Stress Test Your Retirement: Unexpected Expenses And How To Prepare

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stress Test Your Retirement: Unexpected Expenses and How to Prepare

Retirement. The word conjures images of leisurely days, travel adventures, and finally having the time to pursue passions. But the reality can be far more complex, especially when unexpected expenses rear their heads. A successful retirement isn't just about accumulating savings; it's about strategically planning for the inevitable curveballs life throws your way. This article will explore common unexpected retirement expenses and provide actionable steps to prepare and stress-test your financial plan for a truly peaceful retirement.

The Silent Saboteurs: Unexpected Expenses That Can Derail Retirement

Many retirees underestimate the financial impact of unforeseen events. While diligently saving for retirement is crucial, overlooking these potential drains can significantly impact your golden years:

-

Healthcare Costs: This is often the biggest surprise. Even with Medicare, out-of-pocket expenses for premiums, deductibles, co-pays, and long-term care can quickly escalate. Unexpected illnesses or injuries can lead to substantial medical bills. Consider long-term care insurance as a crucial part of your retirement planning. [Link to a reputable article on long-term care insurance]

-

Home Repairs and Maintenance: Your home, once a source of comfort, can become a costly burden in retirement. Unexpected repairs – a leaky roof, a failing HVAC system, or foundation issues – can drain your savings. Regular maintenance and a dedicated home repair fund are essential.

-

Unexpected Travel Expenses: While retirement travel is often anticipated, unforeseen circumstances like flight cancellations, medical emergencies abroad, or unexpected accommodation costs can significantly impact your budget. Travel insurance can offer some protection against these surprises.

-

Unexpected Vehicle Expenses: Car repairs, replacements, and increased insurance premiums can strain your finances, especially if you rely on a vehicle for transportation. Factor in car maintenance and potential replacement costs into your retirement budget.

-

Family Emergencies: Supporting family members facing financial hardship or medical emergencies can put a significant strain on your retirement savings. Having a contingency plan in place can help alleviate some of this stress.

Stress-Testing Your Retirement Plan: A Proactive Approach

Don't wait for a crisis to hit. Proactively stress-testing your retirement plan is crucial for peace of mind. Here’s how:

1. Develop a Comprehensive Budget: Go beyond basic expenses. Include potential unexpected costs, such as home repairs, medical expenses, and travel contingencies. Use online budgeting tools or consult a financial advisor to help you create a realistic budget.

2. Emergency Fund: Having 3-6 months of living expenses in a readily accessible account is crucial to cushion against unexpected events. This will provide a safety net before dipping into your retirement savings.

3. Regular Review and Adjustment: Your financial needs and circumstances change over time. Regularly review and adjust your retirement plan to reflect these changes, especially as you get closer to retirement.

4. Explore Long-Term Care Insurance: The cost of long-term care can be astronomical. Consider purchasing long-term care insurance while you are younger and healthier to secure more affordable rates.

5. Seek Professional Advice: A qualified financial advisor can help you create a comprehensive retirement plan, assess your risk tolerance, and navigate complex financial decisions.

Conclusion:

Retirement should be a time of joy and fulfillment. By acknowledging the potential for unexpected expenses and proactively preparing for them, you can significantly reduce financial stress and ensure a more secure and enjoyable retirement. Don't let unforeseen circumstances derail your dreams – take control of your financial future today. Start planning and stress-testing your retirement plan now! Your future self will thank you.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stress Test Your Retirement: Unexpected Expenses And How To Prepare. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Will Broadcom Hit 250 Wall Streets Pre Earnings Focus

Jun 04, 2025

Will Broadcom Hit 250 Wall Streets Pre Earnings Focus

Jun 04, 2025 -

Stefon Diggs Controversy Patriots Confirm No Plans For Release

Jun 04, 2025

Stefon Diggs Controversy Patriots Confirm No Plans For Release

Jun 04, 2025 -

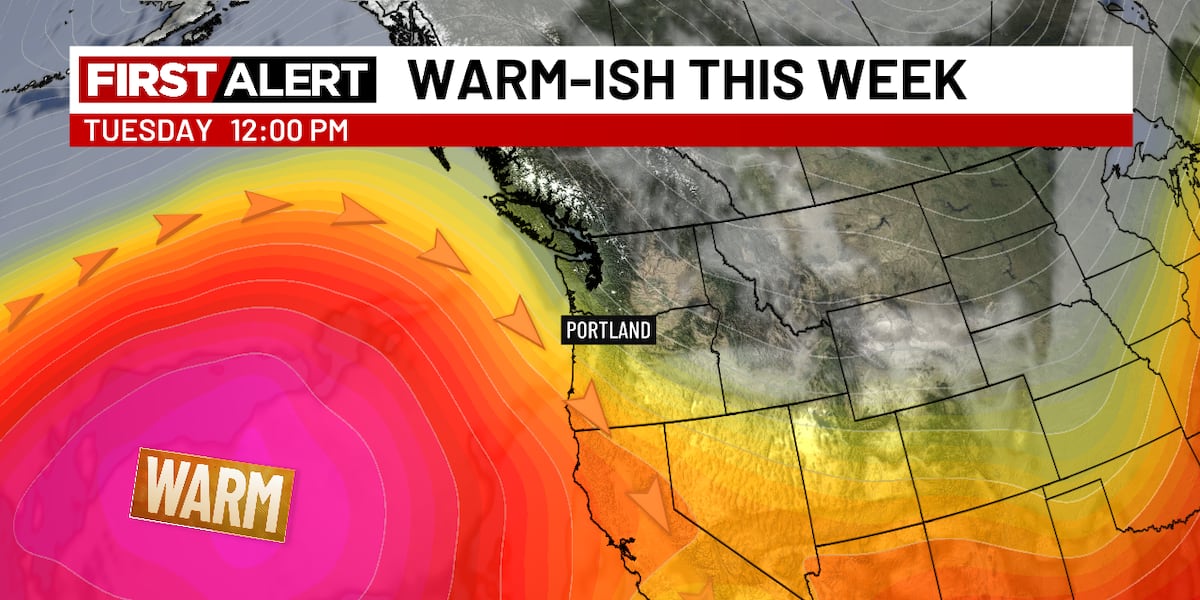

Enjoy The Sunshine June Kicks Off With Warm And Dry Temperatures

Jun 04, 2025

Enjoy The Sunshine June Kicks Off With Warm And Dry Temperatures

Jun 04, 2025 -

Schefflers Memorial Repeat Joining An Elite Club With Tiger Woods

Jun 04, 2025

Schefflers Memorial Repeat Joining An Elite Club With Tiger Woods

Jun 04, 2025 -

Injury Concerns Yankees To Place Luke Weaver On Il

Jun 04, 2025

Injury Concerns Yankees To Place Luke Weaver On Il

Jun 04, 2025