Should You Invest In Nio Stock? A Current Market Perspective

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Invest in Nio Stock? A Current Market Perspective

The electric vehicle (EV) market is booming, and Nio (NIO) is a prominent player vying for a significant share. But is now the right time to invest in Nio stock? This in-depth analysis offers a current market perspective, weighing the potential rewards against the inherent risks.

Nio's Strengths: A Look at the Positives

Nio has carved a niche for itself in the premium EV segment, particularly in China, the world's largest EV market. Several factors contribute to its appeal:

- Innovative Technology: Nio boasts advanced battery technology, including its Battery as a Service (BaaS) model, which allows customers to lease batteries, reducing upfront costs and offering flexibility. This unique approach is a key differentiator.

- Strong Brand Recognition: Nio has cultivated a strong brand image, appealing to a tech-savvy and environmentally conscious consumer base. This brand loyalty is a crucial asset in a competitive market.

- Expanding Product Line: Nio continues to expand its product portfolio, catering to a wider range of consumer needs and preferences. New models and upgrades keep the company competitive and attract new customers.

- Government Support: The Chinese government's strong push for EV adoption provides a favorable regulatory environment for Nio's growth. This support includes subsidies and infrastructure development.

Nio's Challenges: Navigating the Headwinds

Despite its strengths, Nio faces significant challenges:

- Intense Competition: The EV market is incredibly competitive, with established players like Tesla and a growing number of Chinese and international rivals. Maintaining market share requires continuous innovation and aggressive marketing.

- Supply Chain Issues: Global supply chain disruptions continue to pose a threat, potentially impacting production and delivery timelines. This uncertainty can affect profitability and investor confidence.

- Profitability Concerns: Nio, like many other EV manufacturers, is still striving for consistent profitability. While revenue is growing, achieving sustained profitability remains a key challenge.

- Geopolitical Risks: Investing in a Chinese company carries inherent geopolitical risks, including potential trade tensions and regulatory changes.

Analyzing Nio Stock: A Balanced Perspective

Determining whether to invest in Nio stock requires careful consideration of both its strengths and weaknesses. The company's innovative technology and strong brand appeal are attractive, but the intense competition and profitability concerns need careful evaluation.

Factors to Consider Before Investing:

- Your Risk Tolerance: Nio is a growth stock, inherently carrying higher risk than more established companies. Assess your risk tolerance before investing.

- Long-Term Outlook: Investing in Nio is a long-term play. Don't expect immediate returns. Assess your investment horizon and your ability to withstand market volatility.

- Diversification: Diversify your portfolio to mitigate risk. Don't put all your eggs in one basket, especially in a volatile sector like EVs.

- Financial Analysis: Thoroughly research Nio's financial statements, including revenue, earnings, and debt levels, before making any investment decisions. Consult with a financial advisor for personalized guidance.

Conclusion: A Calculated Gamble?

Nio presents both exciting opportunities and significant risks. The future of the EV market is bright, and Nio is well-positioned to capitalize on its growth. However, the intense competition and ongoing challenges require careful consideration. Conduct thorough research, assess your risk tolerance, and consider seeking professional financial advice before making any investment decisions. This article provides information for educational purposes only and is not financial advice. Remember to always do your own due diligence.

Related Articles:

- [Link to an article about the Chinese EV market]

- [Link to an article comparing Nio to Tesla]

- [Link to an article on investing in growth stocks]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Invest In Nio Stock? A Current Market Perspective. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

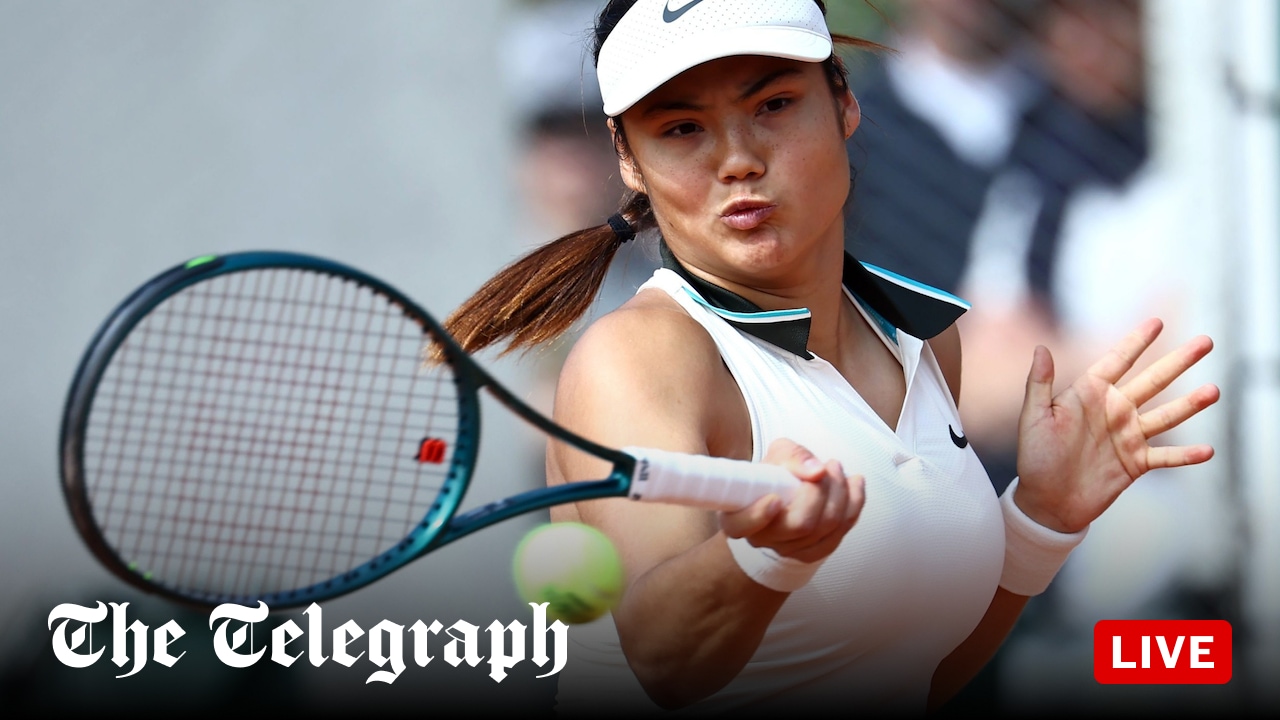

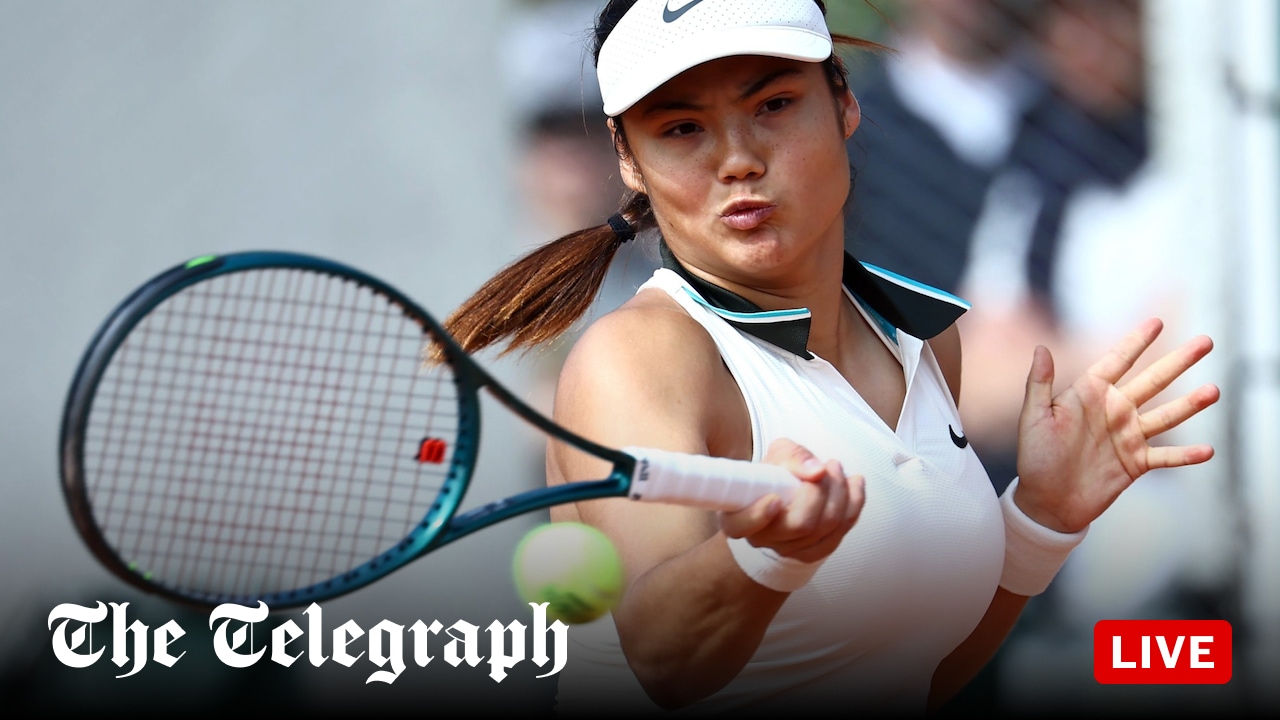

French Open Real Time Scores And News Raducanu Vs Wang Xinyu

May 27, 2025

French Open Real Time Scores And News Raducanu Vs Wang Xinyu

May 27, 2025 -

From Worst To First Ross Chastains Dramatic Coca Cola 600 Triumph

May 27, 2025

From Worst To First Ross Chastains Dramatic Coca Cola 600 Triumph

May 27, 2025 -

Live Score Raducanu Battles Wang Xinyu At The French Open

May 27, 2025

Live Score Raducanu Battles Wang Xinyu At The French Open

May 27, 2025 -

College Football Star Travis Hunter Marries Leanna De La Fuente

May 27, 2025

College Football Star Travis Hunter Marries Leanna De La Fuente

May 27, 2025 -

Timberwolves Take Game 3 How Will The Thunder Respond In The West Finals

May 27, 2025

Timberwolves Take Game 3 How Will The Thunder Respond In The West Finals

May 27, 2025