Rubrik Soars: Q2 Results Show 51% Year-Over-Year Revenue Increase (RBRK)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rubrik Soars: Q2 Results Show 51% Year-Over-Year Revenue Increase (RBRK)

Rubrik, the leading provider of cloud data management solutions, announced stellar second-quarter fiscal year 2024 results, exceeding expectations with a remarkable 51% year-over-year revenue increase. This surge signifies strong market demand for Rubrik's innovative approach to data protection and management in the increasingly complex cloud landscape. The company's stock (RBRK) experienced a positive market reaction following the announcement, reflecting investor confidence in Rubrik's growth trajectory.

Key Highlights from Rubrik's Q2 FY24 Earnings Report:

- Revenue Growth: The 51% year-over-year revenue increase to $172.4 million clearly demonstrates Rubrik's success in capturing market share within the rapidly expanding data management sector. This surpasses analyst predictions and solidifies Rubrik's position as a key player.

- Subscription Revenue Strength: A significant portion of this growth stemmed from a robust increase in subscription revenue, highlighting the long-term value proposition of Rubrik's offerings. This recurring revenue stream provides stability and predictability for future growth.

- Increased Customer Acquisition: Rubrik added numerous new customers across various industries, indicating broad appeal and applicability of its solutions. This expansion reinforces the versatility and effectiveness of Rubrik's data management platform.

- Strong Profitability Metrics: While full profitability is still a goal for the future, Rubrik showcased improvements in key profitability metrics, hinting at a path towards long-term financial sustainability. This signals a positive trend for investors concerned about the company's bottom line.

- Focus on Innovation: Rubrik continues to invest heavily in research and development, ensuring its platform remains at the forefront of data management innovation. This commitment to innovation is crucial in a constantly evolving technological landscape.

What Fueled Rubrik's Impressive Growth?

Several factors contributed to Rubrik's outstanding Q2 performance. The company's focus on simplifying data management in hybrid and multi-cloud environments resonates strongly with enterprises grappling with the complexities of modern data infrastructure. Rubrik's unified platform offers a compelling alternative to fragmented legacy solutions, allowing organizations to streamline operations and reduce costs. Furthermore, the growing importance of data security and compliance further bolsters demand for robust and secure data management solutions, a key area where Rubrik excels.

Looking Ahead: Rubrik's Future Prospects

Rubrik's Q2 results paint a positive picture for the company's future. The strong revenue growth, increased customer acquisition, and improving profitability metrics indicate a healthy and sustainable growth trajectory. Continued investment in innovation and expansion into new markets will be key drivers of future success. The company’s focus on addressing the challenges faced by organizations navigating the complexities of cloud data management positions them favorably for sustained growth in the coming years.

Investing in Rubrik (RBRK): A Word of Caution

While Rubrik's performance is impressive, potential investors should conduct thorough due diligence before making any investment decisions. Analyzing market trends, competitive landscapes, and the company's long-term strategic plans is crucial for informed investing. Consult with a financial advisor for personalized advice.

Disclaimer: This article provides general information and analysis regarding Rubrik's financial performance and should not be considered financial advice. Investment decisions should be made based on independent research and consultation with a qualified financial professional.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rubrik Soars: Q2 Results Show 51% Year-Over-Year Revenue Increase (RBRK). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

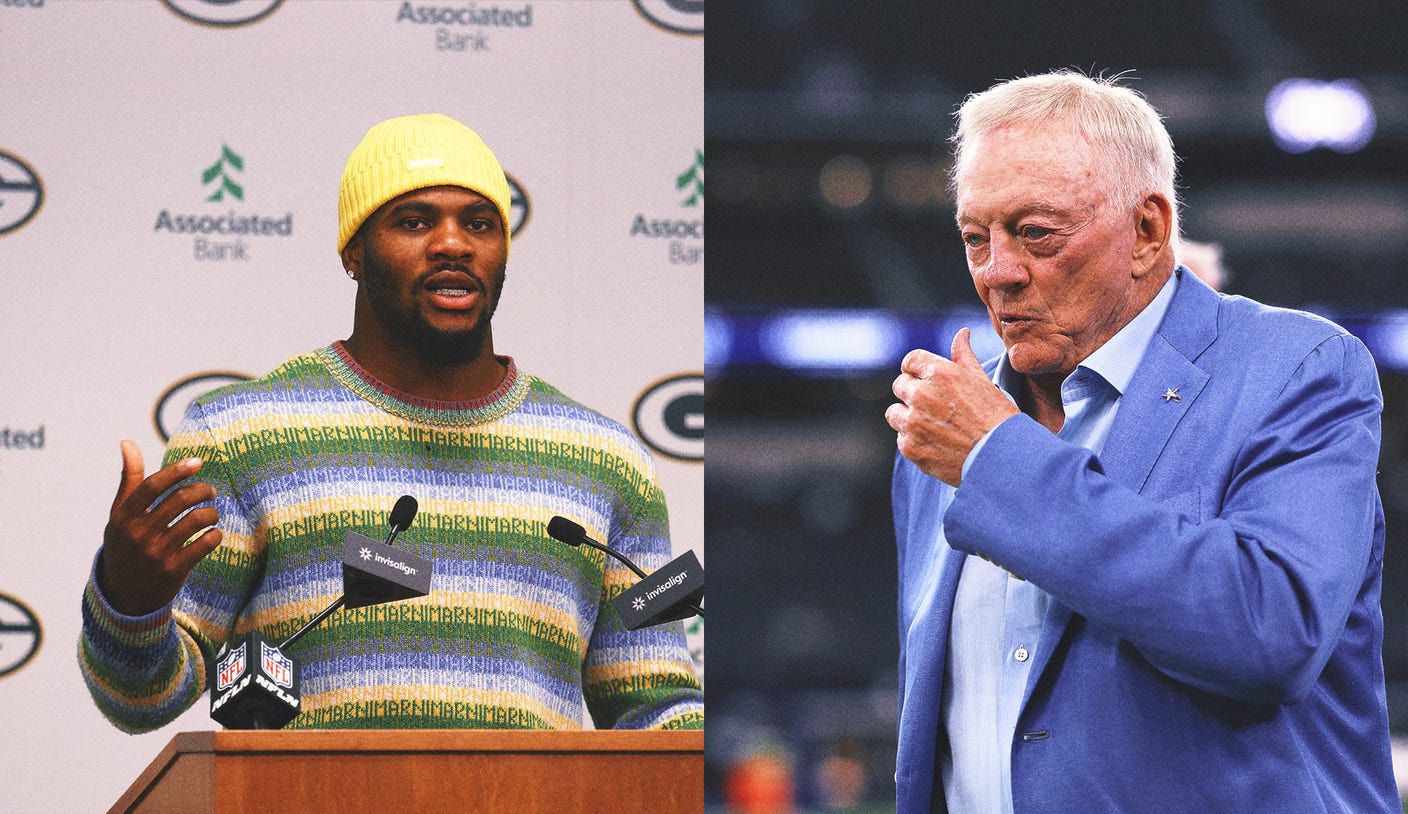

Bradshaw Sides With Jones Analyzing The Cowboys Micah Parsons Trade

Sep 10, 2025

Bradshaw Sides With Jones Analyzing The Cowboys Micah Parsons Trade

Sep 10, 2025 -

Domestic Violence Claims Life Of Naz Reids Sister Boyfriend In Custody

Sep 10, 2025

Domestic Violence Claims Life Of Naz Reids Sister Boyfriend In Custody

Sep 10, 2025 -

Buffalo Bills Sign K Matt Prater P Cameron Johnston Waive Brad Robbins

Sep 10, 2025

Buffalo Bills Sign K Matt Prater P Cameron Johnston Waive Brad Robbins

Sep 10, 2025 -

Rubrik Earnings Call Key Analyst Projections And Stock Implications

Sep 10, 2025

Rubrik Earnings Call Key Analyst Projections And Stock Implications

Sep 10, 2025 -

Patriots Coach Vrabel Bill Belichick Always Welcome

Sep 10, 2025

Patriots Coach Vrabel Bill Belichick Always Welcome

Sep 10, 2025

Latest Posts

-

Uncanny Doppelganger Bills Add Comedians Look Alike To Roster

Sep 10, 2025

Uncanny Doppelganger Bills Add Comedians Look Alike To Roster

Sep 10, 2025 -

Norways Haaland To Play Moldova Despite Facial Injury Requiring Stitches

Sep 10, 2025

Norways Haaland To Play Moldova Despite Facial Injury Requiring Stitches

Sep 10, 2025 -

Cameron Johnston In Brad Robbins Out Significant Nfl Punter Change

Sep 10, 2025

Cameron Johnston In Brad Robbins Out Significant Nfl Punter Change

Sep 10, 2025 -

Data Protection Leader Rubrik Rbrk Nyse Shows 51 Revenue Growth In Q2

Sep 10, 2025

Data Protection Leader Rubrik Rbrk Nyse Shows 51 Revenue Growth In Q2

Sep 10, 2025 -

Senator Urges Wnba Non Involvement In Phoenix Suns Sale

Sep 10, 2025

Senator Urges Wnba Non Involvement In Phoenix Suns Sale

Sep 10, 2025