Robinhood Stock Performance: Reasons For Continued Investor Interest.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Stock Performance: Reasons for Continued Investor Interest

Robinhood, the commission-free trading app that exploded onto the scene, has experienced a rollercoaster ride since its IPO. While its stock price has fluctuated significantly, investor interest remains surprisingly robust. But why? What keeps investors hooked on this volatile stock, despite its challenges? Let's delve into the factors fueling continued interest in Robinhood's performance.

H2: The Appeal of a Disruptive Force

Robinhood's initial success stemmed from its disruptive business model. By eliminating trading commissions, it democratized investing, attracting millions of new, often younger, investors. This broad user base, even with recent account decreases, still represents a significant potential for future growth. The company's focus on user-friendly interfaces and gamified investing continues to be a draw, especially for those new to the market. This inherent appeal to a large, growing demographic keeps Robinhood on the radar of many investors.

H2: Beyond Trading: Diversification and Future Growth

While trading remains core to Robinhood's business, the company is actively diversifying its revenue streams. This strategic move is crucial for long-term sustainability and a key reason for continued investor optimism. Recent expansions into areas like crypto trading, options trading, and premium subscription services showcase a commitment to growth beyond its initial commission-free trading model. The potential for these new offerings to generate significant revenue is a major factor in attracting investors.

H3: Cryptocurrency's Influence

The cryptocurrency market's volatility directly impacts Robinhood's performance. With a significant portion of its user base actively trading cryptocurrencies, any major shift in the crypto market translates to increased trading activity on the platform. This inherent link to the volatile yet potentially lucrative crypto world creates both risk and reward, attracting investors with a higher risk tolerance. The growth of the crypto market, therefore, is inextricably linked to Robinhood's potential for future success.

H2: Navigating Challenges and Showing Resilience

Robinhood hasn't been without its challenges. Regulatory scrutiny, market downturns, and negative press have all impacted its stock price. However, the company's ability to navigate these hurdles and demonstrate resilience has impressed some investors. Their ongoing efforts to improve compliance and enhance their platform suggest a commitment to long-term stability, building confidence amongst some investors.

H3: Long-Term Growth Potential

Despite the volatility, many believe Robinhood possesses significant long-term growth potential. The sheer size of its user base, combined with its ongoing efforts to diversify its revenue streams and expand its product offerings, paints a picture of a company striving for sustained growth. This potential for future returns is a major reason why some investors remain committed, viewing the current stock price as a buying opportunity.

H2: Risks to Consider

It's crucial to acknowledge the risks associated with investing in Robinhood. The stock remains volatile, and its future performance is uncertain. Regulatory changes, competition from established players, and shifts in market sentiment could all significantly impact its stock price. Potential investors should conduct thorough due diligence and understand these inherent risks before making any investment decisions.

H2: Conclusion: A Risky but Potentially Rewarding Investment

Robinhood's stock performance has been anything but predictable. However, a combination of factors, including its disruptive business model, diversification efforts, and potential for future growth, continues to attract investors. While significant risks exist, the potential rewards for those willing to ride the volatility could be substantial. Remember to always conduct your own thorough research and consult with a financial advisor before investing. This article is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Stock Performance: Reasons For Continued Investor Interest.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

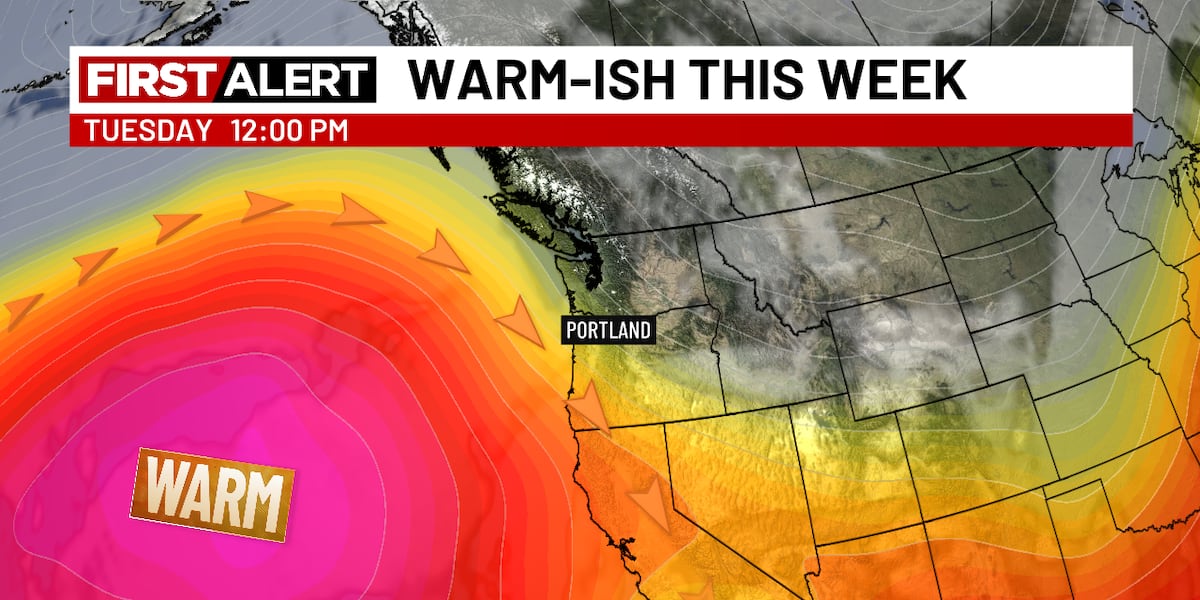

June Starts Warm Sunny And Dry Weather Forecast

Jun 05, 2025

June Starts Warm Sunny And Dry Weather Forecast

Jun 05, 2025 -

Broadcom Stock Forecast Earnings On The Horizon 250 In Play

Jun 05, 2025

Broadcom Stock Forecast Earnings On The Horizon 250 In Play

Jun 05, 2025 -

Nations League Semifinal Germany Vs Portugal How To Watch The Match Live

Jun 05, 2025

Nations League Semifinal Germany Vs Portugal How To Watch The Match Live

Jun 05, 2025 -

Teyana Taylor Discusses Straw Movie And Details New Music Escape Room

Jun 05, 2025

Teyana Taylor Discusses Straw Movie And Details New Music Escape Room

Jun 05, 2025 -

Philadelphia Eagles Send Bryce Huff To San Francisco 49ers In Draft Day Deal

Jun 05, 2025

Philadelphia Eagles Send Bryce Huff To San Francisco 49ers In Draft Day Deal

Jun 05, 2025