Super Micro Computer Stock: Is A Price Correction Imminent?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro Computer Stock: Is a Price Correction Imminent?

Super Micro Computer (SMCI) has enjoyed a remarkable run, surging significantly in recent months. This impressive growth, fueled by strong demand for its server and storage solutions, particularly in the burgeoning AI sector, leaves many investors wondering: is a price correction on the horizon? While the company's future looks bright, understanding the potential for a pullback is crucial for informed investment decisions.

The Bull Case for SMCI:

Super Micro's success stems from its strategic positioning within the rapidly expanding data center and AI markets. The company's high-performance computing (HPC) solutions are increasingly vital for powering AI workloads, cloud computing infrastructure, and other demanding applications. This demand has translated into strong financial results, boosting investor confidence and driving up the stock price. Key factors supporting the bullish outlook include:

- Strong Revenue Growth: Super Micro consistently delivers robust revenue growth, fueled by increasing demand for its products.

- AI Market Dominance: The company is a major player in the AI hardware market, benefiting from the explosive growth of AI applications.

- Technological Innovation: Super Micro continuously invests in R&D, ensuring it remains at the forefront of technological advancements.

- Robust Supply Chain: Maintaining a strong supply chain, particularly crucial in the current global environment, is a key advantage.

Signs of Potential Correction:

Despite the positive outlook, several factors suggest a potential price correction might be imminent. These include:

- Overvaluation Concerns: Some analysts argue that SMCI's stock price may have become overvalued relative to its fundamentals. A period of consolidation or correction could be a natural market response.

- Market Volatility: Broader market volatility can impact even the strongest performing stocks. Geopolitical events and economic uncertainty could trigger a sell-off.

- Profit-Taking: Investors who have seen significant gains might choose to take profits, leading to a temporary price decline.

- Competition: While Super Micro holds a strong position, increased competition in the server and storage market could impact its growth trajectory.

Analyzing the Technicals:

Technical analysis provides additional insights into potential price movements. Looking at key indicators like relative strength index (RSI) and moving averages can help identify overbought conditions, which often precede a correction. Investors should consult with a financial advisor before making any investment decisions based on technical analysis.

What to Watch For:

Investors should keep a close eye on the following factors:

- Earnings Reports: Upcoming earnings reports will be crucial in assessing the company's financial health and future prospects. Any significant deviation from expectations could trigger price volatility.

- Industry Trends: Monitoring trends in the data center and AI markets will provide valuable insights into Super Micro's future growth potential.

- Analyst Ratings: Tracking analyst ratings and price targets can provide a broader perspective on market sentiment towards SMCI.

Conclusion:

While Super Micro Computer's long-term prospects appear strong, the possibility of a price correction shouldn't be dismissed. Investors should carefully consider the potential risks and rewards before investing in SMCI. Conducting thorough due diligence, diversifying your portfolio, and consulting with a financial advisor are crucial steps in navigating the complexities of the stock market. Remember, past performance is not indicative of future results.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro Computer Stock: Is A Price Correction Imminent?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Amc Stock Performance Following Deutsche Banks Share Purchase

May 27, 2025

Amc Stock Performance Following Deutsche Banks Share Purchase

May 27, 2025 -

French Open 2025 Live Updates Day 2 Navarro Struggles Swiatek Sinner And Alcaraz To Play

May 27, 2025

French Open 2025 Live Updates Day 2 Navarro Struggles Swiatek Sinner And Alcaraz To Play

May 27, 2025 -

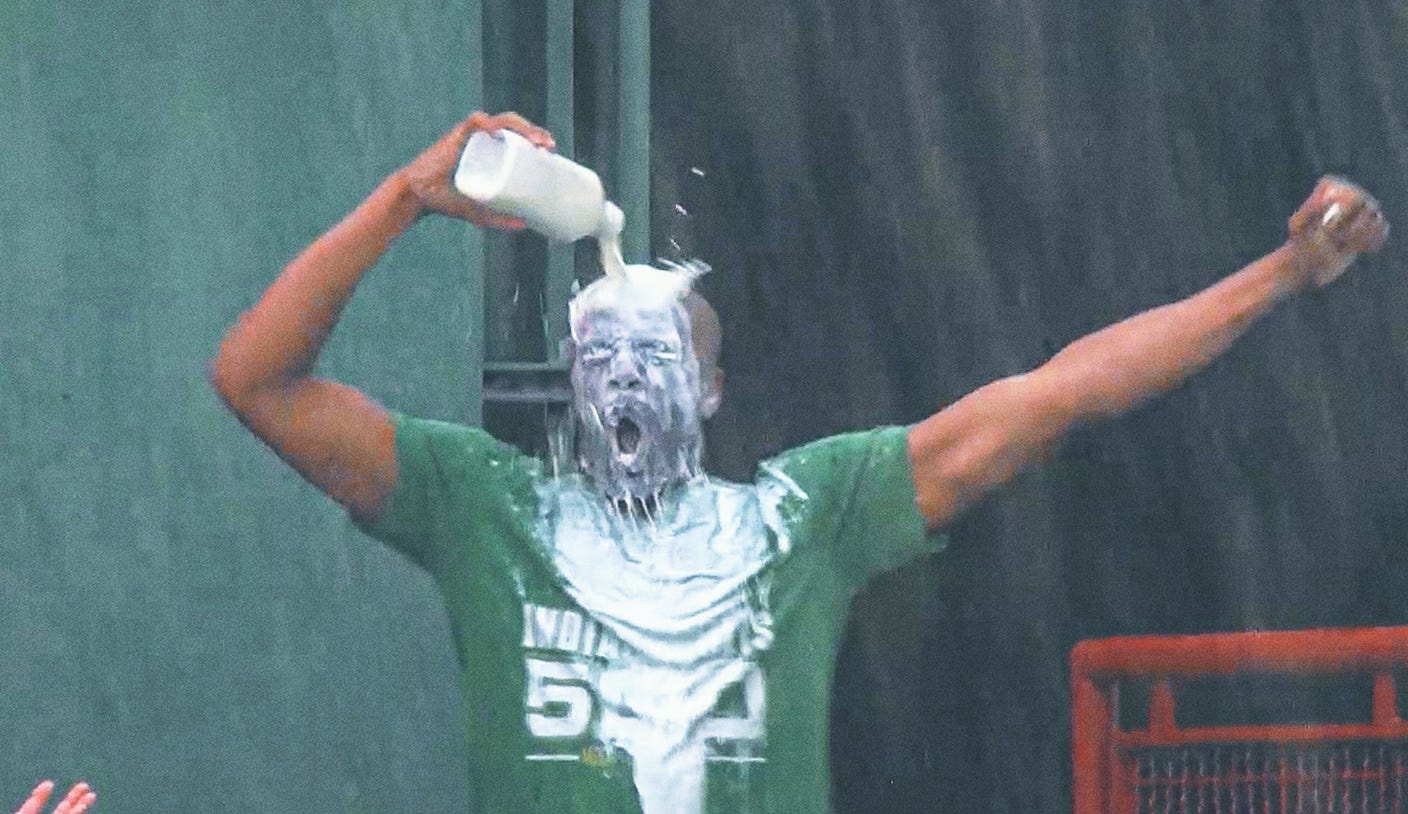

From Indy 500 To Baseball The Unexpected Milk Celebration Phenomenon

May 27, 2025

From Indy 500 To Baseball The Unexpected Milk Celebration Phenomenon

May 27, 2025 -

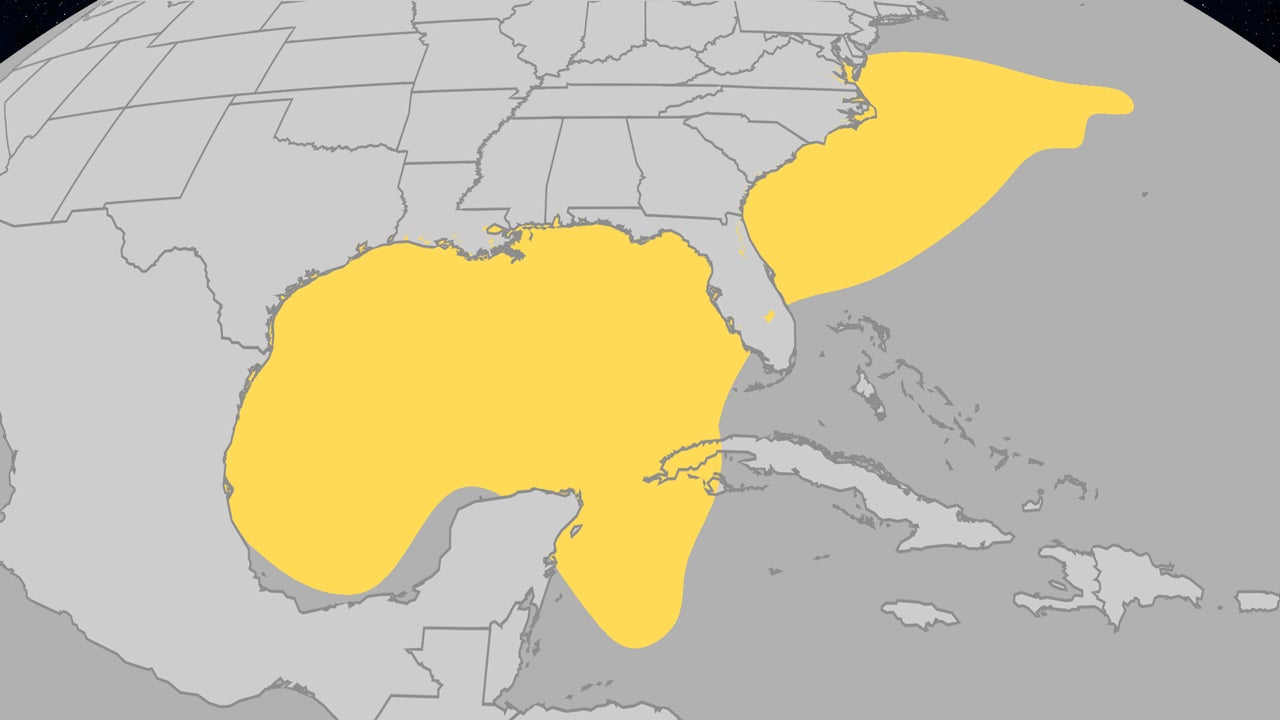

Atlantic Hurricane Season June Storm Formation And Recent Activity

May 27, 2025

Atlantic Hurricane Season June Storm Formation And Recent Activity

May 27, 2025 -

Phoenix The Cats Owner Completes Epic Oregon To Hawaii Sail

May 27, 2025

Phoenix The Cats Owner Completes Epic Oregon To Hawaii Sail

May 27, 2025