Should You Buy Robinhood Stock Now? Weighing The Pros And Cons For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy Robinhood Stock Now? Weighing the Pros and Cons for Investors

The meteoric rise and subsequent fall of Robinhood Markets, Inc. (HOOD) has left many investors wondering: is now the time to buy? This once-darling of the millennial investing crowd has faced significant challenges, prompting serious consideration before jumping in. This in-depth analysis weighs the pros and cons, helping you make an informed investment decision.

The Allure of Robinhood: A Look at the Potential Upsides

Robinhood's disruptive approach to investing undeniably revolutionized the brokerage industry. Its commission-free trading and user-friendly app attracted millions, solidifying its brand recognition. This established user base represents a significant asset, potentially fueling future growth.

- Brand Recognition and Market Penetration: Robinhood is a household name, a powerful advantage in attracting new customers. This established brand loyalty offers a solid foundation for future expansion.

- Innovation Potential: The company continues to explore new financial products and services, potentially unlocking further revenue streams. Future innovations could significantly impact profitability.

- Growth in Active Users: While fluctuating, Robinhood's user base remains considerable. An increase in active users directly translates to increased trading volume and revenue potential.

- Expansion into Crypto and Other Assets: Robinhood's foray into cryptocurrency trading and other asset classes diversifies its revenue streams and caters to evolving investor preferences.

Navigating the Challenges: Understanding the Downsides

Despite its potential, Robinhood faces several significant headwinds that investors must consider carefully.

- Regulatory Scrutiny: The company has faced increased regulatory scrutiny, impacting its operations and potentially leading to increased costs and compliance burdens. This uncertainty presents a considerable risk.

- Competition: The brokerage industry is intensely competitive, with established players and new entrants vying for market share. Robinhood needs to constantly innovate to stay ahead.

- Profitability Concerns: Robinhood has struggled to achieve consistent profitability, raising concerns about its long-term financial viability. Investors need to analyze its financial statements meticulously.

- Market Volatility: The overall market volatility significantly impacts Robinhood's performance, as trading volume and user activity are often correlated with market sentiment.

Analyzing the Financials: A Deep Dive into the Numbers

Before making any investment decision, thoroughly examine Robinhood's financial reports, including revenue growth, operating expenses, and net income (or loss). Compare these figures to industry benchmarks and analyze the company's overall financial health. Resources like the offer valuable insights.

Should You Buy? The Verdict

The decision to buy Robinhood stock is highly dependent on your individual risk tolerance and investment goals. While the company possesses considerable potential, the significant risks involved demand careful consideration.

For Conservative Investors: The risks outweigh the potential rewards. A more established, profitable company might be a better fit.

For Growth Investors with High Risk Tolerance: Robinhood's potential for growth, albeit risky, might align with your investment strategy. However, diversification is crucial. Don't put all your eggs in one basket.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions. Investing in the stock market always involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Robinhood Stock Now? Weighing The Pros And Cons For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Guilty Verdict Maxwell Anderson Sentenced For The Brutal Murder Of Sade Robinson

Jun 06, 2025

Guilty Verdict Maxwell Anderson Sentenced For The Brutal Murder Of Sade Robinson

Jun 06, 2025 -

Update The Reason Behind Todays Cancellation Of The Karen Read Trial

Jun 06, 2025

Update The Reason Behind Todays Cancellation Of The Karen Read Trial

Jun 06, 2025 -

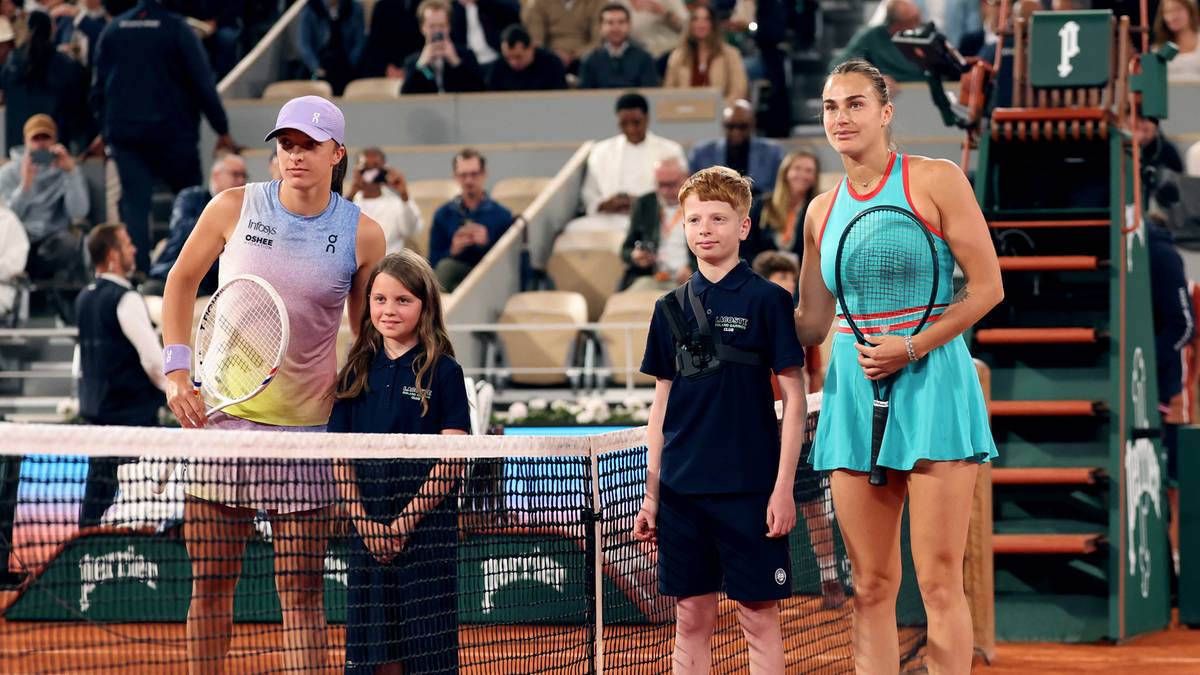

Live Swiatek Kontra Sabalenka Roland Garros Wynik I Relacja Meczu

Jun 06, 2025

Live Swiatek Kontra Sabalenka Roland Garros Wynik I Relacja Meczu

Jun 06, 2025 -

Late Game Heroics How Freddie Freeman Secured The Dodgers Win

Jun 06, 2025

Late Game Heroics How Freddie Freeman Secured The Dodgers Win

Jun 06, 2025 -

2020 Nfl Drafts Top 10 A Retrospective Analysis Of Their Impact

Jun 06, 2025

2020 Nfl Drafts Top 10 A Retrospective Analysis Of Their Impact

Jun 06, 2025