SBET Stock: Dissecting The Factors Behind Its Dramatic 1000% Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SBET Stock: Dissecting the Factors Behind its Dramatic 1000% Increase

The small-cap stock market has witnessed incredible volatility recently, and few stories are as captivating as SBET's meteoric rise. This previously obscure company has seen its stock price surge by a staggering 1000%, leaving investors both bewildered and awestruck. But what's behind this phenomenal growth? This article delves into the key factors contributing to SBET's dramatic increase, examining the potential catalysts and inherent risks involved.

Understanding SBET's Business Model:

Before analyzing the reasons behind its explosive growth, it's crucial to understand SBET's core business. [Insert a brief, concise description of SBET's business model and industry here. For example: "SBET is a technology company specializing in [specific area, e.g., AI-powered data analytics for the financial sector]. They operate primarily in [geographic region] and target [specific customer base]."]. A clear understanding of their operations is vital to interpreting the market's reaction.

Key Factors Driving the 1000% Increase:

Several interconnected factors have likely contributed to SBET's remarkable performance:

-

Positive Earnings Reports and Revenue Growth: Strong financial results often trigger significant stock price increases. SBET's recent earnings reports likely showcased impressive revenue growth and profitability, exceeding market expectations. Analyzing these reports meticulously will reveal the specifics of this success. [Link to a reputable financial news source for SBET's financial reports, if available].

-

Technological Breakthroughs and Innovation: In the tech sector, innovation is paramount. SBET's 1000% surge could be attributed to a significant technological breakthrough, the launch of a highly successful new product, or the securing of a crucial patent. Further investigation into their recent announcements and press releases is necessary to pinpoint any such developments.

-

Strategic Partnerships and Acquisitions: Collaborations with major industry players or strategic acquisitions can significantly boost a company's value and market perception. SBET might have forged impactful partnerships or acquired key assets that have resonated positively with investors.

-

Increased Investor Interest and Market Speculation: The stock market is driven by sentiment as much as fundamentals. Positive media coverage, analyst upgrades, and growing investor interest in the sector could have fueled a speculative buying frenzy, contributing to the dramatic price increase. This often involves a self-reinforcing cycle where rising prices attract more buyers, further driving up the price.

-

Short Squeeze: In some cases, a rapid price increase can be driven by a "short squeeze," where investors who bet against the stock (short selling) are forced to buy it back to cover their positions, further increasing demand and price.

Risks and Considerations:

While SBET's growth is impressive, investors should remain cautious. Such dramatic price increases often come with significant risks:

- Overvaluation: The current price might not reflect the company's true underlying value, creating a bubble prone to bursting.

- Volatility: SBET's stock price is likely to remain highly volatile, susceptible to sudden and significant drops.

- Lack of Diversification: Investing heavily in a single stock, especially one experiencing such rapid growth, represents a significant risk.

Conclusion:

SBET's 1000% stock price increase is a remarkable event, but investors need to carefully analyze the underlying reasons for this surge. Understanding the company's business model, examining its recent financial performance, and assessing the risks associated with such rapid growth are crucial before making any investment decisions. Further research is recommended before considering any action related to SBET stock. Always consult with a qualified financial advisor before making any investment choices.

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and you could lose money.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SBET Stock: Dissecting The Factors Behind Its Dramatic 1000% Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

California High School Track New Rules In The Spotlight After Transgender Athletes Victory

May 30, 2025

California High School Track New Rules In The Spotlight After Transgender Athletes Victory

May 30, 2025 -

Officials Newark Airport Air Traffic Control Modernization Delayed

May 30, 2025

Officials Newark Airport Air Traffic Control Modernization Delayed

May 30, 2025 -

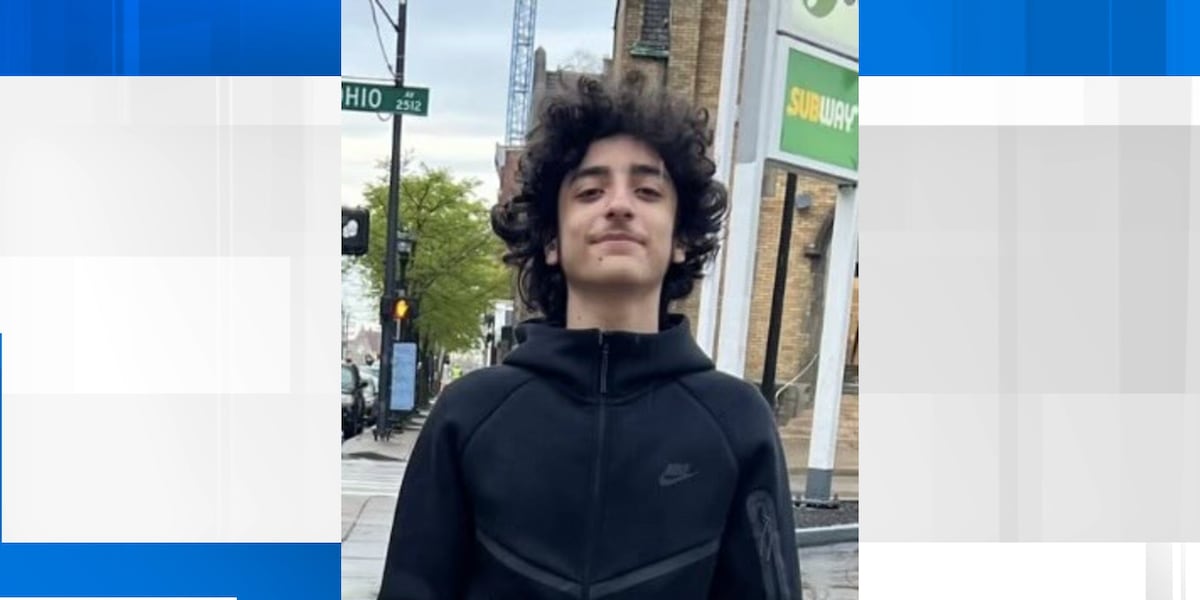

Missing Teen In Lexington Police Urge Publics Help In Search

May 30, 2025

Missing Teen In Lexington Police Urge Publics Help In Search

May 30, 2025 -

Revelacion Impactante Influencer Espanola Explica El Motivo De Su Ataque A Tom Cruise

May 30, 2025

Revelacion Impactante Influencer Espanola Explica El Motivo De Su Ataque A Tom Cruise

May 30, 2025 -

Unraveling Connections Sports Edition Puzzle 248 Hints For May 29 2025

May 30, 2025

Unraveling Connections Sports Edition Puzzle 248 Hints For May 29 2025

May 30, 2025

Latest Posts

-

Severe Penalties Sec To Fine Schools 500 000 For Field Rushing

May 31, 2025

Severe Penalties Sec To Fine Schools 500 000 For Field Rushing

May 31, 2025 -

Espn Astros Pitcher Lance Mc Cullers Jr Increases Family Security

May 31, 2025

Espn Astros Pitcher Lance Mc Cullers Jr Increases Family Security

May 31, 2025 -

Michael Grimm And Others Pardoned By Trump Details And Reactions

May 31, 2025

Michael Grimm And Others Pardoned By Trump Details And Reactions

May 31, 2025 -

Is Mike Trout Ready Angels Face Crucial Decision On Superstars Activation

May 31, 2025

Is Mike Trout Ready Angels Face Crucial Decision On Superstars Activation

May 31, 2025 -

Oilers Double Up Stars Punch Ticket To Stanley Cup Final

May 31, 2025

Oilers Double Up Stars Punch Ticket To Stanley Cup Final

May 31, 2025