Should You Capitalize On The Tech Stock Downturn?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Capitalize on the Tech Stock Downturn? A Smart Investor's Guide

The tech sector has experienced a significant downturn recently, leaving many investors wondering: is this a buying opportunity, or a sign of further trouble ahead? The plummeting valuations of once-high-flying tech giants have understandably caused concern, but for savvy investors, this market correction could present a unique chance to acquire valuable assets at discounted prices. This article explores the factors influencing the tech stock downturn and offers guidance on whether now is the right time to invest.

Understanding the Current Tech Stock Market Landscape

Several factors contribute to the current state of the tech market. High inflation, rising interest rates, and a potential recession are all playing significant roles. Furthermore, the post-pandemic slowdown has impacted demand for certain tech products and services, leading to decreased revenue and subsequently, lower stock prices. Specific sectors, like those focused on e-commerce and cloud computing, have felt the pressure particularly acutely.

- Inflation and Interest Rates: The Federal Reserve's aggressive interest rate hikes aim to curb inflation, but this also increases borrowing costs for companies, impacting their growth and profitability.

- Recessionary Fears: Concerns about a potential recession are further dampening investor sentiment, causing a flight to safety and reducing investment in riskier assets like tech stocks.

- Post-Pandemic Adjustment: The rapid growth experienced during the pandemic was, in many ways, unsustainable. The market is now adjusting to a more normalized pace of growth.

- Overvaluation Corrections: Many tech companies experienced significant price increases in the past, leading to valuations that some analysts considered unsustainable. The current downturn can be seen as a correction of these inflated prices.

Is Now the Time to Buy? A Cautious Approach

While the current downturn presents potential opportunities, it's crucial to approach investing with caution. Not all tech stocks are created equal. Thorough due diligence is paramount. Consider these points:

- Fundamental Analysis: Focus on the company's financial health, revenue streams, and long-term growth potential. Look beyond short-term fluctuations. A strong balance sheet and consistent profitability are key indicators of resilience.

- Valuation: Compare the company's current stock price to its intrinsic value. Are you buying at a discount? Utilize metrics like the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio to assess valuation.

- Sector-Specific Risks: Different sectors within the tech industry face unique challenges. Research specific companies and understand the risks associated with their particular market segment. For example, the future of the metaverse is still uncertain, impacting investments in that space.

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio across different tech companies and other asset classes to mitigate risk.

Finding Opportunities in the Downturn

Despite the risks, the current market presents opportunities for long-term investors. Focusing on fundamentally strong companies with proven track records and attractive valuations can yield significant returns over time. Consider focusing on:

- Companies with strong cash flows: These companies are better equipped to weather economic downturns.

- Companies with innovative products or services: Look for companies poised for growth in emerging technologies. [Link to an article about emerging technologies].

- Companies with a proven management team: Experienced leadership is critical during challenging economic times.

Conclusion: Proceed with Informed Caution

The tech stock downturn presents both risks and rewards. It's not a time for reckless speculation, but rather for careful, informed investing. By conducting thorough research, focusing on fundamental analysis, and diversifying your portfolio, you can potentially capitalize on the current market correction and build a strong investment portfolio for the long term. Remember to consult with a financial advisor before making any significant investment decisions. This article provides information for educational purposes and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Capitalize On The Tech Stock Downturn?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

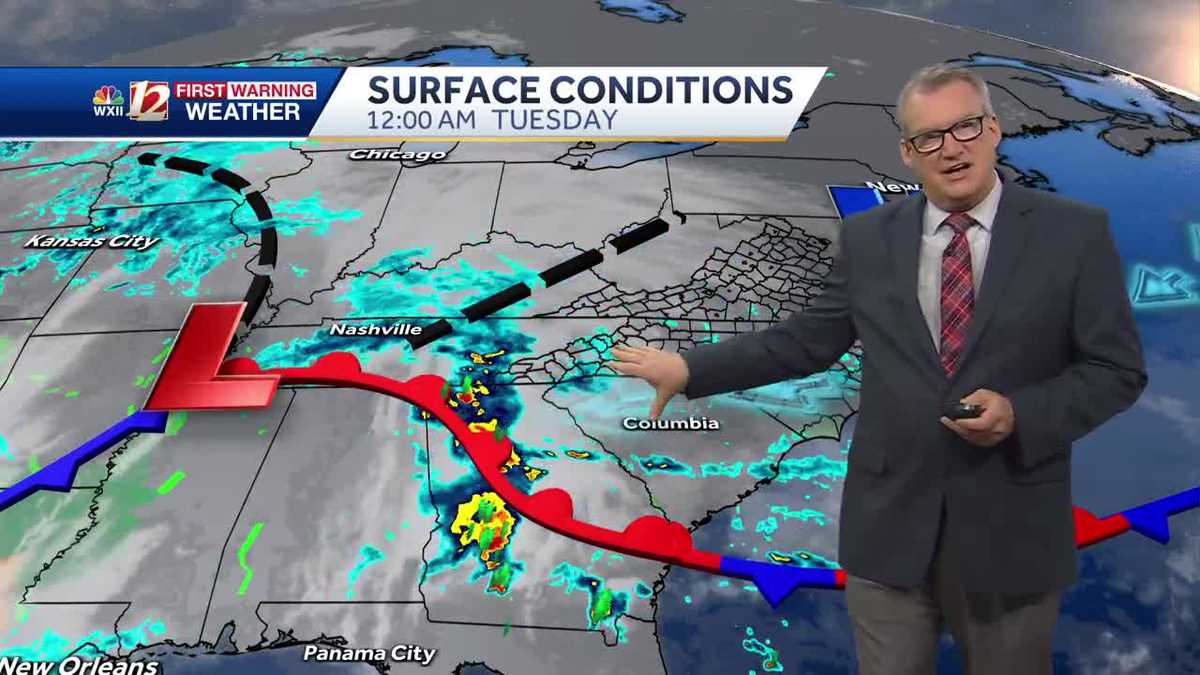

Tuesdays Weather Cool Temperatures And Persistent Rain

May 28, 2025

Tuesdays Weather Cool Temperatures And Persistent Rain

May 28, 2025 -

Chaos At The Start Comparing The 109th Indy 500 To The Infamous 1992 Race

May 28, 2025

Chaos At The Start Comparing The 109th Indy 500 To The Infamous 1992 Race

May 28, 2025 -

Rigetti Computing Stock Soars A Deep Dive Into The Recent Rally

May 28, 2025

Rigetti Computing Stock Soars A Deep Dive Into The Recent Rally

May 28, 2025 -

Karl Anthony Towns Knicks Impact A Pivotal Game 4 In The Eastern Conference Finals

May 28, 2025

Karl Anthony Towns Knicks Impact A Pivotal Game 4 In The Eastern Conference Finals

May 28, 2025 -

May 27 2025 A Retrospective Look At The Days Impact

May 28, 2025

May 27 2025 A Retrospective Look At The Days Impact

May 28, 2025