Secure Your Retirement: A Comprehensive Stress Test For Your Financial Plan

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Secure Your Retirement: A Comprehensive Stress Test for Your Financial Plan

Retirement. The word conjures images of sun-drenched beaches, leisurely hobbies, and carefree days. But the reality for many is anxiety – anxiety about whether their carefully crafted retirement plan will actually withstand the inevitable storms of life. Don't let uncertainty overshadow your golden years. This comprehensive guide will help you stress-test your financial plan, ensuring a secure and comfortable retirement.

Why Stress-Testing Your Retirement Plan is Crucial

Retirement planning isn't a one-time event; it's an ongoing process requiring regular review and adjustment. A comprehensive stress test identifies vulnerabilities in your plan before they become major problems. Unexpected events – job loss, medical emergencies, market downturns – can significantly impact your retirement savings. By proactively identifying these potential risks, you can develop strategies to mitigate them.

Key Areas to Include in Your Retirement Plan Stress Test:

1. Market Volatility: The Rollercoaster Ride

The stock market is inherently volatile. Your stress test should consider various market scenarios, including prolonged bear markets. How would your portfolio perform during a significant market downturn? Consider using online retirement calculators that allow you to model different market conditions. Diversification is key; don't put all your eggs in one basket. Learn more about .

2. Inflation: The Silent Thief

Inflation erodes the purchasing power of your savings over time. Have you accounted for inflation in your retirement projections? A simple inflation calculator can help you understand the impact of rising prices on your retirement income. Consider investing in assets that historically keep pace with or outpace inflation.

3. Longevity Risk: Living Longer Than Expected

People are living longer than ever before. Does your plan account for the possibility of living beyond your initial retirement projections? This is a critical factor often overlooked. You need to ensure your savings will last throughout your entire retirement. Explore options like annuities to provide a guaranteed income stream.

4. Healthcare Costs: The Unexpected Expense

Healthcare costs are a significant and unpredictable expense in retirement. Have you adequately budgeted for potential medical expenses, including long-term care? Medicare doesn't cover everything, and supplemental insurance can be costly. Consider exploring long-term care insurance options or setting aside a substantial healthcare reserve.

5. Unexpected Expenses: Life's Curveballs

Life throws curveballs. Have you considered unexpected expenses like home repairs, family emergencies, or travel? Building an emergency fund separate from your retirement savings is crucial to absorb these unexpected shocks. Aim for 3-6 months of living expenses in a readily accessible account.

Tools and Resources for Stress-Testing Your Retirement Plan:

- Retirement Calculators: Numerous online calculators can help you model different scenarios and project your retirement income.

- Financial Advisors: A qualified financial advisor can provide personalized guidance and help you develop a robust retirement plan tailored to your specific circumstances.

- Budgeting Apps: Track your spending and identify areas where you can save.

Conclusion: A Secure Retirement is Within Reach

Stress-testing your retirement plan is not about fostering fear, but about empowering yourself with knowledge. By proactively identifying and mitigating potential risks, you can significantly increase your chances of enjoying a comfortable and secure retirement. Don't delay – start stress-testing your plan today and secure your future. Take the first step by . Your future self will thank you.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Secure Your Retirement: A Comprehensive Stress Test For Your Financial Plan. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bruins Joe Sacco Reportedly Set To Join Rival Teams Organization

Jun 05, 2025

Bruins Joe Sacco Reportedly Set To Join Rival Teams Organization

Jun 05, 2025 -

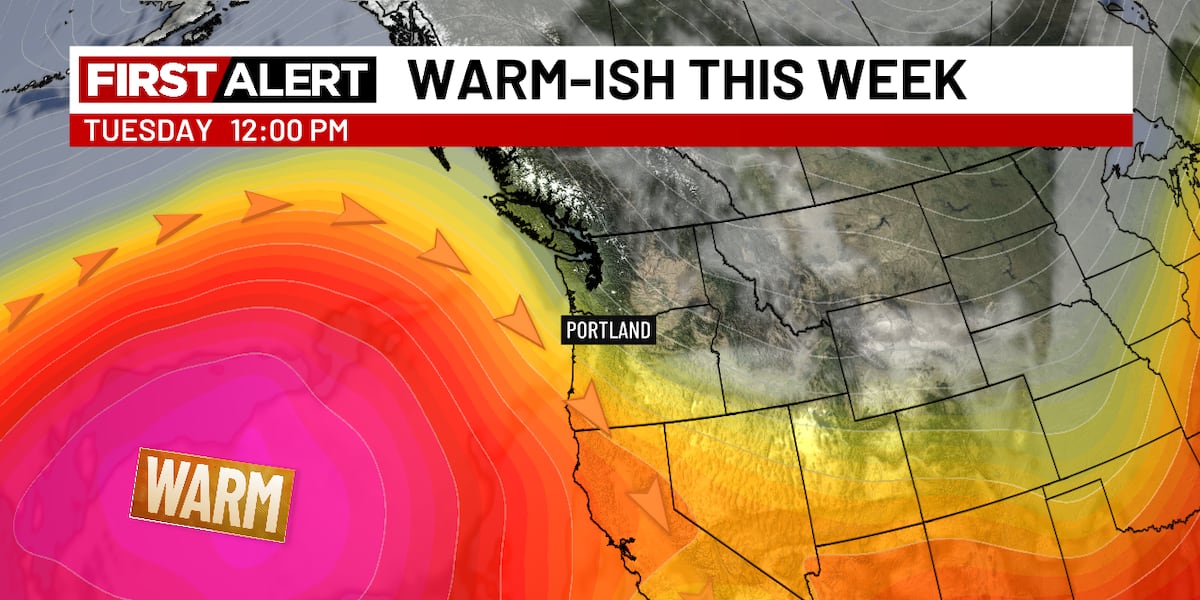

Dry Sunny And Warm June Forecast What To Expect

Jun 05, 2025

Dry Sunny And Warm June Forecast What To Expect

Jun 05, 2025 -

Angels Mike Trout Extends Hot Streak With 3 Hits And Home Run

Jun 05, 2025

Angels Mike Trout Extends Hot Streak With 3 Hits And Home Run

Jun 05, 2025 -

Nba Trade Rumors Teams Eyeing Top Prospect Cooper Flagg In 2025 Draft

Jun 05, 2025

Nba Trade Rumors Teams Eyeing Top Prospect Cooper Flagg In 2025 Draft

Jun 05, 2025 -

Blue Jays Giants Cubs And Angels Vie For Post Ohtani Mlb Success

Jun 05, 2025

Blue Jays Giants Cubs And Angels Vie For Post Ohtani Mlb Success

Jun 05, 2025