SBET Stock: Exploring The Reasons For Its Dramatic 1000% Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SBET Stock Soars 1000%: Unpacking the Meteoric Rise and What it Means for Investors

The small-cap stock market has witnessed a stunning surge recently, with SBET stock leading the charge. Its price has skyrocketed by an incredible 1000%, leaving investors both awestruck and questioning the reasons behind this dramatic increase. This article delves into the factors contributing to SBET's phenomenal growth, exploring the potential risks and rewards for those considering investing in this volatile market.

The Speculative Frenzy: Understanding the Surge

SBET's meteoric rise isn't solely attributable to one singular event. Instead, a confluence of factors has fueled this explosive growth, making it a compelling case study in speculative market behavior. Here's a breakdown of the key contributing elements:

-

Social Media Hype: The power of social media in driving stock prices cannot be underestimated. Platforms like Reddit's WallStreetBets have shown the potential for collective action to significantly impact stock valuations. SBET has been a frequent topic of discussion on these platforms, leading to a surge in buying pressure.

-

Short Squeeze Potential: While not confirmed, speculation regarding a potential short squeeze has played a significant role. If a substantial number of investors were shorting SBET (betting on its price decline), a rapid price increase could force them to buy back shares to limit their losses, further fueling the upward momentum. This is a high-risk, high-reward strategy, and understanding its mechanics is crucial for informed investing. Learn more about short squeezes .

-

Positive Company News (if applicable): Any recent positive news announcements from SBET itself, such as strong earnings reports, new product launches, or strategic partnerships, would significantly influence investor sentiment. It's crucial to scrutinize these announcements carefully to determine their true impact on the company's long-term prospects.

-

Overall Market Sentiment: The broader market conditions also influence individual stock performance. A generally bullish market can amplify the effects of positive news and speculative activity, contributing to significant price increases.

Risks and Considerations for Investors

While the 1000% increase is undeniably impressive, investors need to approach SBET stock with caution. Such dramatic price swings often indicate high volatility and increased risk. Here are some crucial points to consider:

-

High Volatility: The rapid price increase makes SBET extremely volatile. Prices could just as easily plummet as they have risen, leading to substantial potential losses.

-

Lack of Fundamental Value: The price increase may not be entirely justified by the company's underlying fundamentals. It's vital to analyze SBET's financial statements and business model to ascertain its long-term viability.

-

Regulatory Scrutiny: Such significant price fluctuations often attract the attention of regulatory bodies. Increased scrutiny could lead to investigations and potential consequences for the company.

Conclusion: Proceed with Caution

SBET's 1000% surge is a fascinating example of the unpredictable nature of the stock market, particularly within the small-cap sector. While the potential for significant returns exists, the inherent risks are equally substantial. Thorough due diligence, a clear understanding of market dynamics, and a well-defined investment strategy are essential before considering any investment in SBET or similar high-volatility stocks. Remember, this article is for informational purposes only and does not constitute financial advice. Always consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SBET Stock: Exploring The Reasons For Its Dramatic 1000% Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

De Tom Cruise A Tik Tok La Historia De Angela Marmol

May 30, 2025

De Tom Cruise A Tik Tok La Historia De Angela Marmol

May 30, 2025 -

Caleb Williamss Chicago Bears Love A Look At The New Book Excerpt

May 30, 2025

Caleb Williamss Chicago Bears Love A Look At The New Book Excerpt

May 30, 2025 -

Nba Playoffs 2025 Updated Odds And Analysis For The Conference Finals

May 30, 2025

Nba Playoffs 2025 Updated Odds And Analysis For The Conference Finals

May 30, 2025 -

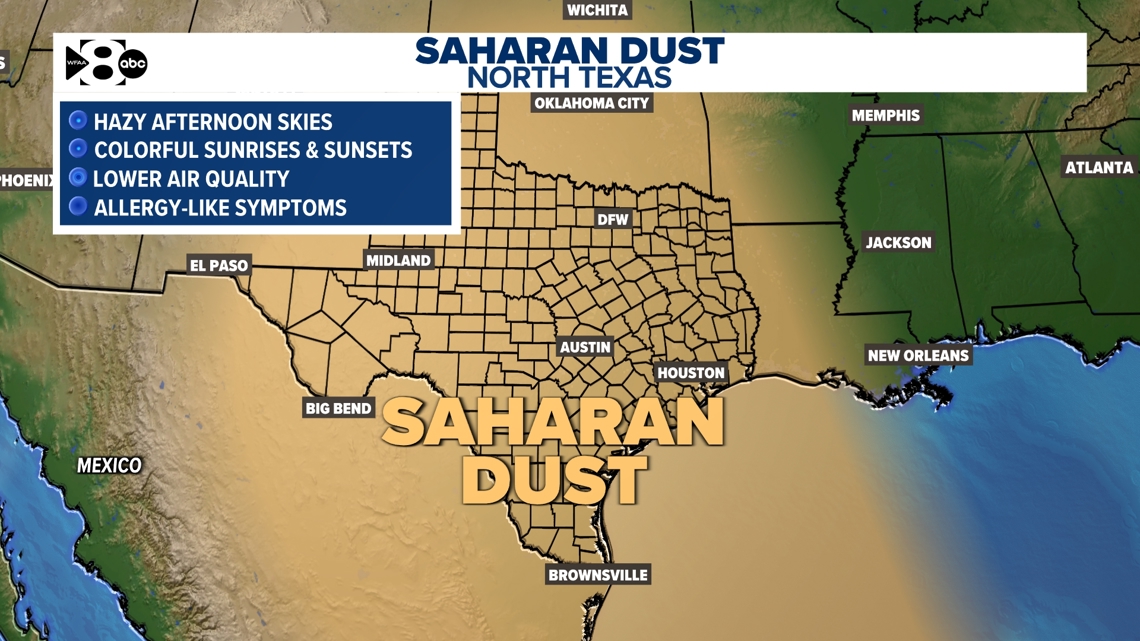

Understanding The Saharan Dust Event In North Texas

May 30, 2025

Understanding The Saharan Dust Event In North Texas

May 30, 2025 -

Nba Playoffs Nesmiths Recovery Game 4 Impact In Pacers Knicks Matchup

May 30, 2025

Nba Playoffs Nesmiths Recovery Game 4 Impact In Pacers Knicks Matchup

May 30, 2025