Should You Buy SMCI Stock? Evaluating Its 14.62 P/E Multiple.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy SMCI Stock? Evaluating its 14.62 P/E Multiple

SMCI stock, or Super Micro Computer, Inc., has garnered significant attention from investors, particularly given its recent performance and attractive Price-to-Earnings (P/E) ratio. But is a P/E multiple of 14.62 enough to warrant a buy? This in-depth analysis explores the factors you should consider before investing in SMCI.

The technology sector is constantly evolving, and understanding the nuances of a company's valuation is crucial for smart investing. A P/E ratio of 14.62, while seemingly low compared to some tech giants, requires a closer look at SMCI's specific circumstances and future prospects. This article will delve into those specifics, providing you with the information you need to make an informed decision.

Understanding SMCI's Business and Market Position

Super Micro Computer, Inc. is a leading provider of high-performance computing, cloud computing, and data center technology. They design and manufacture a wide range of server, storage, and networking solutions. The company holds a strong position in the rapidly growing data center market, benefiting from the increasing demand for advanced computing infrastructure. However, competition in this space is fierce, with established players like Dell, HP, and Cisco vying for market share.

Key factors impacting SMCI's performance include:

- Global Supply Chain Dynamics: The ongoing semiconductor shortage and geopolitical instability can significantly impact SMCI's production and profitability.

- Technological Innovation: The need for continuous innovation to stay ahead of competitors is paramount. SMCI's ability to adapt and introduce cutting-edge technologies will be crucial for its long-term success.

- Demand for Data Center Solutions: The continued growth of cloud computing and big data will directly influence SMCI's revenue streams.

Deconstructing the 14.62 P/E Ratio

A P/E ratio of 14.62 suggests that SMCI is trading at a relatively lower valuation compared to its earnings. However, it's important to consider several factors before drawing conclusions:

- Growth Prospects: A low P/E ratio might indicate undervaluation, but it could also reflect concerns about future growth. Analyzing SMCI's projected earnings growth is crucial. Are analysts bullish on future performance? What are the company's own projections?

- Industry Benchmarks: How does SMCI's P/E ratio compare to its competitors? A lower P/E might be justified if the company's growth trajectory is slower than its peers.

- Debt Levels: High debt levels can impact a company's profitability and overall valuation. Examining SMCI's balance sheet is vital to understanding its financial health.

- Recent Market Performance: Short-term market fluctuations can influence P/E ratios. Consider the overall market sentiment and any recent news affecting SMCI's stock price.

Is SMCI Stock a Buy? The Verdict

Whether or not you should buy SMCI stock depends on your individual investment goals and risk tolerance. The 14.62 P/E ratio presents an intriguing entry point, but thorough due diligence is absolutely necessary. Before making any investment decisions, consider consulting with a financial advisor to discuss your options and determine if SMCI aligns with your portfolio strategy.

Further Research: It's highly recommended to perform in-depth research, including reviewing SMCI's financial statements, analyst reports, and news articles to gain a comprehensive understanding of the company's financial health and future prospects. You can find valuable information on the company's investor relations website and through reputable financial news sources.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and you could lose money. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy SMCI Stock? Evaluating Its 14.62 P/E Multiple.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pacers Lead Evaporates Knicks Game 3 Upset Over Pacers

May 28, 2025

Pacers Lead Evaporates Knicks Game 3 Upset Over Pacers

May 28, 2025 -

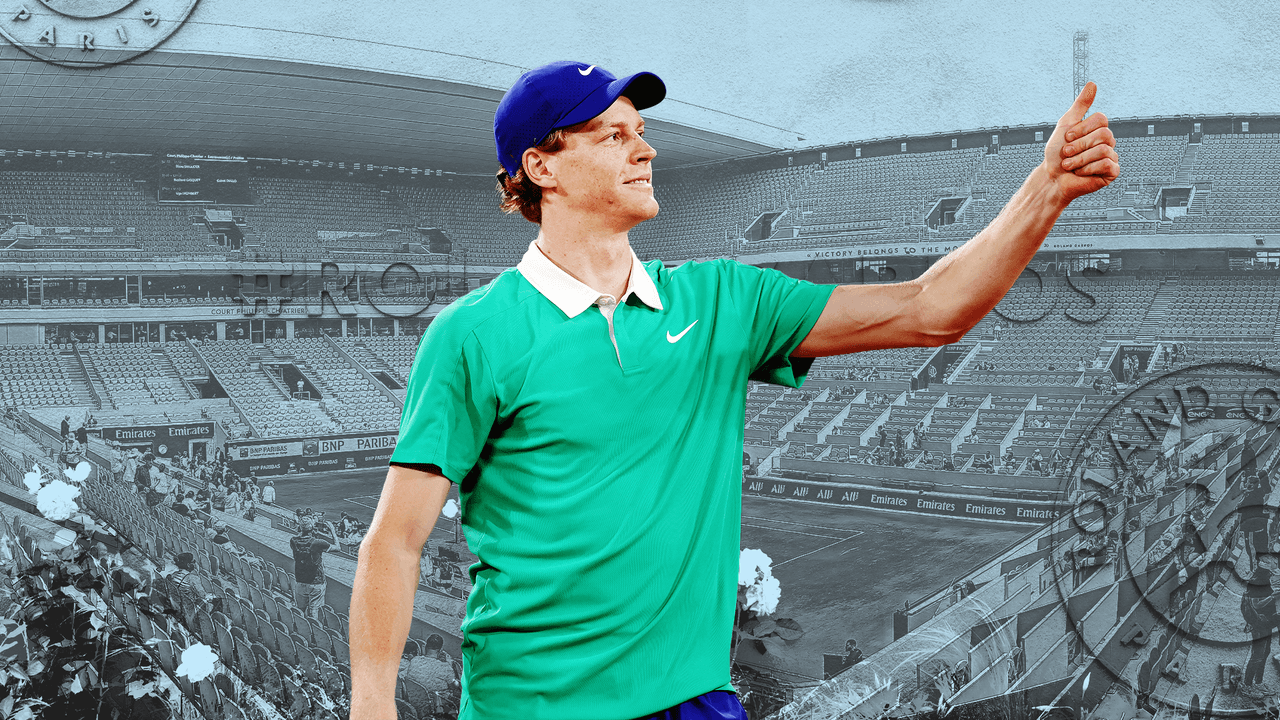

Guarda Sinner Al Roland Garros 2025 Streaming Live Del Match Contro Gasquet E Tutti Gli Incontri

May 28, 2025

Guarda Sinner Al Roland Garros 2025 Streaming Live Del Match Contro Gasquet E Tutti Gli Incontri

May 28, 2025 -

Jannik Sinner Orario E Data Del Match Di Roland Garros 2025

May 28, 2025

Jannik Sinner Orario E Data Del Match Di Roland Garros 2025

May 28, 2025 -

Coca Cola 600 Results Ross Chastain Secures Win Against William Byron

May 28, 2025

Coca Cola 600 Results Ross Chastain Secures Win Against William Byron

May 28, 2025 -

Ranking The Odds Which Nfls Bubble Teams Will Reach The 2023 Playoffs

May 28, 2025

Ranking The Odds Which Nfls Bubble Teams Will Reach The 2023 Playoffs

May 28, 2025