Slight Decrease In U.S. Treasury Yields Following Fed's 2025 Rate Cut Forecast

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slight Decrease in U.S. Treasury Yields Following Fed's 2025 Rate Cut Forecast

U.S. Treasury yields experienced a modest dip following the Federal Reserve's projection of a potential rate cut in 2025. This shift, while subtle, signals a nuanced change in market sentiment regarding the future trajectory of interest rates and the overall economic outlook. The move reflects investor optimism about a potential easing of monetary policy in the not-too-distant future.

The Federal Open Market Committee (FOMC), in its recent meeting, hinted at a possible rate reduction as early as 2025. This forecast, though contingent on future economic data and inflation trends, has injected a degree of uncertainty into the bond market, leading to the observed decrease in yields. This contrasts with previous expectations of sustained higher rates for a longer period.

Understanding the Impact of the Fed's Forecast

The Fed's projection is significant because it influences investor behavior and market dynamics. Lower yields generally translate to higher bond prices, making them more attractive to investors seeking fixed-income investments. This inverse relationship is a cornerstone of bond market trading. The slight decrease in yields suggests that investors are beginning to price in the possibility of the Fed's predicted rate cut.

This move, however, is not universally interpreted as a sign of an impending economic downturn. Some analysts argue that the forecast reflects the Fed's confidence in its ability to manage inflation without causing a significant economic contraction. They believe that the projected rate cut is a preemptive measure designed to maintain economic stability rather than a reaction to a weakening economy.

What Does This Mean for Investors?

The recent yield dip presents a complex scenario for investors. While lower yields might appear less lucrative on the surface, they also signify potentially lower borrowing costs in the future. This could stimulate economic activity and benefit businesses reliant on debt financing. However, investors should proceed with caution, carefully weighing the risks and potential returns associated with various investment strategies. Diversification remains crucial in managing portfolio risk.

- Fixed-income investors: Might consider adjusting their portfolios to capitalize on potentially higher bond prices. However, remember that bond prices are susceptible to interest rate changes.

- Equity investors: Should monitor the situation closely as interest rate changes can influence corporate earnings and stock valuations.

- Real estate investors: Should consider the impact of potentially lower borrowing costs on property investments.

Looking Ahead: Uncertainty Remains

While the Fed's projection provides a glimpse into its future policy intentions, significant uncertainty remains. The actual timing and magnitude of any potential rate cut will depend heavily on the evolution of macroeconomic indicators like inflation, employment figures, and GDP growth. Close monitoring of these economic data points is crucial for informed investment decisions. The coming months will be critical in observing how the market reacts to the evolving economic landscape. Further analysis of inflation data, specifically the Consumer Price Index (CPI) and the Producer Price Index (PPI), will be essential in gauging the Fed's next steps. Investors should consult with financial advisors to navigate the complexities of the current market environment.

Disclaimer: This article provides general information and does not constitute financial advice. Consult with a qualified financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slight Decrease In U.S. Treasury Yields Following Fed's 2025 Rate Cut Forecast. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Report Fred Warner Signs 3 Year 63 Million Extension With San Francisco 49ers

May 21, 2025

Report Fred Warner Signs 3 Year 63 Million Extension With San Francisco 49ers

May 21, 2025 -

Mets Mendoza To Mentor Soto On Hustle Espn Report

May 21, 2025

Mets Mendoza To Mentor Soto On Hustle Espn Report

May 21, 2025 -

Cavaliers Gm On Rising Expectations Overcoming The Playoffs Hurdle Is Key

May 21, 2025

Cavaliers Gm On Rising Expectations Overcoming The Playoffs Hurdle Is Key

May 21, 2025 -

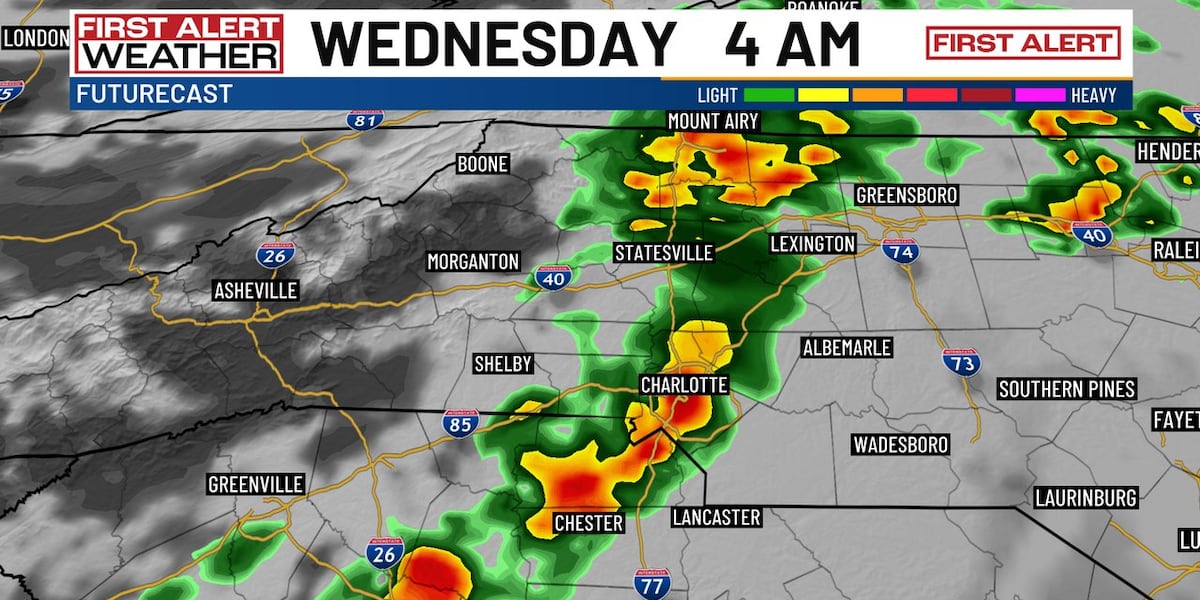

Charlotte Facing Overnight Storms Before Significant Temperature Drop

May 21, 2025

Charlotte Facing Overnight Storms Before Significant Temperature Drop

May 21, 2025 -

North Carolina Residents Urged To Prepare Severe Storms And Heavy Rain Forecast Overnight

May 21, 2025

North Carolina Residents Urged To Prepare Severe Storms And Heavy Rain Forecast Overnight

May 21, 2025