Room For Disappointment? Assessing Super Micro Computer's Stock Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Room for Disappointment? Assessing Super Micro Computer's Stock Outlook

Super Micro Computer (SMCI) has enjoyed a significant surge in its stock price recently, fueled by the burgeoning demand for artificial intelligence (AI) hardware. But is this rally sustainable? This article delves into the current market conditions, Super Micro's financial performance, and potential risks to assess whether the company's stock outlook is truly as bright as it seems, or if there's room for disappointment.

Super Micro's AI-Driven Growth:

Super Micro's success is undeniably linked to the explosive growth of the AI sector. The company is a major supplier of servers and storage solutions, critical components for building and maintaining large-scale AI infrastructure. This demand, driven by the likes of cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, has significantly boosted Super Micro's revenue and profitability. Recent quarterly earnings reports showcased impressive year-over-year growth, solidifying its position as a key player in the AI hardware market. However, this rapid growth raises questions about its long-term sustainability.

Analyzing the Financial Performance:

While Super Micro's financial performance has been impressive, a closer examination reveals some nuances. While revenue growth is strong, investors should scrutinize factors like gross margins, operating expenses, and debt levels to gain a complete picture of the company's financial health. A detailed analysis of their financial statements, available on the , is crucial for any informed investment decision. Consider comparing their performance to competitors like and to better understand their market positioning.

Potential Headwinds and Risks:

Despite the positive momentum, several factors could temper Super Micro's future growth:

- Increased Competition: The AI hardware market is becoming increasingly competitive, with established players and new entrants vying for market share. This could lead to price pressure and reduced profitability.

- Supply Chain Disruptions: Global supply chain issues continue to pose a risk, potentially impacting Super Micro's ability to meet the growing demand for its products.

- Economic Slowdown: A broader economic slowdown could dampen demand for AI infrastructure, negatively impacting Super Micro's revenue growth.

- Valuation Concerns: The recent surge in Super Micro's stock price has pushed its valuation to relatively high levels. This raises concerns about potential overvaluation and future price corrections.

Is there room for disappointment?

The short answer is: possibly. While Super Micro is undeniably benefiting from the AI boom, its future performance hinges on its ability to navigate the competitive landscape, manage its supply chain effectively, and withstand potential economic headwinds. Investors should approach this stock with a degree of caution, conducting thorough due diligence before making any investment decisions. Considering factors beyond the current hype is vital for long-term success.

Conclusion:

Super Micro Computer's stock presents a compelling investment opportunity, especially given its strong position in the rapidly expanding AI market. However, potential risks and valuation concerns necessitate a cautious approach. Thorough research, including analysis of financial statements and competitive landscape, is crucial before making any investment decisions. Remember to consult with a financial advisor before making any significant investment choices. The information provided here is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Room For Disappointment? Assessing Super Micro Computer's Stock Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Important Update Early June Ssi Checks And Full 2025 Payment Schedule

May 28, 2025

Important Update Early June Ssi Checks And Full 2025 Payment Schedule

May 28, 2025 -

Radar Africa Portugal Reforca Apoio Financeiro A Mocambique Com Nova Linha De Credito

May 28, 2025

Radar Africa Portugal Reforca Apoio Financeiro A Mocambique Com Nova Linha De Credito

May 28, 2025 -

Rigetti Vs D Wave Evaluating Quantum Computing Stocks For Potential Returns

May 28, 2025

Rigetti Vs D Wave Evaluating Quantum Computing Stocks For Potential Returns

May 28, 2025 -

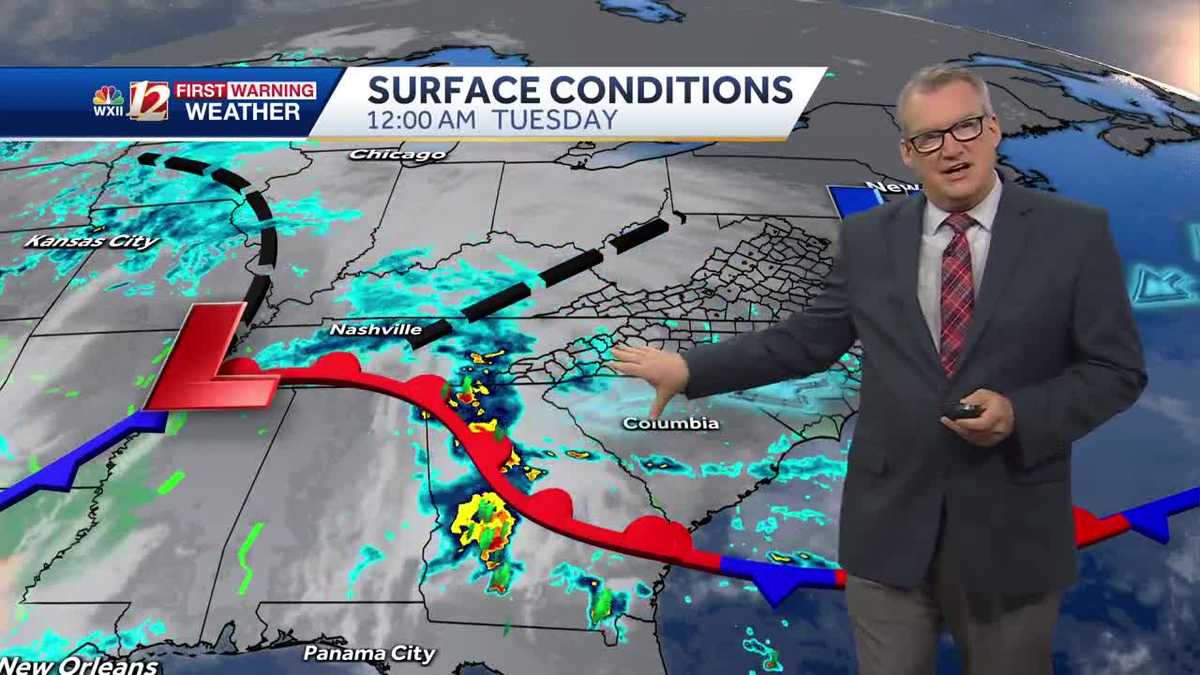

Travel Alert Cool And Wet Tuesday Conditions Expected

May 28, 2025

Travel Alert Cool And Wet Tuesday Conditions Expected

May 28, 2025 -

American Migration Trends Data Reveals The Leading International Destination

May 28, 2025

American Migration Trends Data Reveals The Leading International Destination

May 28, 2025