S&P 500 Leads Market Surge Despite Moody's Negative Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 Leads Market Surge Despite Moody's Negative Outlook: A Bullish Signal or Temporary Relief?

The US stock market experienced a significant surge on [Date], with the S&P 500 leading the charge despite a starkly negative outlook issued by Moody's earlier in the week. This seemingly contradictory market behavior has left investors questioning the underlying strength of the rally and pondering whether it's a genuine bullish signal or merely a temporary respite before further economic headwinds.

Moody's downgrade of several small and midsize US banks, coupled with their negative outlook on the broader banking sector, sent ripples of concern across Wall Street. The credit rating agency cited persistent stress within the banking system and the potential for further economic slowdown as key reasons for their pessimistic assessment. This news, normally a catalyst for a market downturn, was surprisingly met with a robust rally, leaving many analysts scrambling for explanations.

What Drove the Unexpected Market Surge?

Several factors contributed to the S&P 500's impressive gains despite the gloomy Moody's report:

-

Resilient Corporate Earnings: Stronger-than-expected earnings reports from key companies in the technology and consumer discretionary sectors helped bolster investor confidence. These positive results demonstrated a level of resilience in the face of economic uncertainty. [Link to relevant earnings reports/financial news source]

-

Easing Inflation Concerns: Recent data suggesting a potential cooling in inflation provided a much-needed boost to market sentiment. While inflation remains a concern, the signs of moderation eased fears of aggressive interest rate hikes by the Federal Reserve. [Link to relevant inflation data source]

-

Bargain Hunting: Some analysts believe the market downturn following the Moody's report created attractive buying opportunities for investors seeking bargains. This influx of buying pressure contributed to the market's upward trajectory.

-

Technical Rebound: After a period of decline, a technical rebound was overdue. Many traders use technical indicators to time their trades, and these indicators may have signaled a short-term reversal.

Is This Rally Sustainable? The Long-Term Outlook Remains Uncertain

While the recent market surge is undeniably impressive, it's crucial to maintain a degree of caution. The Moody's report highlights significant underlying risks within the financial system. The sustainability of this rally hinges on several key factors:

-

Federal Reserve Policy: The Federal Reserve's upcoming decisions regarding interest rates will play a crucial role in shaping the market's trajectory. Further aggressive rate hikes could easily reverse the recent gains.

-

Inflation Trajectory: The continued decline in inflation is essential for sustained market growth. Any resurgence in inflationary pressures could trigger another round of selling.

-

Geopolitical Risks: Global geopolitical uncertainties, such as the ongoing war in Ukraine, continue to pose a significant threat to market stability.

Conclusion: Navigating Market Volatility

The S&P 500's recent surge despite Moody's negative outlook presents a complex picture. While the short-term rally offers a degree of relief, the long-term outlook remains clouded by significant economic and geopolitical uncertainties. Investors should approach the market with caution, carefully considering the risks involved before making any significant investment decisions. Diversification remains a crucial strategy for mitigating risk in this volatile environment. Staying informed about economic indicators and geopolitical developments is essential for navigating the challenges ahead. Consult with a financial advisor before making any major investment decisions.

Keywords: S&P 500, Moody's, stock market, market surge, economic outlook, inflation, Federal Reserve, interest rates, banking sector, investment, market volatility, risk management, financial news, US economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500 Leads Market Surge Despite Moody's Negative Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Adelman Earns Respect Nuggets Players Rally Behind Their Coach

May 20, 2025

Adelman Earns Respect Nuggets Players Rally Behind Their Coach

May 20, 2025 -

Controversy And Career The Director Of Netflixs Fall Of Favre Weighs In

May 20, 2025

Controversy And Career The Director Of Netflixs Fall Of Favre Weighs In

May 20, 2025 -

Lost Hiker Tiffany Slaton Recounts California Wilderness Ordeal

May 20, 2025

Lost Hiker Tiffany Slaton Recounts California Wilderness Ordeal

May 20, 2025 -

Semana De Carreras Del Real Madrid Jugadores Clave Y Posibles Alineaciones

May 20, 2025

Semana De Carreras Del Real Madrid Jugadores Clave Y Posibles Alineaciones

May 20, 2025 -

Fantastic Four First Steps Funko Pops Reveal Potential Major Marvel Character

May 20, 2025

Fantastic Four First Steps Funko Pops Reveal Potential Major Marvel Character

May 20, 2025

Latest Posts

-

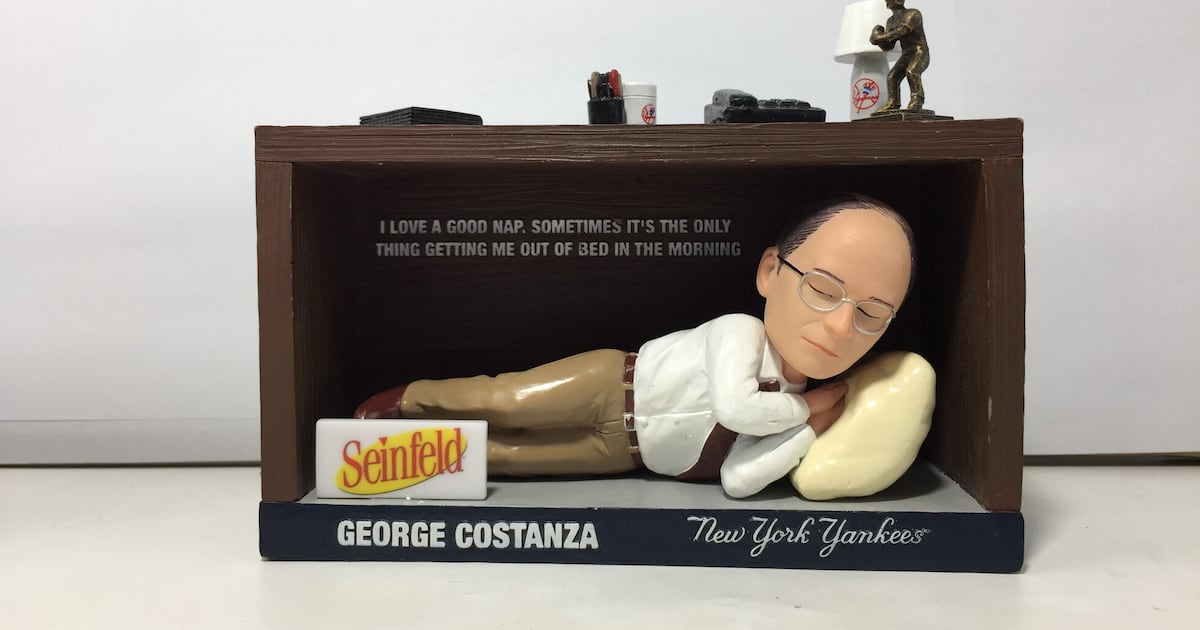

Dont Miss Out Costanza Bobblehead Restock At Yankee Stadium

Aug 23, 2025

Dont Miss Out Costanza Bobblehead Restock At Yankee Stadium

Aug 23, 2025 -

Andy Reids Office Targeted Bullet Found Espn Details Investigation

Aug 23, 2025

Andy Reids Office Targeted Bullet Found Espn Details Investigation

Aug 23, 2025 -

Hand Fracture Didnt Stop Kyle Tucker Managers Confirmation

Aug 23, 2025

Hand Fracture Didnt Stop Kyle Tucker Managers Confirmation

Aug 23, 2025 -

Inter Miamis Suarez Shines Securing Win Against Tigres Without Messi

Aug 23, 2025

Inter Miamis Suarez Shines Securing Win Against Tigres Without Messi

Aug 23, 2025 -

Soccer Jerseys The History Behind The Colors Of Famous Clubs

Aug 23, 2025

Soccer Jerseys The History Behind The Colors Of Famous Clubs

Aug 23, 2025