Snap Stock: 90% Decline – Analyzing The Potential For A Comeback By 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Snap Stock: 90% Decline – Analyzing the Potential for a Comeback by 2025

Snap Inc., the parent company of the popular social media app Snapchat, has experienced a dramatic downturn in its stock price, plummeting by approximately 90% from its peak. This staggering decline has left investors questioning the future of the company and the potential for a resurgence by 2025. While the road to recovery is undeniably challenging, a closer examination reveals several factors that could contribute to a potential comeback.

The Fall from Grace: Understanding Snap's Challenges

Several key factors contributed to Snap's significant stock price drop. These include:

-

Increased Competition: The social media landscape is fiercely competitive. Platforms like TikTok and Instagram, with their innovative features and vast user bases, have aggressively challenged Snapchat's dominance, particularly among younger demographics. This intense competition has impacted user growth and engagement, directly affecting Snap's revenue streams.

-

Advertising Revenue Slowdown: A significant portion of Snap's revenue relies on advertising. Economic downturns and shifts in digital advertising spending have negatively impacted Snap's ability to generate revenue at the same rate as in previous years. This revenue slowdown has directly impacted investor confidence.

-

Privacy Concerns and Regulatory Scrutiny: Growing concerns surrounding data privacy and increasing regulatory scrutiny have also placed pressure on Snap. Navigating these complex regulatory environments requires significant investment and can negatively impact profitability.

-

Management Decisions: Strategic decisions and internal management changes have also been cited as contributing factors to the stock's decline. Critics have pointed to certain missteps in product development and marketing strategies as further setbacks.

The Path to Recovery: Factors Suggesting a Potential Comeback

Despite the significant challenges, several factors suggest a potential for Snap to regain its footing by 2025:

-

Innovation and Product Development: Snap consistently introduces new features and updates to its platform. Continued innovation, focusing on user experience and engaging content formats, could attract and retain users, leading to increased engagement and advertising revenue. Their investment in augmented reality (AR) technology could also prove to be a game-changer.

-

Strategic Partnerships and Acquisitions: Strategic partnerships and acquisitions can broaden Snap's reach and capabilities. Collaborations with other companies and strategic acquisitions of promising technologies could significantly boost its growth.

-

Improving Monetization Strategies: Refining advertising strategies and exploring new revenue streams beyond advertising, such as subscription models or in-app purchases, could diversify revenue and reduce reliance on a single revenue source.

-

Enhanced User Privacy Measures: Addressing privacy concerns and proactively complying with evolving regulations could rebuild user trust and enhance the platform's long-term viability.

Will Snap Stage a Comeback by 2025? A Realistic Outlook

Predicting the future of any stock is inherently speculative. While a 90% decline represents a significant setback, it's not necessarily indicative of complete failure. The potential for a comeback by 2025 hinges on Snap's ability to address its existing challenges effectively, execute its strategic plans successfully, and capitalize on emerging opportunities in the evolving digital landscape. Investors should carefully monitor Snap's performance, its strategic initiatives, and the broader social media market trends before making any investment decisions. This requires continuous analysis of financial reports, user growth statistics, and overall market sentiment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Snap Stock: 90% Decline – Analyzing The Potential For A Comeback By 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Manchester Citys 33 7m Bid For Lyons Rayan Cherki Transfer News

Jun 11, 2025

Manchester Citys 33 7m Bid For Lyons Rayan Cherki Transfer News

Jun 11, 2025 -

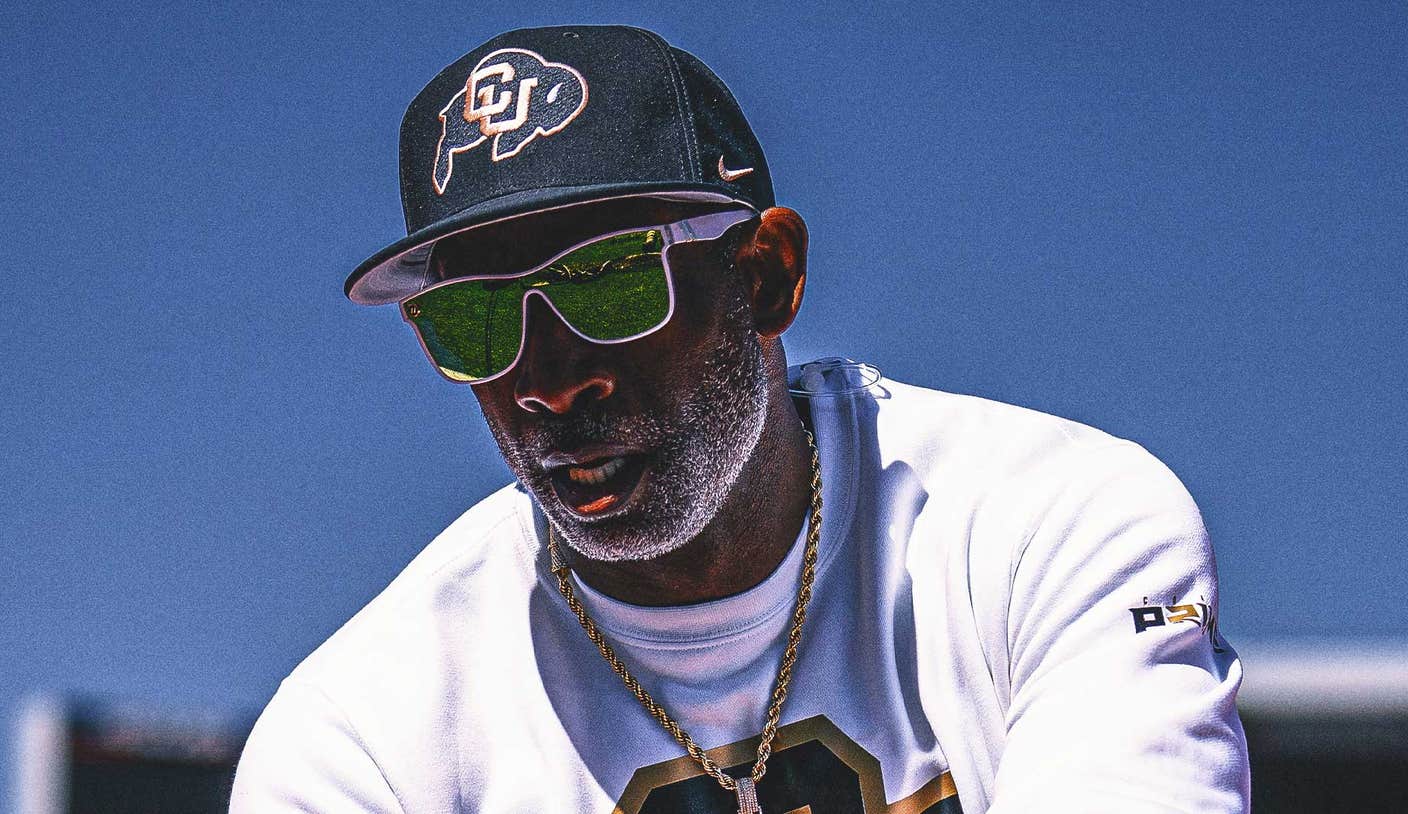

Deion Sanders Medical Leave Impact On Colorado Buffaloes Football

Jun 11, 2025

Deion Sanders Medical Leave Impact On Colorado Buffaloes Football

Jun 11, 2025 -

Wnba 2025 Championship Odds Libertys Rise Fevers Fall

Jun 11, 2025

Wnba 2025 Championship Odds Libertys Rise Fevers Fall

Jun 11, 2025 -

Gilgeous Alexanders 3 000 Point Season An Exclusive Nba Achievement

Jun 11, 2025

Gilgeous Alexanders 3 000 Point Season An Exclusive Nba Achievement

Jun 11, 2025 -

Espn Sources 33 7m Cherki Transfer To Manchester City On The Verge Of Completion

Jun 11, 2025

Espn Sources 33 7m Cherki Transfer To Manchester City On The Verge Of Completion

Jun 11, 2025