Sponsored: From Paper Checks To Digital Payments: A Necessary Transition?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sponsored: From Paper Checks to Digital Payments: A Necessary Transition?

The crisp crackle of a freshly printed check. The satisfying weight of it in your hand. For decades, the paper check symbolized financial transactions. But in today's fast-paced digital world, is this antiquated method still relevant? Many businesses and individuals are asking themselves if the transition to digital payments is not just a trend, but a necessary evolution.

This sponsored article explores the compelling reasons behind the shift from paper checks to digital payment methods, examining the benefits and challenges involved. We'll delve into the efficiency gains, security enhancements, and cost savings associated with embracing digital solutions.

The Inefficiencies of Paper Checks:

Let's face it: paper checks are slow. The process involves writing the check, mailing it, waiting for it to clear, and then reconciling it. This time-consuming process leads to:

- Delays in Payments: Businesses experience cash flow issues due to delayed payments, impacting their ability to meet operational expenses and invest in growth.

- Increased Administrative Burden: Manually processing checks requires significant administrative time and resources, leading to higher labor costs.

- Higher Risk of Errors: Human error, such as incorrect amounts or misplaced checks, is a significant concern. These errors lead to costly corrections and reconciliation efforts.

- Security Vulnerabilities: Lost, stolen, or forged checks pose a security risk, potentially resulting in substantial financial losses.

The Advantages of Digital Payments:

Digital payment methods, including ACH transfers, online payments, and mobile wallets like Apple Pay and Google Pay, offer a plethora of advantages:

- Speed and Efficiency: Transactions are processed almost instantly, improving cash flow and streamlining business operations.

- Reduced Costs: Eliminating the costs associated with printing, mailing, and processing paper checks leads to significant savings.

- Enhanced Security: Digital payment systems offer robust security features, minimizing the risk of fraud and loss. [Link to article on payment security best practices]

- Improved Tracking and Reconciliation: Digital records provide clear audit trails, simplifying reconciliation and reducing errors.

- Increased Convenience: Digital payments are easily accessible anytime, anywhere, enhancing convenience for both businesses and customers.

Addressing Concerns about the Transition:

While the benefits of digital payments are undeniable, some concerns remain:

- Technological Barriers: Not everyone is comfortable using digital technologies, particularly older generations. Education and support are crucial to bridge this gap.

- Security Concerns: While digital systems are generally secure, the risk of cyberattacks remains. Choosing reputable payment providers and implementing strong security measures are essential.

- Potential for Fees: Some digital payment platforms charge transaction fees, which can impact profitability. Careful selection of providers is necessary to minimize these costs.

The Path Forward: A Gradual Transition:

The shift to digital payments doesn't have to be abrupt. A phased approach, incorporating training and support for employees and customers, can ensure a smooth transition. Businesses can start by integrating digital payment options alongside existing methods, gradually phasing out paper checks as confidence and comfort with digital solutions grow.

Conclusion:

The transition from paper checks to digital payments is not just a trend; it's a necessary step towards a more efficient, secure, and cost-effective financial ecosystem. By embracing digital solutions and addressing the associated challenges proactively, businesses and individuals can unlock significant advantages and prepare for the future of finance. Are you ready to make the switch?

(This is a sponsored article. The views and opinions expressed in this article are those of the sponsor and do not necessarily reflect the views of this publication.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sponsored: From Paper Checks To Digital Payments: A Necessary Transition?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nacional Vs Once Caldas Un Partido Clave Para La Lucha Por La Clasificacion

Jun 20, 2025

Nacional Vs Once Caldas Un Partido Clave Para La Lucha Por La Clasificacion

Jun 20, 2025 -

Analyzing Xabi Alonsos First Real Madrid Club World Cup Appearance

Jun 20, 2025

Analyzing Xabi Alonsos First Real Madrid Club World Cup Appearance

Jun 20, 2025 -

Mlb Roster Move Braves Dfa Veteran Call Up Prospect To Face Marlins

Jun 20, 2025

Mlb Roster Move Braves Dfa Veteran Call Up Prospect To Face Marlins

Jun 20, 2025 -

Wnba Phoenix Mercury Vs New York Liberty Live Stream June 19th 2025

Jun 20, 2025

Wnba Phoenix Mercury Vs New York Liberty Live Stream June 19th 2025

Jun 20, 2025 -

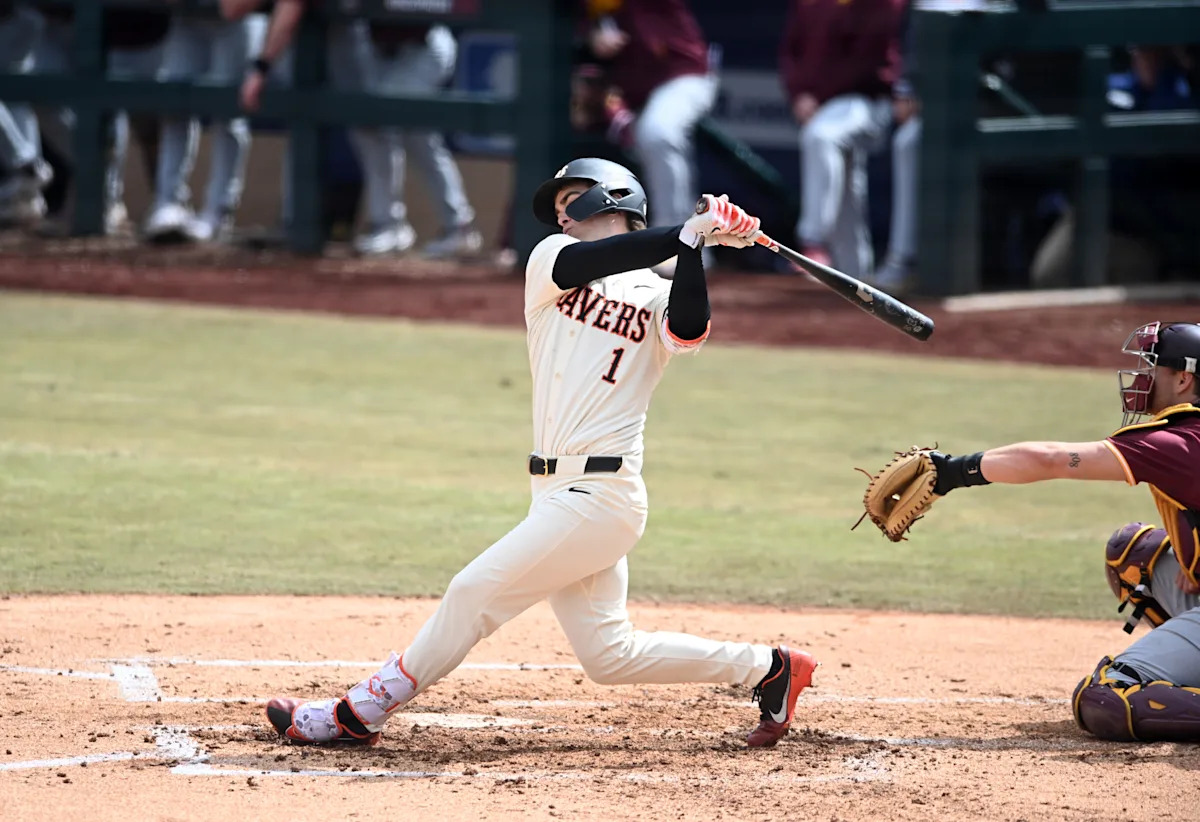

Dont Miss A Pitch Your Complete Guide To The College World Series 2025 Finals

Jun 20, 2025

Dont Miss A Pitch Your Complete Guide To The College World Series 2025 Finals

Jun 20, 2025

Latest Posts

-

Rock Fest 2025 A Comprehensive Guide For Attendees

Jul 18, 2025

Rock Fest 2025 A Comprehensive Guide For Attendees

Jul 18, 2025 -

Rare Makeup Free Photo Of Princess Beatrice Edoardo Mozzis Anniversary Message

Jul 18, 2025

Rare Makeup Free Photo Of Princess Beatrice Edoardo Mozzis Anniversary Message

Jul 18, 2025 -

Dont Miss Out Msi 2025 Skins With Exclusive Discounts In The Lo L Store

Jul 18, 2025

Dont Miss Out Msi 2025 Skins With Exclusive Discounts In The Lo L Store

Jul 18, 2025 -

Pre Camp Deal Raiders Finalize Contract With Second Round Rookie

Jul 18, 2025

Pre Camp Deal Raiders Finalize Contract With Second Round Rookie

Jul 18, 2025 -

Will Poulters Relationship Status New Romance After Split

Jul 18, 2025

Will Poulters Relationship Status New Romance After Split

Jul 18, 2025