Stress Testing Your Retirement: A Step-by-Step Guide To Financial Security

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stress Testing Your Retirement: A Step-by-Step Guide to Financial Security

Retirement. The word conjures images of leisurely days, travel adventures, and finally pursuing those long-held passions. But the reality of a comfortable retirement requires careful planning and, crucially, stress testing your financial strategy. This isn't about fear-mongering; it's about proactive preparation to ensure your golden years truly shine. This step-by-step guide will help you navigate the process and build a retirement plan resilient to life's inevitable curveballs.

Why Stress Test Your Retirement Plan?

Life throws surprises. Unexpected medical expenses, a downturn in the market, or needing to support family members – these unforeseen events can significantly impact your retirement savings. Stress testing your plan allows you to anticipate these challenges and adjust your strategy accordingly. It's about building a financial fortress, not just a flimsy shelter. By identifying potential vulnerabilities now, you can avoid a financial crisis later.

Step 1: Calculate Your Current Retirement Savings

Before you can stress test, you need a baseline. Add up all your retirement accounts: 401(k)s, IRAs, pensions, and any other savings earmarked for retirement. Be brutally honest; include all your assets and liabilities. This forms the foundation of your analysis.

Step 2: Project Your Retirement Expenses

This is where things get personal. Consider your anticipated lifestyle in retirement. Will you downsize your home? Will you continue traveling? What about healthcare costs, which can be substantial in later life? Use online retirement calculators (many are available for free) to estimate your monthly and annual expenses. Don't underestimate the impact of inflation; factor that in as well. [Link to a reputable retirement calculator].

Step 3: Identify Potential Risks

This is the heart of stress testing. Consider these potential scenarios:

- Market Downturn: What would happen to your portfolio if the market experienced a significant drop, say 20% or even 30%? Would you still be able to maintain your desired lifestyle?

- Unexpected Medical Expenses: A serious illness or long-term care can drain retirement savings quickly. How would you cope with a large, unexpected medical bill? Do you have adequate health insurance?

- Inflation: The rising cost of living can erode purchasing power. How will you adjust your budget to account for inflation over the long term?

- Longevity: People are living longer than ever before. Are your savings sufficient to cover your expenses for a longer-than-anticipated retirement?

- Unexpected Family Needs: Supporting family members can put a strain on your resources. How would you handle this situation without compromising your own retirement security?

Step 4: Run Different Scenarios

Use your projected expenses and identified risks to run different scenarios. What happens if your investments underperform? What if you need to withdraw more money than anticipated? Experiment with different withdrawal rates and investment strategies to see how your portfolio holds up under pressure.

Step 5: Adjust Your Plan Accordingly

Based on your stress testing, you may need to adjust your retirement plan. This could involve:

- Increasing your savings rate: If you discover your savings are insufficient, consider increasing contributions to your retirement accounts.

- Delaying retirement: Working a few extra years can significantly boost your retirement savings.

- Adjusting your spending habits: Identify areas where you can cut expenses in retirement to free up more funds.

- Exploring alternative income streams: Consider part-time work, rental income, or other sources of income to supplement your retirement savings.

Step 6: Regularly Review and Rebalance

Your retirement plan isn't set in stone. Life changes, and so should your plan. Regularly review your progress, rebalance your portfolio, and adjust your strategy as needed. Consider seeking professional financial advice to ensure your plan remains on track.

Conclusion:

Stress testing your retirement plan isn't about inducing panic; it's about empowering yourself with knowledge and control. By proactively identifying potential risks and adjusting your strategy accordingly, you can significantly improve your chances of achieving a secure and fulfilling retirement. Start today, and secure your financial future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stress Testing Your Retirement: A Step-by-Step Guide To Financial Security. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Secure Your Retirement The Importance Of Regularly Stress Testing Your Financial Plan

Jun 05, 2025

Secure Your Retirement The Importance Of Regularly Stress Testing Your Financial Plan

Jun 05, 2025 -

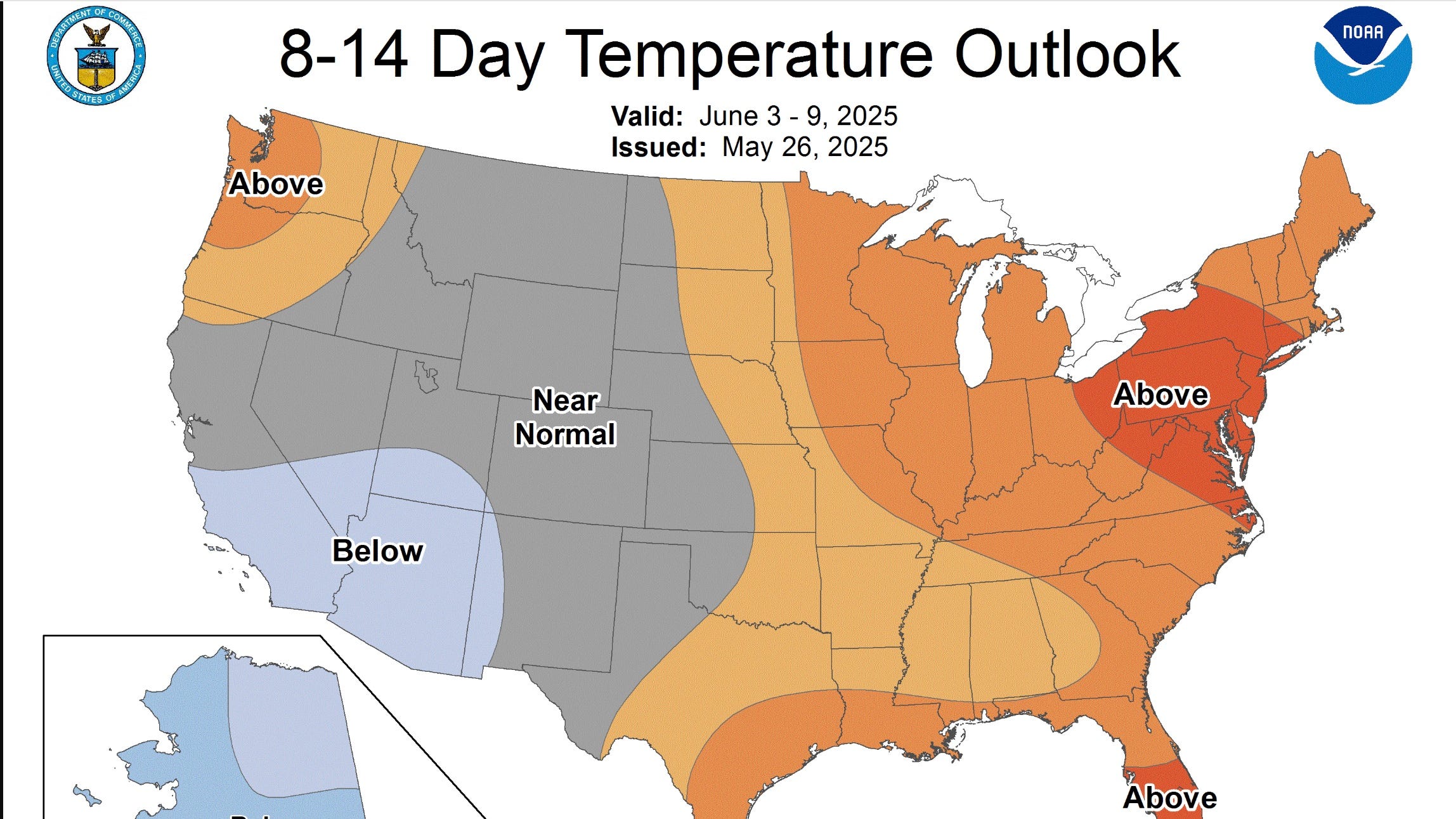

Willamette Valley Heatwave Record High Temperatures Expected

Jun 05, 2025

Willamette Valley Heatwave Record High Temperatures Expected

Jun 05, 2025 -

Angels Triumph Trouts Hot Bat Delivers 3 Hits And A Home Run

Jun 05, 2025

Angels Triumph Trouts Hot Bat Delivers 3 Hits And A Home Run

Jun 05, 2025 -

Former Indiana Team Doctor Faces Growing Number Of Sexual Misconduct Allegations

Jun 05, 2025

Former Indiana Team Doctor Faces Growing Number Of Sexual Misconduct Allegations

Jun 05, 2025 -

Unearthing Grace Potters Past The Open The Vault Collection Unveiled

Jun 05, 2025

Unearthing Grace Potters Past The Open The Vault Collection Unveiled

Jun 05, 2025