Robinhood Stock Performance: Analyzing The Reasons For Continued Investor Interest

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Stock Performance: Analyzing the Reasons for Continued Investor Interest

Robinhood, the commission-free trading app that disrupted the brokerage industry, continues to attract investor attention despite a volatile stock performance. While its share price has experienced significant fluctuations since its IPO, a dedicated investor base remains, intrigued by its potential for growth and disruptive innovation. But what exactly fuels this continued interest? Let's delve into the factors driving Robinhood's stock performance and the reasons behind enduring investor enthusiasm.

The Appeal of a Disruptive Business Model

Robinhood's initial success stemmed from its groundbreaking commission-free trading model. This democratized access to the stock market, attracting millions of new, often younger, investors. This disruptive approach resonated strongly with a generation accustomed to free or low-cost services, setting Robinhood apart from established brokerages. While competitors have since adopted similar models, Robinhood retains a significant market share, built on its early-adopter advantage and user-friendly platform.

Expansion Beyond Trading: Diversification as a Growth Catalyst

Recognizing the limitations of relying solely on trading commissions, Robinhood has strategically expanded its offerings. The introduction of features like cash management accounts, crypto trading, and options trading has broadened its revenue streams and appeal to a wider range of investors. This diversification strategy is crucial for long-term growth and reduces reliance on trading volume fluctuations, a key factor influencing its stock price. Further diversification into areas like wealth management could significantly impact future performance.

Challenges and Headwinds Affecting Robinhood's Stock

Despite the positive aspects, Robinhood faces significant challenges. Regulatory scrutiny, increasing competition, and the cyclical nature of the stock market all impact its stock performance. The company has also faced criticism regarding its handling of certain market events and its target audience. Understanding these challenges is crucial for assessing the overall risk associated with investing in Robinhood.

- Regulatory Scrutiny: Increased regulatory pressure on the fintech industry poses a potential threat to Robinhood's operations and profitability.

- Competitive Landscape: The brokerage industry is becoming increasingly competitive, with established players and new entrants vying for market share.

- Market Volatility: Robinhood's stock price is sensitive to overall market conditions, meaning periods of market downturn can negatively affect investor sentiment.

Analyzing Future Growth Potential

Looking ahead, Robinhood's future success hinges on its ability to effectively execute its expansion strategy, navigate regulatory hurdles, and maintain a loyal user base. Its focus on technological innovation and user experience could prove instrumental in attracting and retaining customers. The company’s potential for international expansion also presents a significant growth opportunity. However, investors need to carefully weigh the risks and potential rewards before making any investment decisions.

Investor Sentiment and Market Outlook

Investor sentiment towards Robinhood remains mixed. While some see its disruptive model and expansion strategy as catalysts for long-term growth, others remain cautious due to the company’s challenges and market volatility. Analyzing financial reports, news articles, and expert opinions is crucial for informed decision-making. Staying informed about the latest developments in the fintech industry and Robinhood's performance will be key for investors considering adding this volatile stock to their portfolio.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Stock Performance: Analyzing The Reasons For Continued Investor Interest. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hood Stock Surge Robinhood Shares Climb 6 46 June 3rd Whats Behind The Rally

Jun 06, 2025

Hood Stock Surge Robinhood Shares Climb 6 46 June 3rd Whats Behind The Rally

Jun 06, 2025 -

Teyana Taylor Unveiling Straw And The Escape Room Album

Jun 06, 2025

Teyana Taylor Unveiling Straw And The Escape Room Album

Jun 06, 2025 -

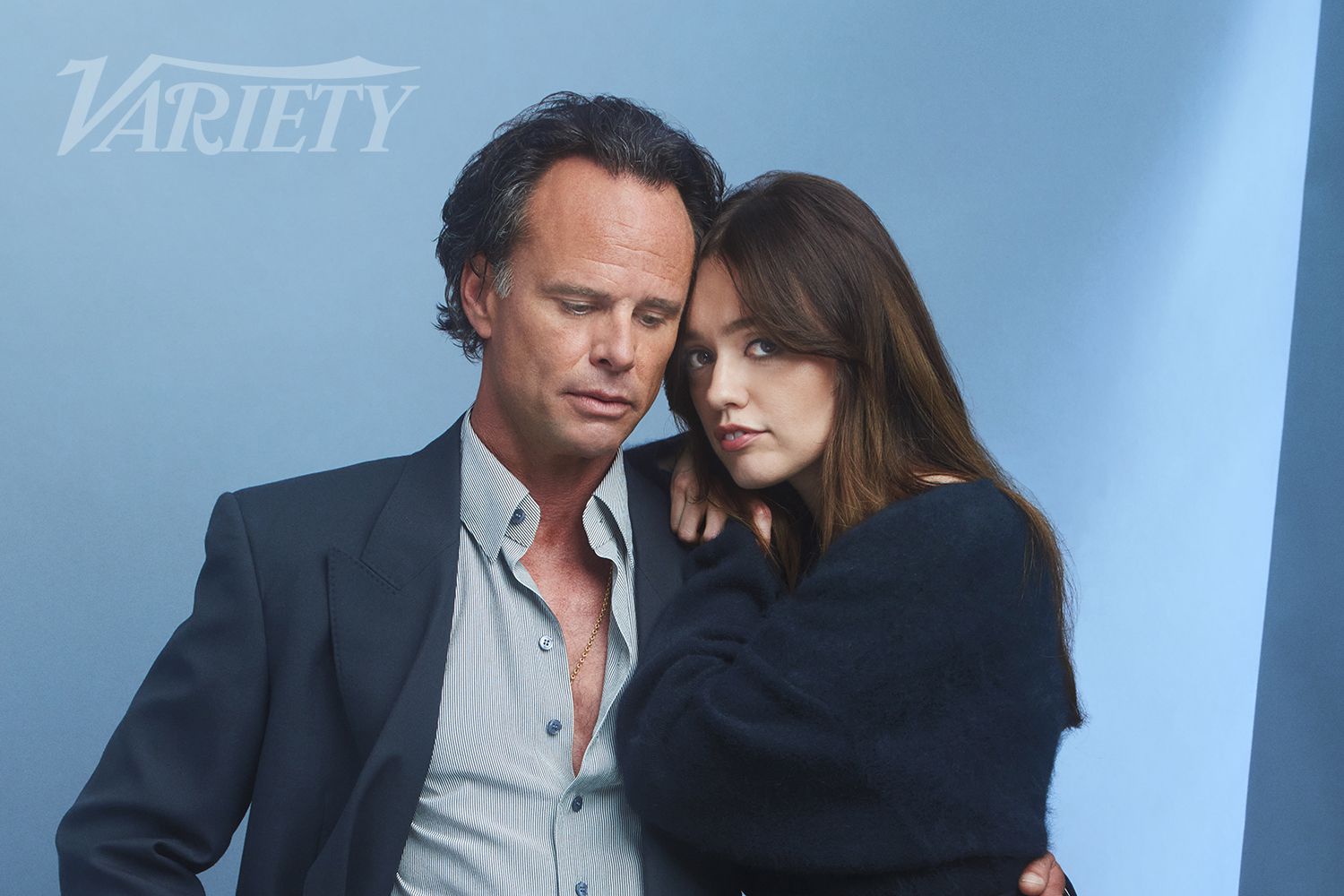

New Interview Walton Goggins And Aimee Lou Wood Respond To Feud Allegations

Jun 06, 2025

New Interview Walton Goggins And Aimee Lou Wood Respond To Feud Allegations

Jun 06, 2025 -

Applied Digital Apld Stock Market Performance Analysis Of Todays Gains

Jun 06, 2025

Applied Digital Apld Stock Market Performance Analysis Of Todays Gains

Jun 06, 2025 -

Germany Vs Portugal Nations League Semifinal Match Details Broadcast Info And Betting Odds

Jun 06, 2025

Germany Vs Portugal Nations League Semifinal Match Details Broadcast Info And Betting Odds

Jun 06, 2025