Smart Money Moves: 2 S&P 500 Stocks To Buy During Market Volatility

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Smart Money Moves: 2 S&P 500 Stocks to Buy During Market Volatility

Market volatility. Those two words alone are enough to send shivers down the spine of even the most seasoned investor. But while uncertainty can be unsettling, it also presents opportunities for savvy investors to snag undervalued assets. Instead of panicking, now is the time to consider strategic additions to your portfolio. We've identified two S&P 500 stocks poised to weather the storm and potentially deliver strong returns in the long term, even amidst market fluctuations.

Why Invest During Volatility?

Before diving into specific stocks, it's crucial to understand the logic behind investing during periods of market uncertainty. While short-term losses can be alarming, history shows that market downturns are often followed by periods of significant growth. Buying quality stocks at discounted prices – a common strategy employed during volatility – can significantly boost your long-term investment returns. This approach is often referred to as "value investing," a strategy championed by legendary investors like Warren Buffett. [Link to an article about value investing]

Stock #1: [Company Name A] (Ticker Symbol: [Ticker Symbol A])

[Company Name A] operates in the [Industry Sector] sector and has a proven track record of [mention key strengths, e.g., consistent dividend payouts, strong revenue growth, innovative product pipeline]. Despite recent market dips, the company's fundamentals remain strong, showcasing its resilience.

- Key Strengths: [List 3-4 bullet points highlighting key strengths. Examples: Strong brand recognition, diversified revenue streams, efficient operations, positive earnings growth.]

- Reasons for Purchase: [Explain why this stock is a good buy during market volatility. Examples: Undervalued based on its intrinsic value, potential for future growth despite current market conditions, a strong balance sheet that can withstand economic downturns.]

- Potential Risks: [Transparency is key. Briefly address potential downsides. Examples: Competition in the market, dependence on specific economic factors, potential regulatory changes.]

Stock #2: [Company Name B] (Ticker Symbol: [Ticker Symbol B])

[Company Name B], a leader in the [Industry Sector] industry, offers a compelling investment opportunity due to its [mention key strengths, e.g., innovative technology, strong management team, expanding market share]. The recent market correction has presented a buying opportunity for long-term investors.

- Key Strengths: [List 3-4 bullet points highlighting key strengths. Examples: First-mover advantage in a growing market, patented technology, experienced leadership team, recurring revenue streams.]

- Reasons for Purchase: [Explain why this stock is a good buy during market volatility. Examples: Strong growth potential despite current market headwinds, undervalued relative to its peers, potential for significant long-term capital appreciation.]

- Potential Risks: [Again, transparency is crucial. Address potential downsides. Examples: Dependence on a single product line, potential technological disruptions, exposure to geopolitical risks.]

Important Disclaimer: This article is for informational purposes only and should not be considered financial advice. Before making any investment decisions, it's crucial to conduct thorough research and consult with a qualified financial advisor. The performance of any stock can fluctuate significantly, and past performance is not indicative of future results.

Investing in the S&P 500: A Long-Term Strategy

Investing in the S&P 500, a leading index of large-cap U.S. companies, is a common strategy for long-term growth. While short-term volatility is inevitable, history suggests that the S&P 500 tends to trend upward over time. By carefully selecting strong companies within the index, investors can potentially mitigate risk and generate long-term returns. [Link to an article about investing in the S&P 500]

Call to Action: Do your due diligence, consider your risk tolerance, and make informed decisions based on your individual financial goals. Remember, long-term investment success is built on a foundation of thorough research and strategic planning.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Smart Money Moves: 2 S&P 500 Stocks To Buy During Market Volatility. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

French Open 2025 Day 2 Live Scores And Updates Navarros Early Exit

May 27, 2025

French Open 2025 Day 2 Live Scores And Updates Navarros Early Exit

May 27, 2025 -

Teslas Robotaxi Nears Wedbush Predicts A Golden Age Of Autonomous Driving

May 27, 2025

Teslas Robotaxi Nears Wedbush Predicts A Golden Age Of Autonomous Driving

May 27, 2025 -

Super Micro Computer Factors Contributing To A Possible Correction

May 27, 2025

Super Micro Computer Factors Contributing To A Possible Correction

May 27, 2025 -

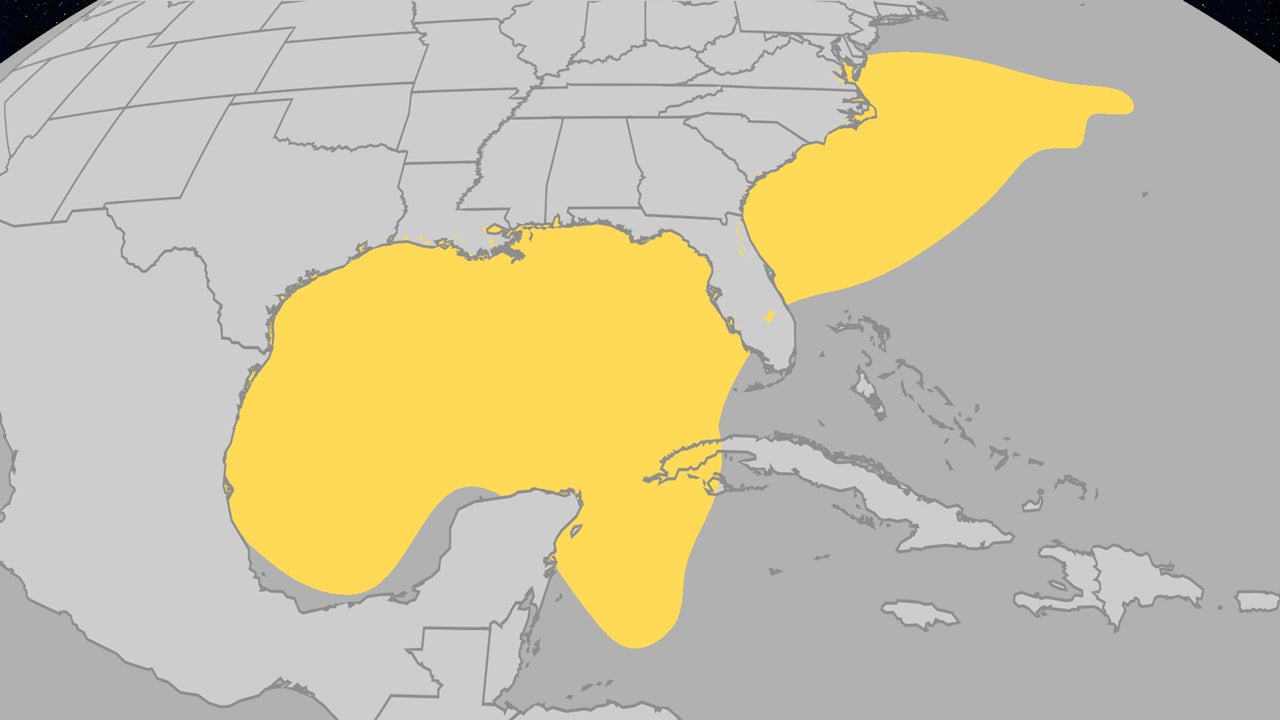

June Hurricanes An Analysis Of Atlantic Storm Development And Recent Trends

May 27, 2025

June Hurricanes An Analysis Of Atlantic Storm Development And Recent Trends

May 27, 2025 -

Analysis Reveals Recurring Pattern In Tropical Weather Systems

May 27, 2025

Analysis Reveals Recurring Pattern In Tropical Weather Systems

May 27, 2025