Stress Testing Your Retirement: A Crucial Step Before Retirement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stress Testing Your Retirement: A Crucial Step Before Hanging Up Your Hat

Retirement. The word conjures images of sunny beaches, leisurely hobbies, and finally having the time to pursue those long-deferred dreams. But the reality of retirement can be far more complex than idyllic postcards suggest. That's why stress testing your retirement plan is absolutely crucial before you take that final leap. Failing to do so could lead to financial hardship and a retirement far less enjoyable than you envisioned.

What is Retirement Stress Testing?

Retirement stress testing isn't just about checking your current savings against your projected expenses. It's a much more thorough process that simulates various potential scenarios, allowing you to identify potential vulnerabilities in your plan and adjust accordingly. Think of it as a financial "what if" scenario generator, designed to help you weather unexpected storms.

This involves analyzing the potential impact of various factors, including:

- Inflation: The insidious erosion of purchasing power over time. Even a modest inflation rate can significantly impact your retirement budget over several decades.

- Market Volatility: Stock markets fluctuate. Stress testing helps you understand how your portfolio might fare during periods of market downturn. Are you adequately diversified? Do you have enough reserves to withstand a significant market correction?

- Unexpected Expenses: Life throws curveballs. A major health issue, home repairs, or unexpected family emergencies can dramatically alter your financial landscape. Stress testing helps you prepare for these unforeseen events.

- Longevity: Are you prepared to live longer than you anticipated? This is a critical factor often overlooked.

- Healthcare Costs: Medical expenses can skyrocket in retirement. Do you have adequate health insurance coverage and sufficient savings to cover potential out-of-pocket costs?

How to Conduct a Retirement Stress Test:

While you can certainly work with a financial advisor (a highly recommended step!), you can also perform a basic stress test yourself using online calculators and retirement planning software. Many free and paid tools are available. Look for features that allow you to:

- Adjust key assumptions: Experiment with different inflation rates, market return scenarios, and longevity estimates.

- Model unexpected expenses: Input potential costs like home repairs or long-term care.

- Analyze your withdrawal strategy: Test different withdrawal rates to see how your portfolio performs under various scenarios.

Beyond the Numbers: Emotional and Lifestyle Stress Testing

While financial stress testing is paramount, don't forget the emotional and lifestyle aspects. Consider:

- Purpose and Meaning: How will you fill your days? Having a plan for your time is crucial for mental wellbeing in retirement.

- Social Connections: Maintaining strong social connections is key to a happy retirement.

- Health and Wellness: Proactive healthcare and a healthy lifestyle are essential for enjoying your retirement years.

Conclusion: Don't Gamble with Your Future

Retirement stress testing is not a one-time exercise. It’s an ongoing process that requires regular review and adjustment. By proactively identifying and addressing potential risks, you can significantly increase your chances of enjoying a secure and fulfilling retirement. Don't wait until it's too late. Start stress testing your retirement plan today and secure a brighter financial future. For further guidance, consider consulting with a qualified financial advisor who can tailor a plan to your specific circumstances. This proactive approach will provide peace of mind and ensure your retirement dreams become a reality.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stress Testing Your Retirement: A Crucial Step Before Retirement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Who Is Van Hunt Exploring Halle Berrys Romantic Life

Jun 04, 2025

Who Is Van Hunt Exploring Halle Berrys Romantic Life

Jun 04, 2025 -

Warning Key Australian Big Battery Supplier May Go Bankrupt

Jun 04, 2025

Warning Key Australian Big Battery Supplier May Go Bankrupt

Jun 04, 2025 -

Belmont Stakes 2025 Post Time Tv Coverage And Horse Racing Draw Results

Jun 04, 2025

Belmont Stakes 2025 Post Time Tv Coverage And Horse Racing Draw Results

Jun 04, 2025 -

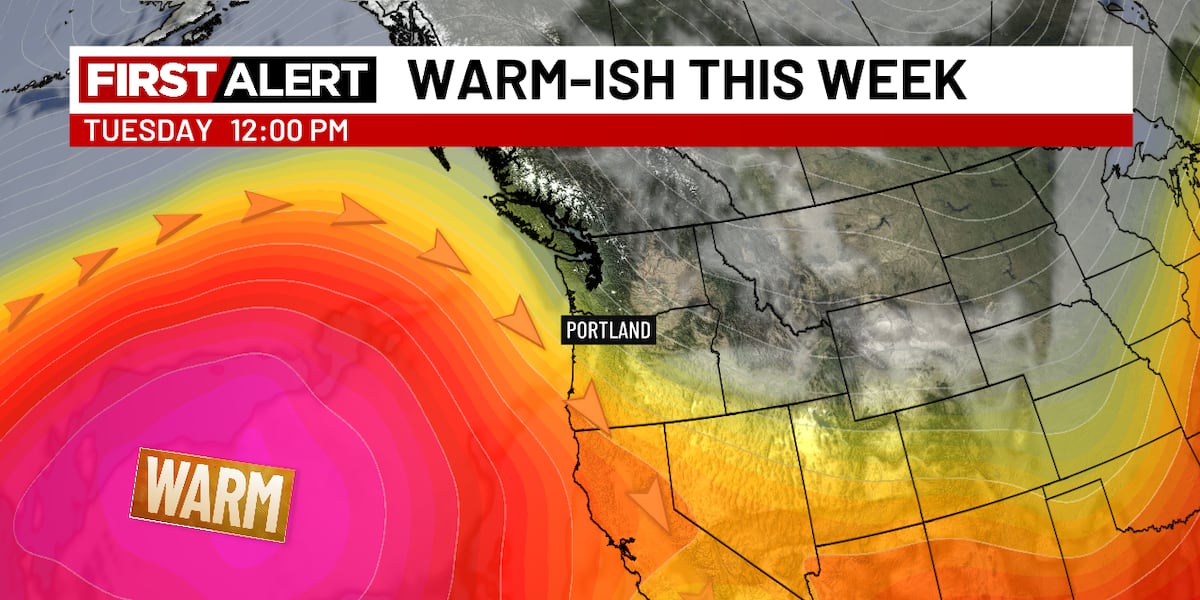

Fair Weather Ahead June Opens With Warm Dry Conditions

Jun 04, 2025

Fair Weather Ahead June Opens With Warm Dry Conditions

Jun 04, 2025 -

Wcws Bound Texas Tech Defeats Oklahoma Dynasty

Jun 04, 2025

Wcws Bound Texas Tech Defeats Oklahoma Dynasty

Jun 04, 2025