Snap Stock's 90% Fall: Predicting A 2025 Reversal.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Snap Stock's 90% Fall: Predicting a 2025 Reversal?

Snap Inc. (SNAP), the parent company of the popular social media app Snapchat, has experienced a dramatic downturn, with its stock price plummeting by approximately 90% from its all-time high. This staggering decline has left many investors wondering: is this the bottom, or is there further to fall? While predicting the future of any stock is inherently risky, a closer look at Snap's current situation and potential future catalysts suggests a possible reversal by 2025. However, it's crucial to approach any investment with caution and thorough due diligence.

The Fall from Grace: Understanding Snap's Decline

Several factors contributed to Snap's significant stock price drop. The initial hype surrounding the company's IPO gradually faded as investors became concerned about:

- Competition: The fiercely competitive social media landscape, dominated by giants like Meta (Facebook) and TikTok, has put immense pressure on Snap's user growth and advertising revenue. These platforms offer similar features and often attract a larger user base.

- Advertising Revenue Challenges: The broader economic downturn has impacted advertising spending, directly affecting Snap's primary revenue stream. Companies are cutting back on marketing budgets, leading to decreased ad revenue for platforms like Snapchat.

- Privacy Concerns: Growing concerns about data privacy and user security have impacted user trust and potentially slowed user growth. Regulations like GDPR and CCPA have also added complexities for social media companies.

- Management Decisions: Some investors have questioned certain management decisions, including strategic investments and the overall direction of the company.

Signs of a Potential 2025 Reversal?

Despite the gloomy picture, several factors could potentially contribute to a Snap stock reversal by 2025:

- Innovation and New Features: Snap consistently introduces new features and updates to its platform. The success of these innovations in attracting and retaining users could significantly impact its revenue growth. Their focus on augmented reality (AR) technology, for example, holds considerable long-term potential.

- Improved Monetization Strategies: Snap may implement new monetization strategies to diversify its revenue streams and reduce its reliance on advertising revenue alone. This could include exploring subscription models or expanding into new markets.

- Economic Recovery: A global economic recovery would likely boost advertising spending, benefitting Snap's revenue and potentially its stock price. Increased consumer confidence could translate into higher ad revenue.

- Strategic Partnerships: Strategic partnerships and acquisitions could help Snap expand its reach and capabilities, further bolstering its competitive position.

Investing in Snap: Proceed with Caution

While a 2025 reversal is possible, it's crucial to acknowledge the significant risks involved in investing in Snap stock. The company faces considerable challenges, and there's no guarantee of a price recovery. Before investing, consider these points:

- Conduct Thorough Research: Before making any investment decisions, thoroughly research Snap's financial performance, competitive landscape, and future prospects.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversifying your investment portfolio across different asset classes can mitigate risk.

- Consult a Financial Advisor: Seek advice from a qualified financial advisor before making any significant investment decisions. They can help you assess your risk tolerance and develop an investment strategy that aligns with your financial goals.

Conclusion:

Snap's 90% stock price drop is undeniably significant. However, the potential for a reversal by 2025 exists, driven by factors like innovation, improved monetization, economic recovery, and strategic partnerships. But investors must approach this potential with caution, conducting thorough research and understanding the inherent risks before committing any capital. The future of Snap remains uncertain, making careful consideration and diligent due diligence paramount.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Snap Stock's 90% Fall: Predicting A 2025 Reversal.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

World Cup Dreams Palestines Goalkeeper Rami Hamadi Faces Crucial Matches

Jun 11, 2025

World Cup Dreams Palestines Goalkeeper Rami Hamadi Faces Crucial Matches

Jun 11, 2025 -

Yankees Red Sox Rivalry Heats Up Judge Responds To Dobbins Comments

Jun 11, 2025

Yankees Red Sox Rivalry Heats Up Judge Responds To Dobbins Comments

Jun 11, 2025 -

College Game Day 2025 Espn Announces Ohio State As Opening Game Site

Jun 11, 2025

College Game Day 2025 Espn Announces Ohio State As Opening Game Site

Jun 11, 2025 -

Australia Vs Saudi Arabia A Crucial World Cup Qualifier

Jun 11, 2025

Australia Vs Saudi Arabia A Crucial World Cup Qualifier

Jun 11, 2025 -

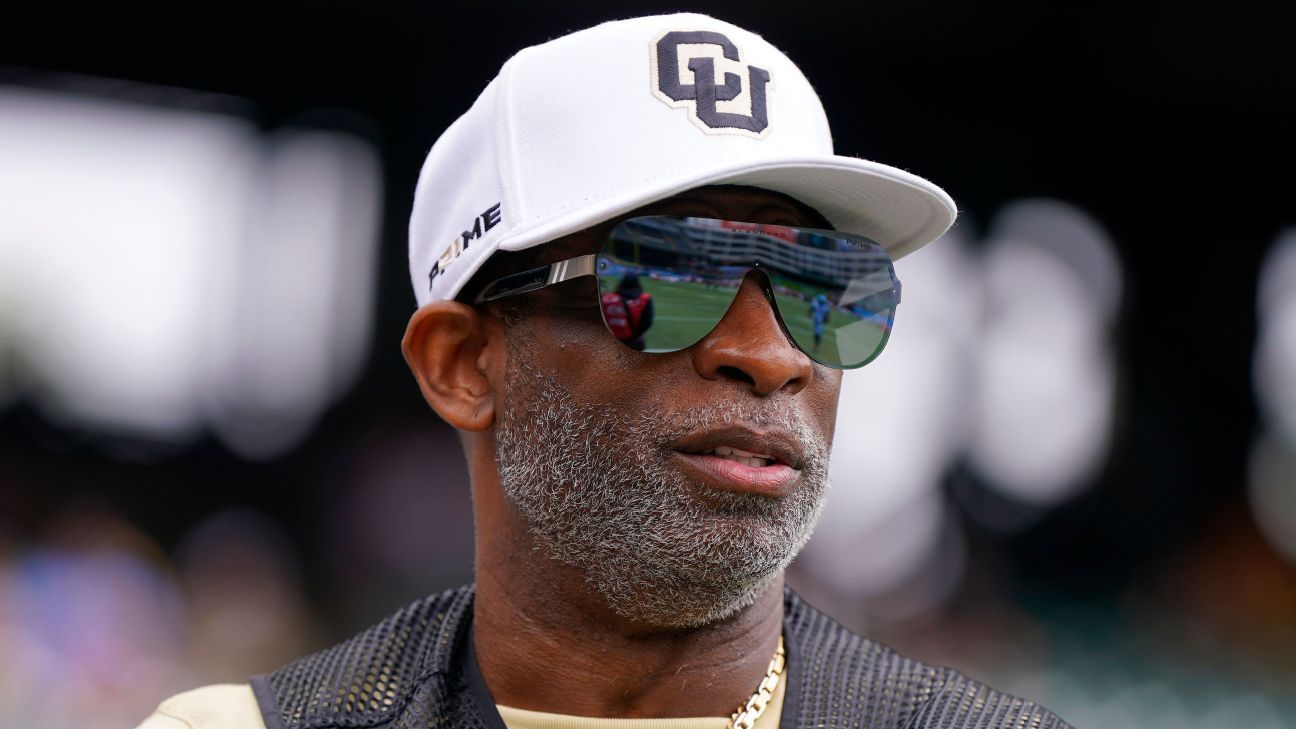

Illness Sidelines Colorados Deion Sanders Latest On His Health And Recovery

Jun 11, 2025

Illness Sidelines Colorados Deion Sanders Latest On His Health And Recovery

Jun 11, 2025