Single Rate Cut Projected For 2025: Impact On U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Single Rate Cut Projected for 2025: Impact on U.S. Treasury Yields

The Federal Reserve's aggressive interest rate hikes throughout 2022 and early 2023 have finally begun to show signs of slowing inflation. However, the expectation now is for a single rate cut in 2025, a projection that has significant implications for U.S. Treasury yields. This article delves into the projected rate cut, its potential impact on Treasury yields, and what investors should consider.

The Fed's Shifting Stance and the 2025 Rate Cut Projection

After a period of rapid increases, the Fed has adopted a more cautious approach to monetary policy. While inflation remains a concern, the central bank is carefully monitoring economic data to avoid triggering a recession. Most economic forecasts currently predict a single interest rate reduction in 2025, a shift from previous expectations of multiple cuts. This reflects a belief that inflation will remain stubbornly persistent, requiring continued vigilance from the Fed. This single cut, while seemingly minor, could have a ripple effect across the financial markets.

Impact on U.S. Treasury Yields

U.S. Treasury yields are inversely correlated with interest rates. When the Fed cuts rates, investors generally anticipate lower future returns on Treasury bonds, leading to a decrease in yields. This is because lower interest rates make existing bonds with higher yields more attractive. The projected single rate cut in 2025 is unlikely to cause a dramatic drop in Treasury yields, but it's expected to trigger a moderate decline. Several factors contribute to this anticipated, yet tempered, impact:

- Inflationary Pressures: Persistent inflation could limit the downward pressure on yields, even with a rate cut. The market will closely watch inflation data to gauge the Fed's future actions.

- Economic Growth: The pace of economic growth will heavily influence Treasury yields. A robust economy might offset the impact of a rate cut, while a weakening economy could amplify the decline in yields.

- Global Economic Conditions: International events and global economic uncertainties can also affect investor sentiment towards U.S. Treasuries, influencing their yields.

What Investors Should Consider

The projected single rate cut presents both opportunities and challenges for investors. Here's what to consider:

- Diversification: Maintaining a diversified portfolio remains crucial. Investing solely in Treasuries might not be the optimal strategy, given the potential for moderate yield changes.

- Maturity Dates: Investors should carefully consider the maturity dates of their Treasury holdings. Shorter-term Treasuries are generally less sensitive to interest rate changes than longer-term ones.

- Risk Tolerance: Investors with a higher risk tolerance might consider adjusting their portfolios to capitalize on potential opportunities arising from yield fluctuations. Conversely, risk-averse investors may want to maintain a more conservative approach.

Looking Ahead: Uncertainty Remains

While a single rate cut in 2025 is currently projected, uncertainty remains. Unforeseen economic events could easily alter this forecast. Closely monitoring economic indicators, including inflation data, GDP growth, and employment figures, is essential for making informed investment decisions. Staying informed about the Fed's pronouncements and actions will be key in navigating this evolving landscape. Consult with a financial advisor for personalized guidance based on your individual circumstances and investment objectives.

Keywords: US Treasury Yields, Federal Reserve, Interest Rate Cut, 2025 Rate Projections, Bond Yields, Inflation, Economic Growth, Investment Strategy, Treasury Bonds, Monetary Policy

(Note: This article provides general information and does not constitute financial advice. Consult with a qualified financial professional before making any investment decisions.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Single Rate Cut Projected For 2025: Impact On U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

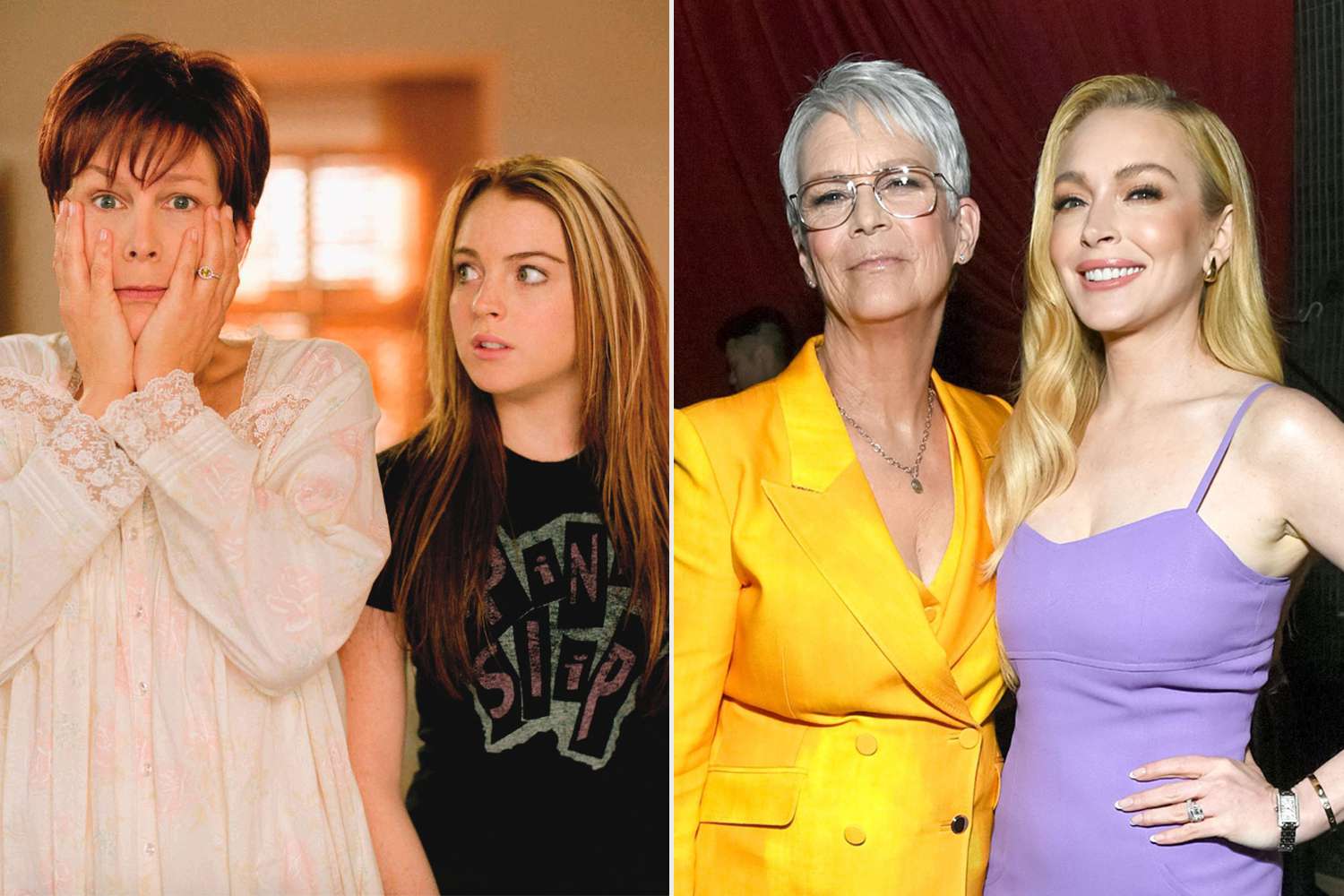

Jamie Lee Curtis Opens Up About Staying Connected With Lindsay Lohan After Their Iconic Film

May 20, 2025

Jamie Lee Curtis Opens Up About Staying Connected With Lindsay Lohan After Their Iconic Film

May 20, 2025 -

Fed Signals One Rate Cut In 2025 Sending U S Treasury Yields Lower

May 20, 2025

Fed Signals One Rate Cut In 2025 Sending U S Treasury Yields Lower

May 20, 2025 -

Oklahoma City Upsets Denver Game 7 Rout Secures Playoff Advancement

May 20, 2025

Oklahoma City Upsets Denver Game 7 Rout Secures Playoff Advancement

May 20, 2025 -

Thunder Triumph Over Nuggets Punching Ticket To Western Conference Finals

May 20, 2025

Thunder Triumph Over Nuggets Punching Ticket To Western Conference Finals

May 20, 2025 -

Bali Calls For Global Cooperation To Enhance Tourist Safety And Respect

May 20, 2025

Bali Calls For Global Cooperation To Enhance Tourist Safety And Respect

May 20, 2025