Slight Decrease In U.S. Treasury Yields Following Fed Announcement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slight Decrease in U.S. Treasury Yields Following Fed Announcement: What It Means for Investors

The Federal Reserve's latest announcement sent ripples through the financial markets, resulting in a slight, yet notable, decrease in U.S. Treasury yields. This unexpected shift has left investors wondering about the implications for future economic growth and investment strategies. Understanding this nuance requires a careful analysis of the Fed's statement and its potential impact on various sectors.

The Fed's Announcement and Market Reaction

The Federal Open Market Committee (FOMC) concluded its meeting with a decision that, while largely anticipated, still surprised some market analysts. While interest rates remained unchanged, the accompanying statement hinted at a more cautious approach to future rate hikes. This subtle shift in tone was enough to trigger a modest decline in Treasury yields across the curve. Specifically, the yield on the benchmark 10-year Treasury note experienced a noticeable dip, falling from [Insert Previous Day's Yield]% to [Insert Current Day's Yield]%. This decrease signals a potential shift in investor sentiment, with some anticipating slower economic growth or a less aggressive tightening of monetary policy.

Why the Decrease? Analyzing the Market's Response

Several factors contributed to the market's reaction:

- Shifting Inflation Expectations: While inflation remains a concern, the Fed's statement hinted at a potential easing of inflationary pressures. This reduced the perceived need for aggressive rate hikes, leading to lower yields. Investors are increasingly looking to indicators beyond the Consumer Price Index (CPI) for a clearer picture of inflation's trajectory.

- Concerns About Economic Slowdown: Recent economic data, including [mention relevant economic indicators like GDP growth or employment figures], has fueled concerns about a potential economic slowdown. This uncertainty prompted investors to seek the relative safety of U.S. Treasury bonds, driving up demand and thus lowering yields.

- Geopolitical Uncertainty: Ongoing global uncertainties, including [mention relevant geopolitical events], can also influence investor behavior. During periods of instability, investors often flock to safe-haven assets like U.S. Treasuries, pushing yields lower.

Implications for Investors and the Broader Economy

The decrease in Treasury yields has significant implications for various sectors:

- Bond Market: Lower yields translate to higher bond prices, offering potential gains for bondholders. However, investors should remain mindful of the interest rate risk associated with bond investments.

- Stock Market: The impact on the stock market is more complex. While lower yields can be positive for some sectors, particularly those sensitive to interest rates, others might face challenges. A slower economic growth scenario, implied by lower yields, might negatively impact corporate earnings.

- Mortgage Rates: Changes in Treasury yields often influence mortgage rates. A decrease in Treasury yields could potentially lead to slightly lower mortgage rates, making homeownership more affordable for some.

Looking Ahead: What to Expect

Predicting future movements in Treasury yields remains challenging. The situation will likely depend on several factors, including future economic data releases, the Fed's future policy decisions, and global events. Investors should carefully monitor economic indicators and the Fed's pronouncements for clues on future market movements.

Call to Action: Stay informed about economic developments and consult with a financial advisor to make informed investment decisions. Understanding the nuances of the bond market and its relationship with other asset classes is crucial for navigating the current economic climate.

Keywords: U.S. Treasury Yields, Federal Reserve, FOMC, Interest Rates, Bond Market, Inflation, Economic Growth, Investment Strategy, Stock Market, Mortgage Rates, Geopolitical Uncertainty, Economic Indicators, Safe-Haven Assets

Related Articles: (Internal links to relevant articles on your website would go here)

External Links: (Links to reputable financial news sources and government websites providing economic data)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slight Decrease In U.S. Treasury Yields Following Fed Announcement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Over 5 Billion Invested In Bitcoin Etfs Analyzing The Directional Bets

May 20, 2025

Over 5 Billion Invested In Bitcoin Etfs Analyzing The Directional Bets

May 20, 2025 -

Dramatic 10th Inning Giants Secure Victory Over Athletics With Walk Off Walk

May 20, 2025

Dramatic 10th Inning Giants Secure Victory Over Athletics With Walk Off Walk

May 20, 2025 -

Ufc News Jon Jones Future Uncertain Following I M Done Statement Aspinall Negotiations Stalled

May 20, 2025

Ufc News Jon Jones Future Uncertain Following I M Done Statement Aspinall Negotiations Stalled

May 20, 2025 -

Imposing Galactus First Look At The Devourer Of Worlds In Fantastic Four First Steps

May 20, 2025

Imposing Galactus First Look At The Devourer Of Worlds In Fantastic Four First Steps

May 20, 2025 -

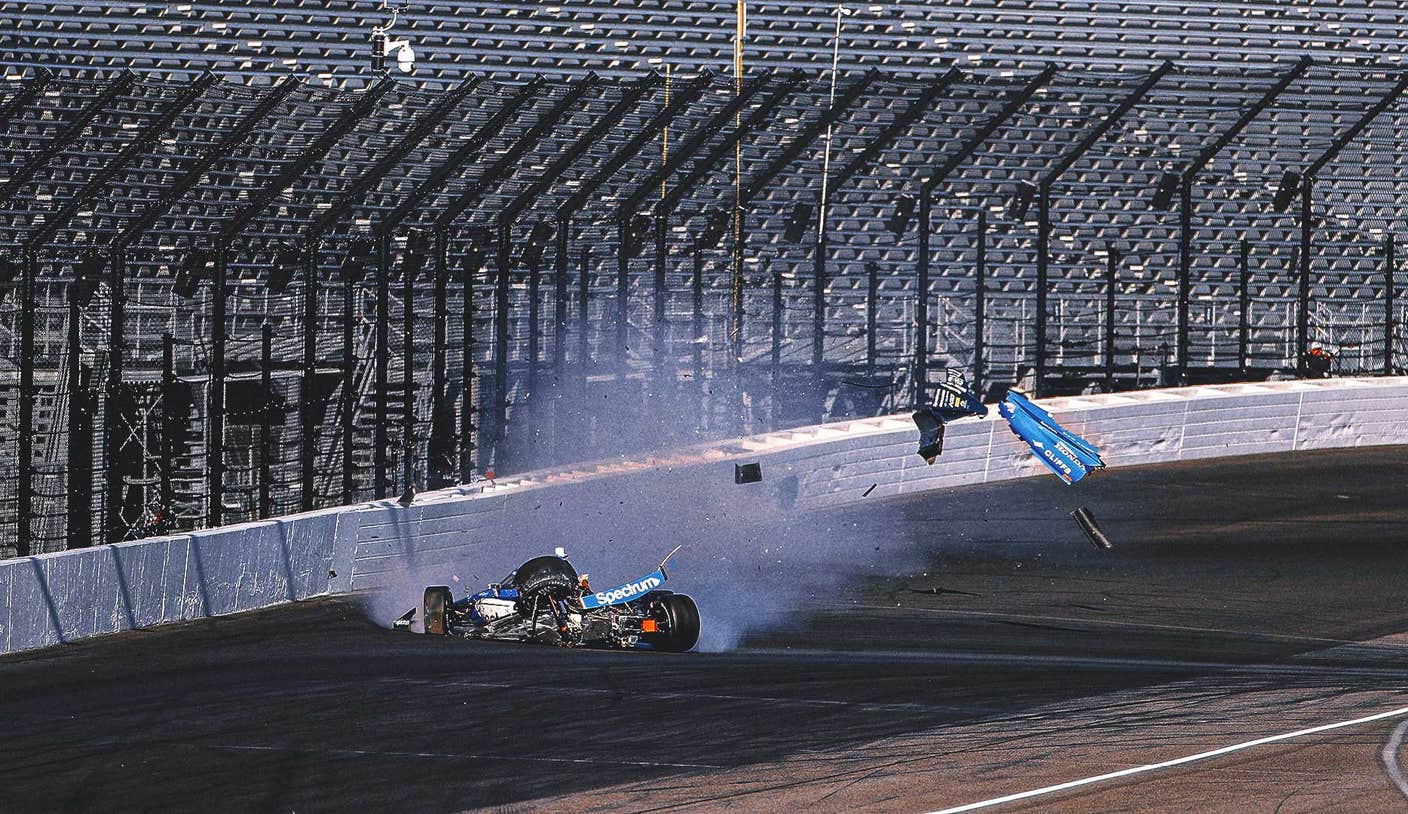

Indy 500 Practice A Roundup Of Weekend Crashes

May 20, 2025

Indy 500 Practice A Roundup Of Weekend Crashes

May 20, 2025