Room For Disappointment? Investor's Assessment Of Super Micro Computer's Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Room for Disappointment? Investor's Assessment of Super Micro Computer's Future

Super Micro Computer, Inc. (SMCI) has carved a significant niche in the server market, known for its innovative designs and commitment to sustainability. However, recent market performance and analysts' projections are prompting investors to carefully assess the company's future trajectory. Is the current valuation justified, or is there room for disappointment? This in-depth analysis explores the factors influencing investor sentiment and the potential challenges and opportunities facing Super Micro in the coming years.

Navigating the Shifting Sands of the Server Market

Super Micro's success hinges on its ability to navigate the ever-evolving landscape of the server market. This sector is characterized by intense competition, rapid technological advancements (like the rise of AI and the growing demand for high-performance computing), and fluctuating demand based on macroeconomic factors. The company's strong position in the enterprise and data center markets is undeniable, but maintaining that position requires consistent innovation and strategic adaptation.

Key Factors Influencing Investor Sentiment

Several factors are contributing to the mixed investor sentiment surrounding Super Micro:

-

Supply Chain Challenges: Like many tech companies, Super Micro has faced ongoing disruptions to its supply chain. These challenges have impacted production timelines and profitability, leading to concerns about future growth prospects. This is a common thread across many tech sectors, and investors are keenly aware of its potential impact on earnings.

-

Economic Uncertainty: The current macroeconomic climate, characterized by inflation and potential recessionary pressures, casts a shadow over the overall tech sector, including Super Micro. Reduced capital expenditure by businesses could dampen demand for server hardware, impacting SMCI's revenue stream.

-

Competition: The server market is fiercely competitive, with established players like Dell Technologies, Hewlett Packard Enterprise, and Lenovo constantly vying for market share. Super Micro's ability to differentiate itself through innovation and pricing strategies will be crucial for sustained success.

-

Valuation Concerns: Some analysts express concerns about Super Micro's current valuation, arguing that it may not fully reflect the potential challenges mentioned above. This has led to a degree of caution among investors, prompting a closer examination of the company's financials and future growth projections.

Areas for Potential Growth and Opportunity

Despite the challenges, Super Micro possesses several strengths that could drive future growth:

-

Focus on Sustainability: Super Micro's commitment to environmentally friendly server designs is a significant differentiator in a market increasingly focused on sustainability. This could attract environmentally conscious clients and enhance the company's brand reputation.

-

Innovation in High-Performance Computing: Super Micro's investments in high-performance computing (HPC) technologies position it well to capitalize on the burgeoning demand for AI and machine learning applications. This focus is crucial in a rapidly changing technological landscape.

-

Strong Customer Relationships: The company enjoys strong relationships with key clients in various sectors, providing a solid foundation for future revenue generation. These established partnerships offer resilience in the face of market fluctuations.

Conclusion: A Cautious Outlook

While Super Micro Computer boasts a strong position in the server market and a clear commitment to innovation, investors should approach the stock with a degree of caution. The company faces significant challenges related to supply chain disruptions, macroeconomic uncertainty, and intense competition. A thorough analysis of its financials and future growth projections is essential before making any investment decisions. Continued monitoring of industry trends and Super Micro's strategic responses will be critical in determining whether the current valuation is justified and whether the company can overcome the headwinds it faces. Further research into competitor strategies and market analysis reports could provide a more complete picture.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Room For Disappointment? Investor's Assessment Of Super Micro Computer's Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Two S And P 500 Stocks Poised For Growth A Smart Buy During The Dip

May 27, 2025

Two S And P 500 Stocks Poised For Growth A Smart Buy During The Dip

May 27, 2025 -

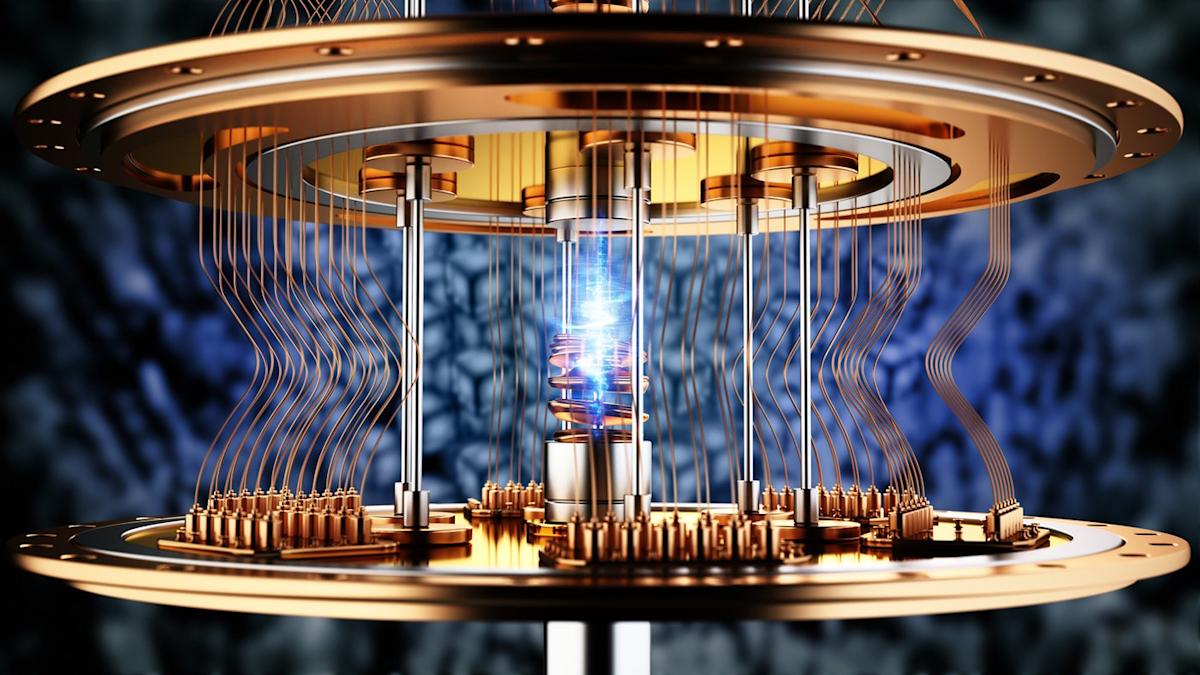

D Wave Quantum Vs Rigetti Computing Evaluating The Potential Of Quantum Computing Stocks

May 27, 2025

D Wave Quantum Vs Rigetti Computing Evaluating The Potential Of Quantum Computing Stocks

May 27, 2025 -

Market Reaction To Deutsche Banks Amc Entertainment Investment

May 27, 2025

Market Reaction To Deutsche Banks Amc Entertainment Investment

May 27, 2025 -

From Wreckage To Victory Lane Stunning Indy 500 Images

May 27, 2025

From Wreckage To Victory Lane Stunning Indy 500 Images

May 27, 2025 -

Ohtanis Transition To Dodgers Successful First Pitch To Hitters

May 27, 2025

Ohtanis Transition To Dodgers Successful First Pitch To Hitters

May 27, 2025