Should You Invest In SMCI Stock? Evaluating Its 14.62 P/E Multiple

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Invest in SMCI Stock? Evaluating its 14.62 P/E Multiple

The allure of a potentially high-growth stock like SMCI (SMCI stock) often tempts investors. But before diving in, a crucial factor to consider is its Price-to-Earnings (P/E) ratio. Currently sitting at 14.62, this metric demands a closer look. Is this a bargain, a fair price, or an overvalued opportunity? This article will delve into the intricacies of SMCI's P/E ratio and help you determine if it's the right investment for your portfolio.

Understanding SMCI's P/E Ratio:

A P/E ratio of 14.62 signifies that investors are willing to pay $14.62 for every $1 of SMCI's earnings per share (EPS). This figure is relative; its significance depends on several factors, including:

-

Industry Benchmarks: Comparing SMCI's P/E ratio to its competitors within the [insert SMCI's industry sector here] sector is crucial. A lower P/E than its peers could suggest undervaluation, while a higher P/E might indicate overvaluation. Analyzing the average P/E ratio of similar companies provides valuable context.

-

Growth Prospects: A company's projected future growth significantly impacts its P/E ratio. High-growth companies often command higher P/E multiples because investors anticipate substantial future earnings. Therefore, examining SMCI's projected revenue growth, earnings growth, and market share is essential. Look for reliable analyst forecasts and consider the company's recent financial statements and press releases.

-

Financial Health: A company's financial stability is paramount. Before investing, assess SMCI's debt levels, cash flow, and profitability. High debt levels or declining profitability could negatively impact its future performance and justify a lower P/E ratio. Check resources like the company's investor relations page for financial reports (10-K, 10-Q).

-

Market Sentiment: Overall market conditions and investor sentiment towards SMCI also influence its P/E ratio. During periods of market uncertainty, investors may be less willing to pay higher multiples for stocks, even if fundamentally strong. Understanding prevailing market trends is crucial.

SMCI's Recent Performance and Future Outlook:

[Insert a concise summary of SMCI's recent financial performance, including key metrics like revenue growth, profit margins, and any significant news impacting the company. Include links to relevant news articles or financial reports whenever possible. For example: "In Q3 2023, SMCI reported a 15% increase in revenue, exceeding analyst expectations. This positive trend suggests a strong underlying business momentum..." ]

Factors to Consider Beyond the P/E Ratio:

While the P/E ratio is a valuable tool, it shouldn't be the sole determinant of your investment decision. Consider other key financial metrics, such as:

- Price-to-Sales (P/S) Ratio: This ratio provides a broader perspective on valuation by comparing the company's market capitalization to its revenue.

- Debt-to-Equity Ratio: Assessing the company's leverage helps understand its financial risk.

- Return on Equity (ROE): This metric indicates how efficiently the company uses shareholder investments to generate profits.

Conclusion: Is SMCI Stock a Buy?

Determining whether SMCI stock is a worthwhile investment requires a comprehensive analysis extending beyond its 14.62 P/E ratio. Thoroughly research the company's financials, growth prospects, industry position, and overall market conditions. Compare its P/E ratio to its competitors and consider other relevant financial metrics. Remember, investing involves inherent risk, and past performance is not indicative of future results. Consider consulting with a qualified financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own thorough research and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Invest In SMCI Stock? Evaluating Its 14.62 P/E Multiple. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Shocking Mlb Result De Groms Strikeoutless Game In The Spotlight

May 28, 2025

Shocking Mlb Result De Groms Strikeoutless Game In The Spotlight

May 28, 2025 -

Il Bayer Leverkusen E La Scommessa Ten Hag Un Analisi Tattica E Strategica

May 28, 2025

Il Bayer Leverkusen E La Scommessa Ten Hag Un Analisi Tattica E Strategica

May 28, 2025 -

Significant Changes To Cuban Immigration Understanding The Trump Era Regulations

May 28, 2025

Significant Changes To Cuban Immigration Understanding The Trump Era Regulations

May 28, 2025 -

June 9th Mark Your Calendar For Game Stop News

May 28, 2025

June 9th Mark Your Calendar For Game Stop News

May 28, 2025 -

100 New Nio Battery Swap Stations Coming To Northeast China

May 28, 2025

100 New Nio Battery Swap Stations Coming To Northeast China

May 28, 2025

Latest Posts

-

Upper Dublin Youth Make Waves 6 Abc Memorial Day Feature

May 29, 2025

Upper Dublin Youth Make Waves 6 Abc Memorial Day Feature

May 29, 2025 -

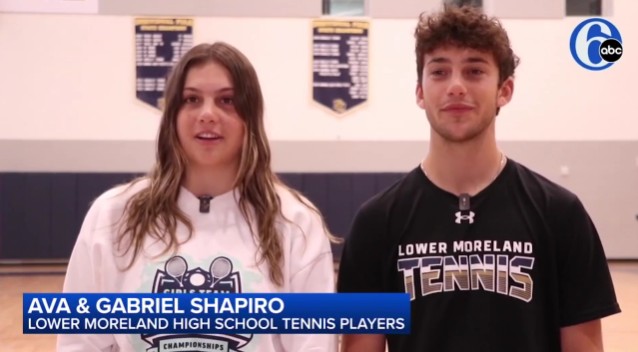

State Tennis Champs Lower Morelands Senior Twin Triumph

May 29, 2025

State Tennis Champs Lower Morelands Senior Twin Triumph

May 29, 2025 -

Evaluating The 2021 Nfl Draft The 10 Best Players And Their Impact

May 29, 2025

Evaluating The 2021 Nfl Draft The 10 Best Players And Their Impact

May 29, 2025 -

Young Star Lamine Yamal Commits Long Term Future To Barcelona

May 29, 2025

Young Star Lamine Yamal Commits Long Term Future To Barcelona

May 29, 2025 -

Oilers Win Game 4 3 1 Series Lead Over Stars In Western Conference Finals

May 29, 2025

Oilers Win Game 4 3 1 Series Lead Over Stars In Western Conference Finals

May 29, 2025