning Of Autonomous Dominance

May 27, 2025 -

Kyle Busch And Rcr Understanding The Logic Behind Another Year Together

May 27, 2025

Kyle Busch And Rcr Understanding The Logic Behind Another Year Together

May 27, 2025