Southeast Banking Transformed: Pinnacle And Synovus Announce Merger

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Southeast Banking Transformed: Pinnacle Financial Partners and Synovus Announce Merger

The Southeast banking landscape is undergoing a significant shift with the announcement of a major merger between Pinnacle Financial Partners (PNFP) and Synovus (SNV). This strategic move promises to reshape the financial services sector in the region, impacting customers, employees, and the overall economic climate. The combined entity will create a banking powerhouse with expanded reach and enhanced capabilities.

A Giant Leap for Pinnacle: This isn't just an acquisition; it's a transformative leap for Pinnacle. The deal, valued at approximately $4.2 billion, will see Pinnacle acquire Synovus's significant operations across the Southeast. This expansion dramatically increases Pinnacle's footprint, boosting its market share and providing access to new customer bases. For Pinnacle, this represents a bold strategic play to solidify its position as a leading financial institution in the competitive Southeast market.

Synovus's Strategic Realignment: While Synovus shareholders will benefit from the acquisition's financial terms, the move signals a strategic realignment for the company. This merger allows Synovus to focus resources and energies on other strategic initiatives, potentially leading to future growth in different market segments. The details surrounding these future plans remain to be seen but suggest a proactive approach to adapting to the changing banking landscape.

What This Means for Customers: The immediate impact on customers is likely to be minimal, with business operations expected to continue as usual during the transition period. However, the long-term implications could be significant. Customers can anticipate access to a wider range of financial products and services, potentially including enhanced digital banking capabilities and a more expansive network of branches and ATMs.

Key Benefits of the Merger:

- Expanded Geographic Reach: The merger significantly expands the combined bank's reach across the Southeast, providing broader access to a larger customer base.

- Enhanced Product Offerings: Customers can expect a wider array of financial products and services tailored to diverse needs.

- Improved Technological Capabilities: The merger could lead to advancements in digital banking and technological infrastructure.

- Increased Financial Strength: The combined entity will boast a stronger financial position, enhancing stability and resilience.

Challenges and Potential Concerns:

- Integration Complexity: Merging two large banking institutions is a complex undertaking, potentially leading to temporary disruptions during the integration process. Effective management of this integration will be crucial for success.

- Regulatory Scrutiny: The merger will likely face regulatory scrutiny, requiring thorough review and approval before finalization.

- Potential Job Losses: While the merger aims to create a stronger entity, there's always the possibility of job losses due to redundancy or streamlining of operations. Transparency in addressing employee concerns will be key.

The Future of Southeast Banking: This merger marks a significant turning point for Southeast banking. It showcases the ongoing consolidation within the industry, driven by the need for scale, technological advancement, and efficient operations. The success of this merger will likely influence future consolidation efforts within the region, setting a precedent for other financial institutions.

Learn More: For the latest updates and official announcements, visit the official websites of Pinnacle Financial Partners and Synovus. Stay tuned for further developments and analyses of this transformative merger in the Southeast banking sector. We will continue to update this article as more information becomes available.

(Keywords: Pinnacle Financial Partners, Synovus, banking merger, Southeast banking, PNFP, SNV, financial acquisition, banking industry, mergers and acquisitions, regional banking, economic impact)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Southeast Banking Transformed: Pinnacle And Synovus Announce Merger. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Iowa Hawkeyes Caitlin Clark Unveils Exclusive Nike Kobe V Edition Sneakers

Jul 25, 2025

Iowa Hawkeyes Caitlin Clark Unveils Exclusive Nike Kobe V Edition Sneakers

Jul 25, 2025 -

Ixhl Stock Price Surge Key Drivers And Future Outlook

Jul 25, 2025

Ixhl Stock Price Surge Key Drivers And Future Outlook

Jul 25, 2025 -

Miami Dolphins Offense Tua And Hills Evolving Connection

Jul 25, 2025

Miami Dolphins Offense Tua And Hills Evolving Connection

Jul 25, 2025 -

Ben Shelton Begins Dc Open Campaign With Impressive Win

Jul 25, 2025

Ben Shelton Begins Dc Open Campaign With Impressive Win

Jul 25, 2025 -

Puka Nacuas Expanded Role A More Versatile Rams Receiver In Year 3

Jul 25, 2025

Puka Nacuas Expanded Role A More Versatile Rams Receiver In Year 3

Jul 25, 2025

Latest Posts

-

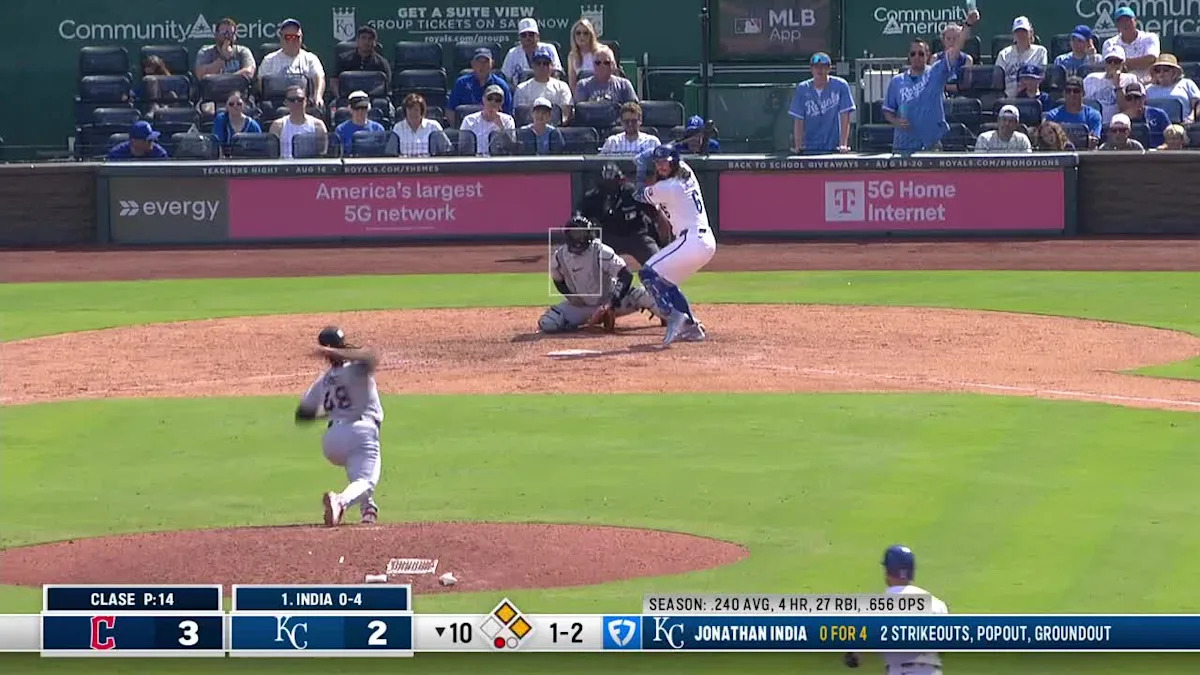

Game 5 Recap Indias Walk Off Blast Delivers Victory

Jul 27, 2025

Game 5 Recap Indias Walk Off Blast Delivers Victory

Jul 27, 2025 -

Reds Defeat Guardians In Doubleheader Opener Indias 10th Inning Blast

Jul 27, 2025

Reds Defeat Guardians In Doubleheader Opener Indias 10th Inning Blast

Jul 27, 2025 -

Sport Vs Santos Match Preview Team News And Predicted Lineups

Jul 27, 2025

Sport Vs Santos Match Preview Team News And Predicted Lineups

Jul 27, 2025 -

Messis Miami Ban Espn Reports Players Anger At Mls Ruling

Jul 27, 2025

Messis Miami Ban Espn Reports Players Anger At Mls Ruling

Jul 27, 2025 -

Watch The 2025 Nascar Indianapolis Brickyard 400 Complete Viewing Guide

Jul 27, 2025

Watch The 2025 Nascar Indianapolis Brickyard 400 Complete Viewing Guide

Jul 27, 2025