Snap Stock's 90% Fall: Analysis And 2025 Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Snap Stock's 90% Fall: Analysis and 2025 Outlook

Snap Inc. (SNAP), the parent company of the popular social media app Snapchat, has experienced a dramatic downturn, with its stock price plummeting by approximately 90% from its all-time high. This staggering fall has left investors reeling and sparked intense debate about the future of the company. This article delves into the reasons behind this significant drop and explores potential scenarios for Snap's stock in 2025.

The Factors Contributing to Snap's Decline:

Several interconnected factors have contributed to Snap's dramatic stock price decline. These include:

-

Increased Competition: The social media landscape is fiercely competitive. Platforms like TikTok, Instagram, and even Facebook continue to innovate and attract users, putting pressure on Snapchat's user growth and engagement metrics. This intense competition has made it challenging for Snap to maintain its market share and justify its valuation.

-

Advertising Revenue Challenges: A significant portion of Snap's revenue comes from advertising. Economic downturns and shifts in advertising spending have directly impacted Snap's bottom line. Advertisers are becoming more selective about their spending, favoring platforms with demonstrably higher returns on investment (ROI).

-

Privacy Concerns and Regulation: Growing concerns about data privacy and increasing regulatory scrutiny have added to Snap's challenges. Changes in Apple's iOS privacy policies, for example, have significantly impacted the effectiveness of targeted advertising, a crucial component of Snap's revenue model.

-

Management Decisions and Strategic Shifts: While Snap has attempted various strategic initiatives, some have faced criticism. Investors often react negatively to perceived missteps in management decisions, further impacting the stock price.

-

Macroeconomic Factors: The overall macroeconomic environment, including inflation and interest rate hikes, has created a challenging climate for many tech stocks, including Snap. Investors are becoming more risk-averse, leading to a sell-off in growth stocks.

Analyzing the Current Situation:

Snap's current situation is complex. While the company continues to innovate with new features and AR technology, it faces significant headwinds. The company's ability to adapt to changing user preferences, navigate the competitive landscape, and effectively monetize its user base will be crucial for its future success.

2025 Outlook: Potential Scenarios:

Predicting the future is inherently uncertain, but several scenarios are possible for Snap's stock by 2025:

-

Scenario 1: Continued Struggle: If Snap fails to significantly improve its user growth, advertising revenue, and address its competitive challenges, the stock price could remain depressed or even decline further.

-

Scenario 2: Gradual Recovery: If Snap successfully implements its strategic initiatives, improves its operational efficiency, and capitalizes on emerging opportunities, a gradual recovery is possible. This scenario would likely involve a slow but steady increase in the stock price.

-

Scenario 3: Strong Rebound: A strong rebound would require Snap to achieve significant breakthroughs in user engagement, advertising revenue, and market share. This scenario is less likely but not impossible, particularly if the company can successfully leverage its strengths in augmented reality (AR) technology.

Investing in Snap: Considerations for 2025 and Beyond:

Investing in Snap in the current climate requires careful consideration. Investors should thoroughly research the company's financials, understand the risks involved, and diversify their portfolios accordingly. The potential for significant returns exists, but the risk of further losses remains.

Conclusion:

Snap's 90% stock price fall is a significant event with far-reaching implications. The future of the company depends on its ability to adapt, innovate, and compete effectively in a rapidly evolving market. While uncertainty remains, a thorough understanding of the factors influencing Snap's performance is crucial for investors navigating this challenging landscape. Further analysis and monitoring of key performance indicators (KPIs) will be necessary to assess the likelihood of the various scenarios outlined above. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Snap Stock's 90% Fall: Analysis And 2025 Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Terry Mc Laurin Skips Commanders Minicamp Amid Contract Dispute

Jun 11, 2025

Terry Mc Laurin Skips Commanders Minicamp Amid Contract Dispute

Jun 11, 2025 -

Lee Corsos Final College Game Day Ohio State Hosts Before Texas Game

Jun 11, 2025

Lee Corsos Final College Game Day Ohio State Hosts Before Texas Game

Jun 11, 2025 -

Six Key Updates Androids Latest Personalized Features

Jun 11, 2025

Six Key Updates Androids Latest Personalized Features

Jun 11, 2025 -

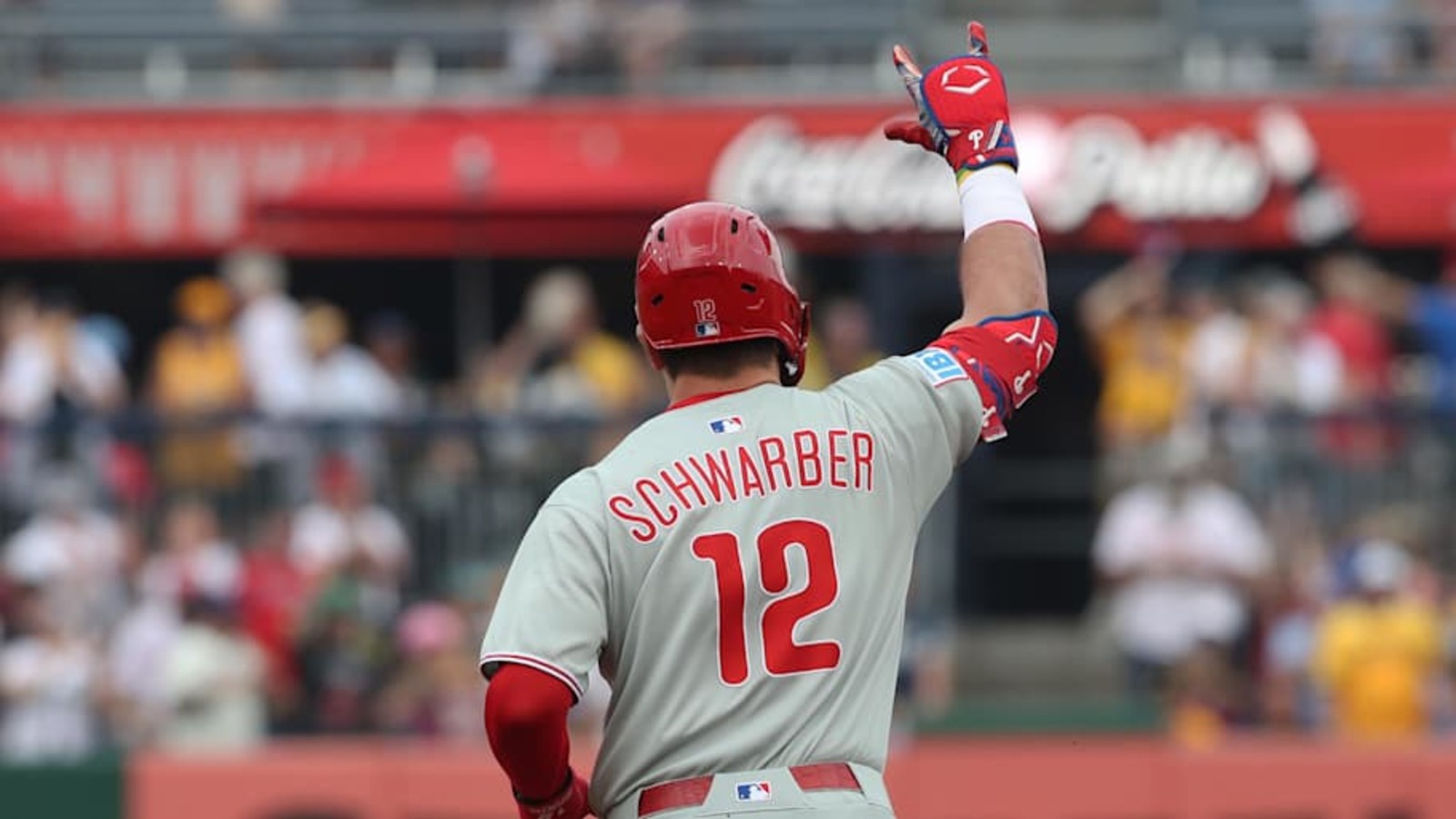

Nl All Star Roster Projections One Philadelphia Phillie Makes The Cut

Jun 11, 2025

Nl All Star Roster Projections One Philadelphia Phillie Makes The Cut

Jun 11, 2025 -

Penix Jr Vs Cousins Falcons Defensive Coordinator Addresses The Potential Challenge

Jun 11, 2025

Penix Jr Vs Cousins Falcons Defensive Coordinator Addresses The Potential Challenge

Jun 11, 2025