SMCI Stock: A Comprehensive Investment Analysis (P/E 14.62)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SMCI Stock: A Comprehensive Investment Analysis (P/E 14.62)

Is SMCI a smart addition to your portfolio? The stock market can be a daunting place, filled with jargon and fluctuating values. Understanding a company's fundamentals before investing is crucial, and today, we're diving deep into SMCI stock, examining its current performance, potential risks, and overall investment prospects. With a Price-to-Earnings ratio (P/E) of 14.62, it's time to assess whether SMCI is worth your investment.

Understanding SMCI's Current Market Position:

Before we delve into the specifics, let's briefly understand what SMCI represents. (Note: Replace this with the actual company name and a brief, accurate description of the company and its industry. For example: "SMCI, short for [Company Full Name], is a leading provider of [Industry] solutions, known for its [Key Product/Service] and strong market presence in [Geographic Location(s)]." )

This section should include details like:

- Industry Overview: What industry does SMCI operate in? What are the current market trends affecting this industry? Are there any significant regulatory changes impacting the sector?

- Competitive Landscape: Who are SMCI's main competitors? How does SMCI differentiate itself in the market? What is its market share?

- Recent Financial Performance: Analyze SMCI's recent financial statements, including revenue growth, profitability, and debt levels. Include data points and cite reliable sources (e.g., financial news websites, SEC filings).

Analyzing the P/E Ratio (14.62): What Does it Mean?

A P/E ratio of 14.62 indicates that investors are willing to pay $14.62 for every $1 of SMCI's earnings. This is considered a relatively low P/E ratio compared to the overall market average and some industry peers (add context here, stating the average P/E for the industry, if possible). A lower P/E ratio might suggest that the stock is undervalued, but it's crucial to consider other factors before reaching a conclusion.

Potential Risks and Considerations:

No investment is without risk. Before investing in SMCI, consider the following:

- Economic Factors: How might macroeconomic factors like inflation, interest rates, and economic downturns impact SMCI's performance?

- Industry-Specific Risks: Are there any specific risks within SMCI's industry that could negatively affect the company's profitability?

- Company-Specific Risks: Does SMCI have any significant debt levels, legal issues, or management changes that could pose a risk to investors?

Growth Potential and Future Outlook:

This section should delve into SMCI's future growth prospects. Analyze their strategic initiatives, expansion plans, and research and development efforts. Consider:

- Market Opportunities: Does SMCI have opportunities to expand into new markets or develop new products/services?

- Technological Advancements: How is SMCI adapting to technological changes in its industry?

- Management Team: Assess the competence and experience of SMCI's management team.

Conclusion: Is SMCI Stock Right for You?

Ultimately, whether or not SMCI stock is a worthwhile investment depends on your individual risk tolerance, investment goals, and financial situation. While a P/E ratio of 14.62 might suggest undervaluation, a thorough due diligence process is essential. Consider consulting with a qualified financial advisor before making any investment decisions. This analysis provides a starting point for your research, but it should not be considered financial advice.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult a financial professional before making any investment decisions.

(Include relevant links to SMCI's investor relations page, SEC filings, and reputable financial news sources.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SMCI Stock: A Comprehensive Investment Analysis (P/E 14.62). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Haddad Maia 23 Vs Baptiste 70 Roland Garros 2025 Match Preview

May 27, 2025

Haddad Maia 23 Vs Baptiste 70 Roland Garros 2025 Match Preview

May 27, 2025 -

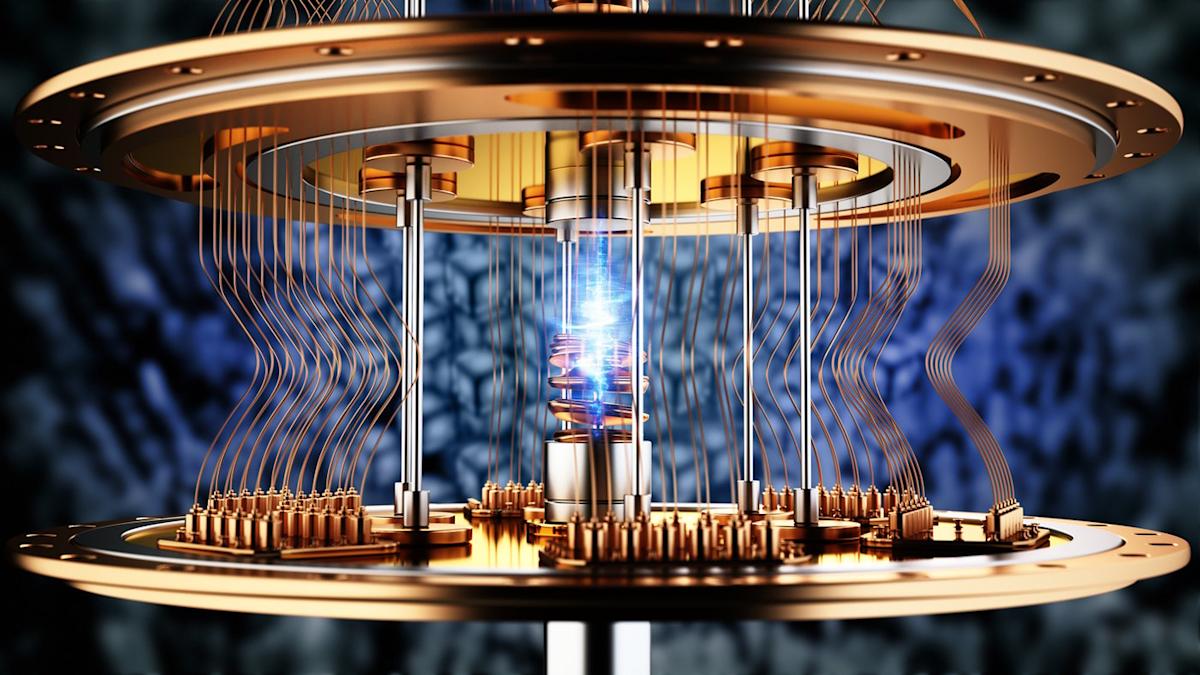

D Wave Vs Rigetti Evaluating The Potential Of Quantum Computing Stocks

May 27, 2025

D Wave Vs Rigetti Evaluating The Potential Of Quantum Computing Stocks

May 27, 2025 -

Assessing The 2025 French Open From Alcaraz To Gauff A Ranking Of Potential Winners

May 27, 2025

Assessing The 2025 French Open From Alcaraz To Gauff A Ranking Of Potential Winners

May 27, 2025 -

Ross Chastain Edges Out William Byron In Thrilling Coca Cola 600 Victory

May 27, 2025

Ross Chastain Edges Out William Byron In Thrilling Coca Cola 600 Victory

May 27, 2025 -

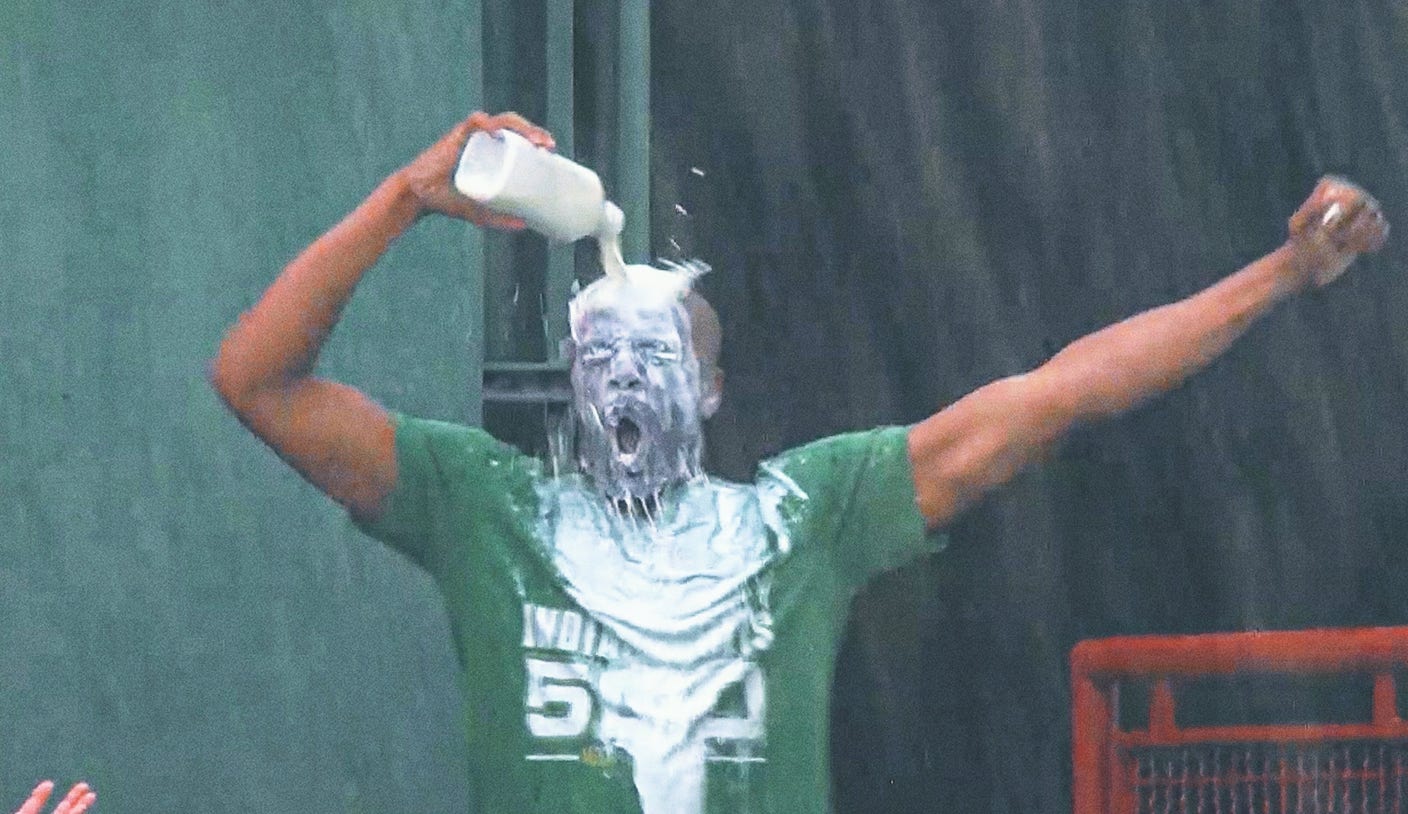

Why Are Baseball Fans Drenching Themselves In Milk

May 27, 2025

Why Are Baseball Fans Drenching Themselves In Milk

May 27, 2025