Snap Stock's Future: Analyzing Its 90% Decline And 2025 Potential

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Snap Stock's Future: Analyzing its 90% Decline and 2025 Potential

Snap Inc., the parent company of the popular photo-sharing app Snapchat, has experienced a dramatic downturn, with its stock price plummeting by approximately 90% from its all-time high. This significant decline raises crucial questions about the company's future and its potential trajectory by 2025. This article delves into the factors contributing to Snap's struggles and explores the possibilities for its recovery.

The Fall from Grace: Understanding Snap's 90% Stock Decline

Several key factors contributed to Snap's substantial stock price drop. These include:

- Increased Competition: The rise of TikTok, Instagram Reels, and other short-form video platforms has significantly impacted Snapchat's user engagement and growth. These competitors offer similar features and often incorporate innovative trends faster.

- Advertising Revenue Challenges: Snap relies heavily on advertising revenue, and a challenging macroeconomic environment, including inflation and reduced ad spending, has negatively affected its financial performance. Competition for advertising dollars is fierce.

- Privacy Concerns and Regulatory Scrutiny: Growing concerns about data privacy and increasing regulatory scrutiny have placed pressure on Snap and other social media companies. This has impacted user trust and potentially limited growth opportunities.

- Management Decisions: Some critics argue that certain management decisions, including strategic pivots and investments, haven't yielded the expected returns, contributing to investor uncertainty.

Analyzing Snap's Strengths and Weaknesses

Despite the significant challenges, Snap possesses certain strengths:

- Large and Engaged User Base: Snapchat still boasts a substantial user base, particularly among younger demographics. Maintaining this engagement is crucial for future growth.

- Innovative Features: Snap consistently introduces new features and filters, keeping its platform fresh and appealing to its core audience. Continued innovation is vital for staying competitive.

- Augmented Reality (AR) Potential: Snap's investment in augmented reality technology presents a significant long-term opportunity. AR advertising and experiences could become a major revenue stream in the future. [Link to an article about AR advertising trends]

However, weaknesses remain:

- Dependence on Advertising Revenue: Snap's heavy reliance on advertising revenue makes it vulnerable to economic downturns and shifts in the advertising market. Diversification of revenue streams is essential.

- Competition from Established Players: Competing with established giants like Meta (Facebook, Instagram) and ByteDance (TikTok) is a monumental task. Snap needs a clear differentiation strategy.

- User Retention: Maintaining user engagement and preventing churn is a critical ongoing challenge. User retention directly impacts advertising revenue.

Snap's Potential in 2025: A Cautious Outlook

Predicting Snap's performance in 2025 is challenging, given the current market dynamics. While a complete recovery to its previous peak is unlikely in the short term, several factors could influence its future:

- Successful Diversification of Revenue Streams: Exploring new revenue avenues beyond advertising, such as subscriptions or in-app purchases, could improve its financial stability.

- Strategic Partnerships and Acquisitions: Strategic collaborations and acquisitions could help Snap expand its reach and capabilities.

- Effective Response to Competition: Adapting to the evolving landscape and effectively countering competition will be crucial for Snap's survival and growth.

- Stronger Focus on User Privacy and Data Security: Addressing user privacy concerns and complying with regulations will build trust and attract new users.

Conclusion: Navigating the Uncertain Future

Snap's future remains uncertain. While its 90% stock decline reflects significant challenges, the company still possesses potential. Its success hinges on effectively addressing its weaknesses, capitalizing on its strengths, and navigating the ever-changing landscape of social media. Investors should carefully consider these factors before making any investment decisions. The next few years will be critical for Snap to demonstrate its ability to adapt and thrive. Further analysis and market observation will be necessary to provide a more definitive outlook on Snap's 2025 potential.

Call to Action: Stay informed about Snap's progress by following reputable financial news sources and analysts' reports.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Snap Stock's Future: Analyzing Its 90% Decline And 2025 Potential. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ncaa To Pay 2 8 Billion Historic Settlement Reached For College Athlete Compensation

Jun 10, 2025

Ncaa To Pay 2 8 Billion Historic Settlement Reached For College Athlete Compensation

Jun 10, 2025 -

Dobbins Bold Yankees Claim Stuns Judge Full Story From Espn

Jun 10, 2025

Dobbins Bold Yankees Claim Stuns Judge Full Story From Espn

Jun 10, 2025 -

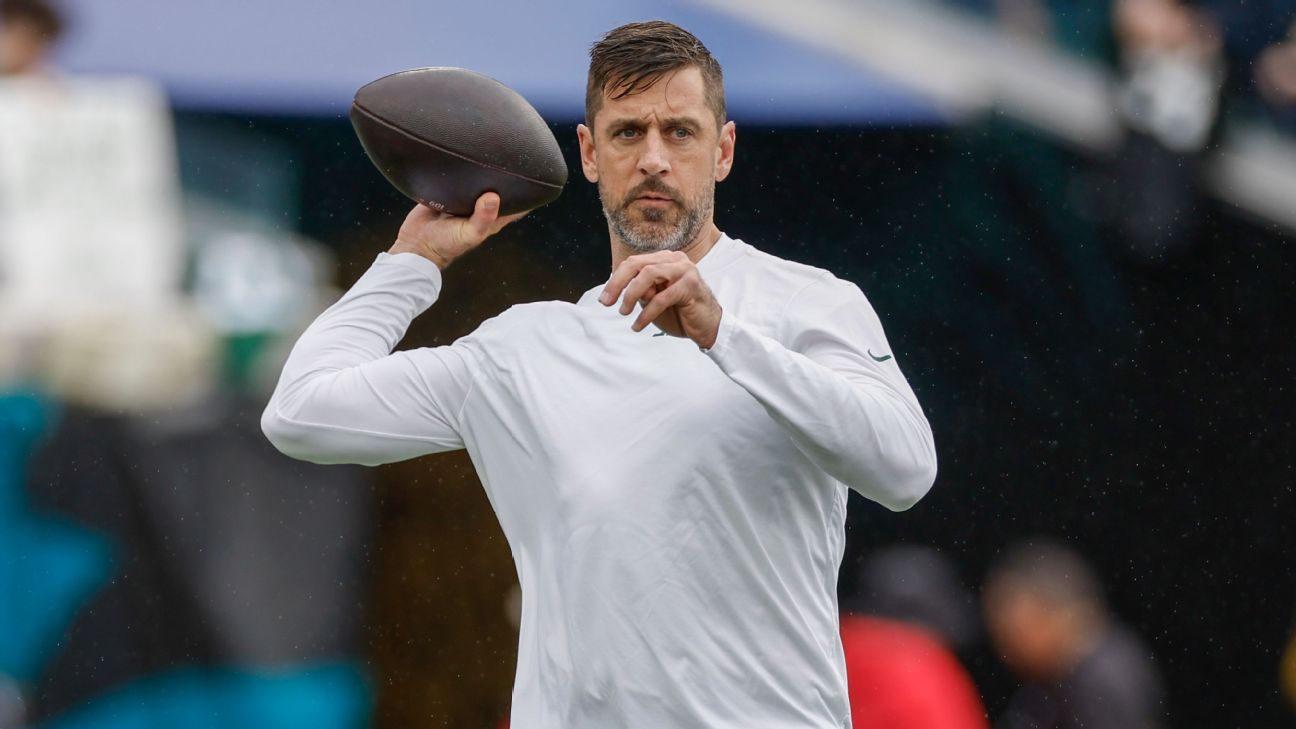

Steelers Land Aaron Rodgers In 13 65 M One Year Contract Sources

Jun 10, 2025

Steelers Land Aaron Rodgers In 13 65 M One Year Contract Sources

Jun 10, 2025 -

Cma Fest 2025 Unforgettable Nissan Stadium Moments From Sunday

Jun 10, 2025

Cma Fest 2025 Unforgettable Nissan Stadium Moments From Sunday

Jun 10, 2025 -

Bengals To Release Team Captain Germaine Pratt Report

Jun 10, 2025

Bengals To Release Team Captain Germaine Pratt Report

Jun 10, 2025