Rubrik (RBRK:NYSE) Q2 Earnings Beat Expectations: 51% YoY Revenue Growth Detailed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rubrik (RBRK:NYSE) Q2 Earnings Beat Expectations: 51% YoY Revenue Growth Detailed

Rubrik, Inc. (RBRK:NYSE), a leading provider of cloud data management solutions, announced its second-quarter fiscal year 2024 earnings on August 30th, 2023, exceeding analysts' expectations and showcasing impressive growth. The results highlight the company's strong position in the rapidly expanding data management market. Investors responded positively to the announcement, with shares experiencing a surge. Let's delve into the details of Rubrik's outstanding Q2 performance.

Headline-Grabbing Q2 Results:

The key takeaway from Rubrik's Q2 earnings report is the significant year-over-year (YoY) revenue growth. The company reported a 51% increase in revenue, reaching $124.1 million, significantly surpassing the anticipated $116.6 million. This robust growth underscores the increasing demand for Rubrik's cloud data management solutions, particularly amidst the rise of hybrid and multi-cloud environments. This substantial growth demonstrates Rubrik's ability to capitalize on the expanding market opportunity.

Beyond the Numbers: Key Performance Indicators (KPIs):

While the overall revenue growth is impressive, several other key performance indicators further solidify Rubrik's strong Q2 showing:

-

Subscription Revenue Growth: A key metric for SaaS companies, Rubrik's subscription revenue also demonstrated significant growth, further solidifying its recurring revenue model. This predictable revenue stream is crucial for long-term stability and growth. Specific figures on subscription revenue growth were not immediately available but will likely be detailed in further analysis from financial analysts.

-

Customer Acquisition: Rubrik's success in acquiring new customers also contributed to its strong performance. While precise figures weren't explicitly provided in the initial press release, the overall revenue growth suggests a healthy influx of new clients. The company likely benefited from strategic partnerships and increased brand awareness.

-

Increased Annual Recurring Revenue (ARR): The increase in ARR is another crucial indicator of sustained growth. A higher ARR signifies a more predictable and stable revenue stream, boosting investor confidence.

What Fueled Rubrik's Success?

Several factors contributed to Rubrik's outstanding Q2 results:

-

Strong Product Demand: The increasing complexity of data management in hybrid and multi-cloud environments drives demand for Rubrik's integrated platform. Their solutions simplify data protection, management, and security across diverse cloud deployments.

-

Strategic Partnerships: Collaborations with major cloud providers likely contributed to market penetration and customer acquisition. These strategic alliances expand Rubrik's reach and enhance its offerings.

-

Focus on Innovation: Rubrik's commitment to innovation and developing cutting-edge data management technologies keeps them at the forefront of the industry. Continuous product enhancements and new feature releases attract and retain customers.

Looking Ahead: Future Outlook and Investment Implications:

Rubrik's Q2 earnings report paints a positive picture for the company's future. The strong growth trajectory and positive market outlook suggest continued success. However, investors should always conduct thorough due diligence before making any investment decisions. The competitive landscape remains dynamic, and economic factors could impact future performance.

Call to Action:

Stay tuned for further analysis of Rubrik's Q2 earnings and in-depth market commentary. You can follow [link to a relevant financial news source] for updates and further insights into the cloud data management market. Understanding the performance of key players like Rubrik is crucial for navigating the ever-evolving tech investment landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rubrik (RBRK:NYSE) Q2 Earnings Beat Expectations: 51% YoY Revenue Growth Detailed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Earnings Miss Doesnt Deter Oracle 21 Stock Surge On Positive Growth Outlook

Sep 10, 2025

Earnings Miss Doesnt Deter Oracle 21 Stock Surge On Positive Growth Outlook

Sep 10, 2025 -

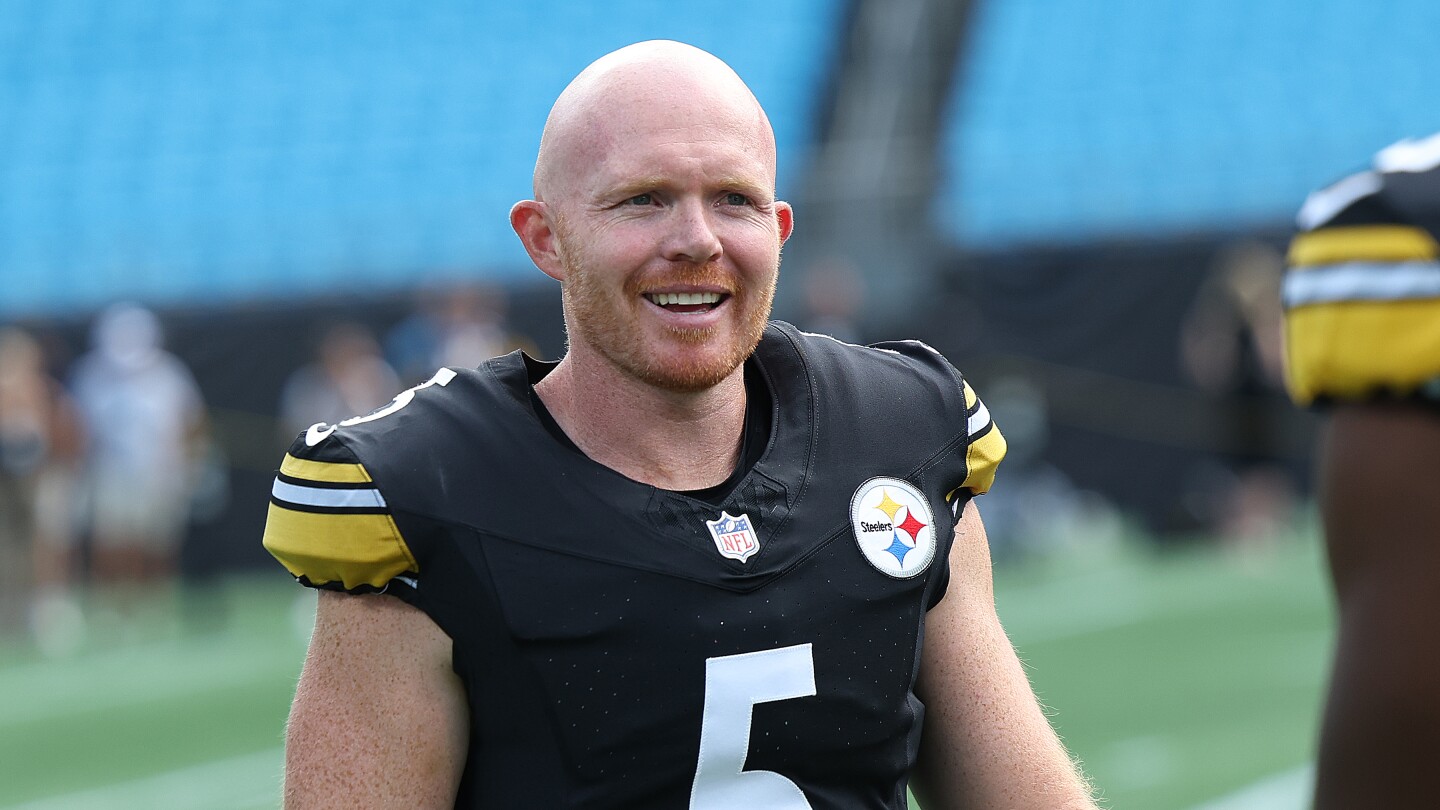

Nfl Roster Shakeup Johnston Replaces Robbins As Punter

Sep 10, 2025

Nfl Roster Shakeup Johnston Replaces Robbins As Punter

Sep 10, 2025 -

Espn Texas Coach Dismisses Speculation On Arch Mannings Health

Sep 10, 2025

Espn Texas Coach Dismisses Speculation On Arch Mannings Health

Sep 10, 2025 -

Naz Reids Sister Fatally Shot Boyfriend Charged In Minneapolis Tragedy

Sep 10, 2025

Naz Reids Sister Fatally Shot Boyfriend Charged In Minneapolis Tragedy

Sep 10, 2025 -

Oracle Stock Rally 21 Gain Driven By Positive Growth Projections

Sep 10, 2025

Oracle Stock Rally 21 Gain Driven By Positive Growth Projections

Sep 10, 2025

Latest Posts

-

Haaland Suffers Facial Injury Needs Stitches Ahead Of Moldova Match

Sep 10, 2025

Haaland Suffers Facial Injury Needs Stitches Ahead Of Moldova Match

Sep 10, 2025 -

Week 1 Nfl Memes Steelers Jokes About Jets Take Center Stage

Sep 10, 2025

Week 1 Nfl Memes Steelers Jokes About Jets Take Center Stage

Sep 10, 2025 -

New Bills Player Is The Spitting Image Of A Famous Comedian

Sep 10, 2025

New Bills Player Is The Spitting Image Of A Famous Comedian

Sep 10, 2025 -

Game Stop Revenue Rises In Second Quarter Analysis And Outlook

Sep 10, 2025

Game Stop Revenue Rises In Second Quarter Analysis And Outlook

Sep 10, 2025 -

Peacocks Love Island Games Season 2 Meet The New Islanders

Sep 10, 2025

Peacocks Love Island Games Season 2 Meet The New Islanders

Sep 10, 2025