S&P 500 Extends Winning Streak: Dow And Nasdaq Join Rally After Moody's Downgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 Extends Winning Streak: Dow and Nasdaq Join Rally Despite Moody's Downgrade

Surprise market resilience follows Moody's downgrade of US government debt. The S&P 500 extended its winning streak on [Date], defying expectations following Moody's downgrade of the U.S. government's credit rating. The Dow Jones Industrial Average and the Nasdaq Composite also joined the rally, showcasing surprising resilience in the face of what many analysts predicted would be a significant market downturn. This unexpected surge raises questions about the long-term implications of the downgrade and the overall strength of the U.S. economy.

Moody's Downgrade: A Catalyst for Unexpected Growth?

Moody's decision to downgrade the U.S. government's credit rating from Aaa to Aa1, citing concerns about fiscal strength and political gridlock, sent shockwaves through financial markets initially. Many predicted a sharp sell-off, but the market's response has been remarkably different. This counterintuitive reaction highlights the complexity of market dynamics and the influence of factors beyond credit ratings. [Link to Moody's press release].

Why Did the Market Rally Despite the Downgrade?

Several factors may contribute to the unexpected market rally:

- Resilient Economic Data: Recent economic data, including [mention specific positive economic indicators, e.g., strong employment numbers or positive consumer spending], has countered some of the negative sentiment surrounding the downgrade. This suggests underlying strength in the U.S. economy despite the fiscal challenges.

- Market Anticipation: It's possible that the market had already priced in a significant portion of the negative impact of a potential downgrade. The actual downgrade, therefore, may have been less impactful than initially feared.

- Investor Sentiment: Despite the downgrade, investor sentiment remains relatively positive, driven by ongoing corporate earnings reports and expectations for future growth.

- Federal Reserve Policy: The Federal Reserve's monetary policy, while still focused on inflation control, may be perceived as supportive of economic stability, bolstering investor confidence.

S&P 500, Dow, and Nasdaq Performance:

The S&P 500 closed at [Closing Value] on [Date], representing a [Percentage Change]% increase. The Dow Jones Industrial Average gained [Percentage Change]%, closing at [Closing Value], while the Nasdaq Composite saw a [Percentage Change]% increase, closing at [Closing Value]. These gains demonstrate a surprising level of market resilience and investor optimism.

Looking Ahead: Uncertainty Remains

While the immediate market reaction has been positive, uncertainty remains. The long-term effects of the Moody's downgrade on borrowing costs and investor confidence are yet to be fully understood. Analysts are divided on the future trajectory of the market, with some expressing caution about potential future volatility. [Link to relevant financial news article discussing future market predictions].

What This Means for Investors:

The current market situation underscores the importance of diversification and a long-term investment strategy. While the recent rally is encouraging, investors should remain vigilant and closely monitor economic indicators and geopolitical developments. It is crucial to consult with a financial advisor before making any significant investment decisions.

Keywords: S&P 500, Dow Jones, Nasdaq, Moody's, credit rating downgrade, US economy, stock market rally, market volatility, investment strategy, financial news, economic indicators, investor sentiment, Federal Reserve.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500 Extends Winning Streak: Dow And Nasdaq Join Rally After Moody's Downgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Always Kept It Real Jamie Lee Curtis Honest Take On Lindsay Lohan

May 21, 2025

Always Kept It Real Jamie Lee Curtis Honest Take On Lindsay Lohan

May 21, 2025 -

Ganassi On Penske Increased Accountability Needed To Uphold Nascars Reputation

May 21, 2025

Ganassi On Penske Increased Accountability Needed To Uphold Nascars Reputation

May 21, 2025 -

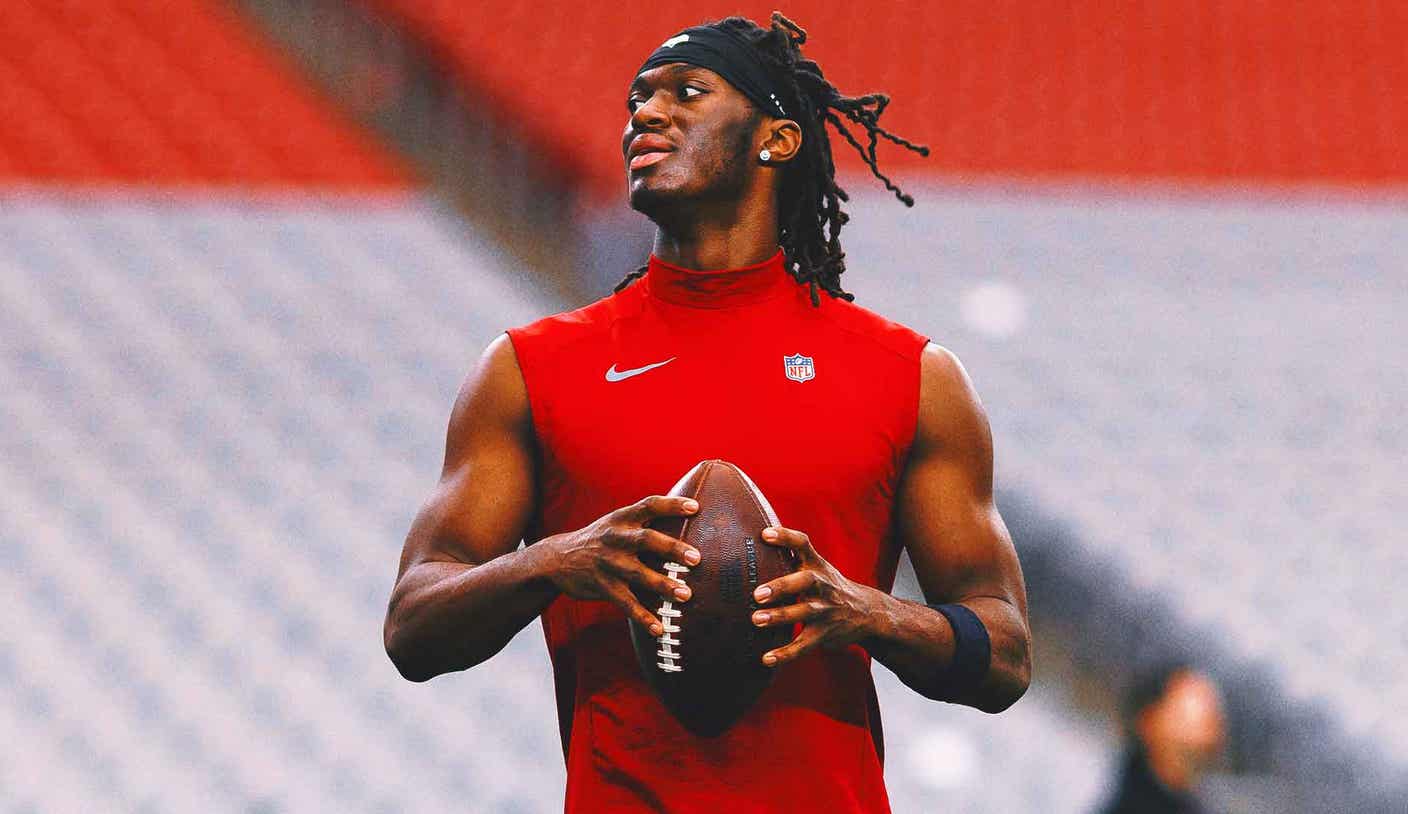

Increased Muscle Increased Expectations Marvin Harrison Jr S Second Season Outlook

May 21, 2025

Increased Muscle Increased Expectations Marvin Harrison Jr S Second Season Outlook

May 21, 2025 -

Ellen De Generes Emotional Post Remembering A Cherished Family Member

May 21, 2025

Ellen De Generes Emotional Post Remembering A Cherished Family Member

May 21, 2025 -

Nfl To Consider New Rules Tush Push Ban Playoff Format And Flag Football

May 21, 2025

Nfl To Consider New Rules Tush Push Ban Playoff Format And Flag Football

May 21, 2025