Social Security Benefit Adjustments: A Comprehensive Guide

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security Benefit Adjustments: A Comprehensive Guide

Are your Social Security benefits keeping pace with inflation? Understanding the annual adjustments to Social Security benefits is crucial for retirees and future retirees alike. This comprehensive guide breaks down the complexities of cost-of-living adjustments (COLAs) and other factors affecting your monthly payments.

Every year, the Social Security Administration (SSA) announces a cost-of-living adjustment (COLA) to Social Security benefits. This adjustment aims to protect the purchasing power of benefits by accounting for inflation. However, the process is more nuanced than simply matching the inflation rate. Let's delve into the details.

How are Social Security COLAs Calculated?

The COLA calculation isn't a simple equation. The SSA uses the Consumer Price Index for Wage Earners and Clerical Workers (CPI-W) to determine the inflation rate. Specifically, they compare the average CPI-W for the third quarter (July, August, and September) of the current year with the average CPI-W for the third quarter of the previous year.

-

The formula: The percentage increase (or decrease, though this is rare) in the CPI-W determines the COLA percentage. This percentage is then applied to the previous year's benefit amount to calculate the adjusted benefit for the upcoming year.

-

Example: If the CPI-W increased by 3% from the third quarter of 2023 to the third quarter of 2024, then the 2025 COLA would be 3%.

Factors Beyond COLA Affecting Your Benefits:

While COLA is the most significant annual adjustment, other factors can influence your Social Security payments:

-

Full Retirement Age (FRA): Your FRA determines when you receive your full retirement benefit. Claiming benefits before your FRA results in a permanently reduced benefit, while delaying benefits beyond your FRA increases them. Understanding your FRA is crucial for maximizing your lifetime benefits. You can find your FRA on your Social Security statement.

-

Earnings Test: If you're younger than your FRA and still working, your benefits may be reduced if your earnings exceed a certain limit. This limit changes annually.

-

Annual Benefit Increases: While COLAs address inflation, Congress can also make changes to Social Security benefits through legislation. These changes are not annual and are often the subject of political debate.

Where to Find More Information:

-

Social Security Administration Website: The SSA's website () is the most reliable source for information on Social Security benefits. You can find detailed explanations of COLA calculations, FRA, the earnings test, and much more.

-

Your Social Security Statement: Regularly review your Social Security statement to track your estimated benefits and understand your FRA. You can access your statement online through the SSA website.

Planning for Your Retirement:

Understanding Social Security benefit adjustments is critical for planning a comfortable retirement. Consider consulting with a financial advisor to create a personalized retirement plan that accounts for potential changes in your Social Security benefits. Proactive planning will ensure you're prepared for the financial realities of retirement.

Call to Action: Visit the Social Security Administration website today to access your personal Social Security statement and learn more about your future benefits. Don't delay – understanding your Social Security benefits is a crucial step in securing your financial future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security Benefit Adjustments: A Comprehensive Guide. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Oops Jesse Tyler Ferguson Sends Embarrassing Text To Wrong Number Martha Plimptons Mom

Jun 19, 2025

Oops Jesse Tyler Ferguson Sends Embarrassing Text To Wrong Number Martha Plimptons Mom

Jun 19, 2025 -

2025 Nba Offseason Trade Tracker Pacers Finals Deal A Comprehensive Review

Jun 19, 2025

2025 Nba Offseason Trade Tracker Pacers Finals Deal A Comprehensive Review

Jun 19, 2025 -

Fit Right In Espns Assessment Of Giants Rookie Qb Jaxson Dart

Jun 19, 2025

Fit Right In Espns Assessment Of Giants Rookie Qb Jaxson Dart

Jun 19, 2025 -

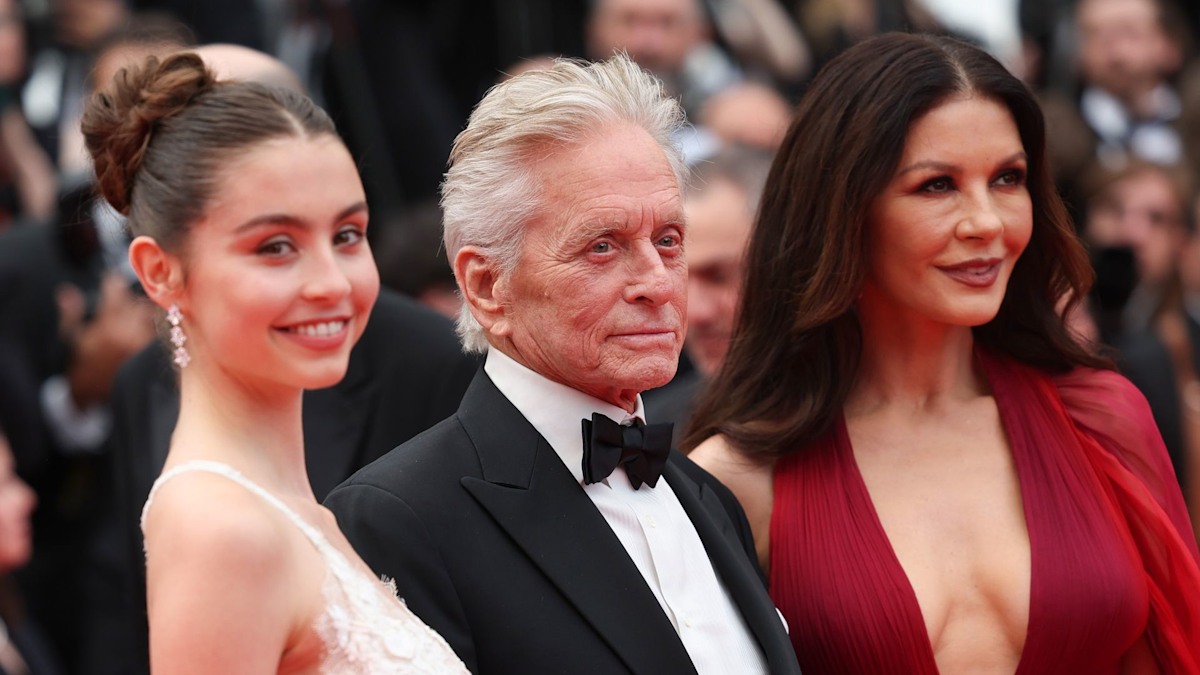

Carys Douglas Move Back Home A Family Reunion

Jun 19, 2025

Carys Douglas Move Back Home A Family Reunion

Jun 19, 2025 -

Exclusive Release Date Announced For Cameron Douglas Memoir Looking Through Water

Jun 19, 2025

Exclusive Release Date Announced For Cameron Douglas Memoir Looking Through Water

Jun 19, 2025