Robinhood Stock Performance: A Look At Recent Investor Interest

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Stock Performance: A Look at Recent Investor Interest

Robinhood, the commission-free trading app that exploded onto the scene, has seen its stock price fluctuate wildly since its initial public offering (IPO). While initially attracting significant investor interest, recent performance has been more muted. This article delves into the recent trends affecting Robinhood's stock performance and explores the factors driving (or dampening) investor enthusiasm.

The Rollercoaster Ride Since the IPO:

Robinhood's IPO in July 2021 was met with considerable hype, but the stock quickly fell short of expectations. The initial price of $38 quickly dropped, and the stock has struggled to regain its footing. Several factors contributed to this initial decline, including concerns about its business model's long-term viability and increased regulatory scrutiny. The subsequent market downturn only exacerbated these issues.

What's Driving Investor Interest (or Lack Thereof)?

Several key factors influence current investor sentiment towards Robinhood:

-

Competition: The brokerage industry is highly competitive, with established players like Fidelity and Charles Schwab offering similar services, often with more robust features and a longer track record. This intense competition puts pressure on Robinhood's margins and growth potential.

-

Regulatory Scrutiny: Increased regulatory scrutiny of the financial technology (fintech) sector, including investigations into Robinhood's practices, adds uncertainty for investors. This uncertainty can lead to a hesitant approach from potential investors.

-

Financial Performance: Robinhood's financial reports are closely scrutinized. While the company has shown growth in certain areas, consistent profitability remains elusive. Investors are keen to see evidence of sustainable profitability before significantly increasing their investments.

-

Cryptocurrency Volatility: Robinhood's cryptocurrency trading platform contributed significantly to its early success. However, the volatile nature of the cryptocurrency market makes this a double-edged sword. Periods of cryptocurrency market downturn directly impact Robinhood's revenue and investor confidence.

-

User Growth: Maintaining strong user growth is crucial for Robinhood's success. While the platform boasts millions of users, slowing user acquisition rates could signal a plateauing of growth and negatively impact stock performance.

The Future of Robinhood:

Despite the challenges, Robinhood continues to innovate and expand its offerings. The company is actively investing in new features and technologies to attract and retain users. However, its success hinges on its ability to address the concerns mentioned above, including navigating increased regulatory pressure, strengthening its financial performance, and competing effectively in a crowded market.

Analyzing the Stock:

Before making any investment decisions, thorough research is crucial. Consider consulting with a financial advisor to assess the risks and potential rewards associated with investing in Robinhood stock. Keep an eye on the company's financial reports and news related to regulatory developments to stay informed about its future prospects.

Conclusion:

Robinhood's stock performance reflects a complex interplay of factors, including competition, regulatory changes, and its own financial performance. While the company shows potential for future growth, investors need to carefully assess the risks and rewards before committing to this volatile stock. The future trajectory of Robinhood's stock price will largely depend on its ability to overcome these challenges and deliver consistent, sustainable growth.

Keywords: Robinhood, Robinhood stock, stock performance, investor interest, IPO, fintech, brokerage, cryptocurrency, regulatory scrutiny, competition, financial performance, stock market, investment, trading app.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Stock Performance: A Look At Recent Investor Interest. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Macdonald On Darnold Seahawks Qb To Start Despite Doubts

Jun 06, 2025

Macdonald On Darnold Seahawks Qb To Start Despite Doubts

Jun 06, 2025 -

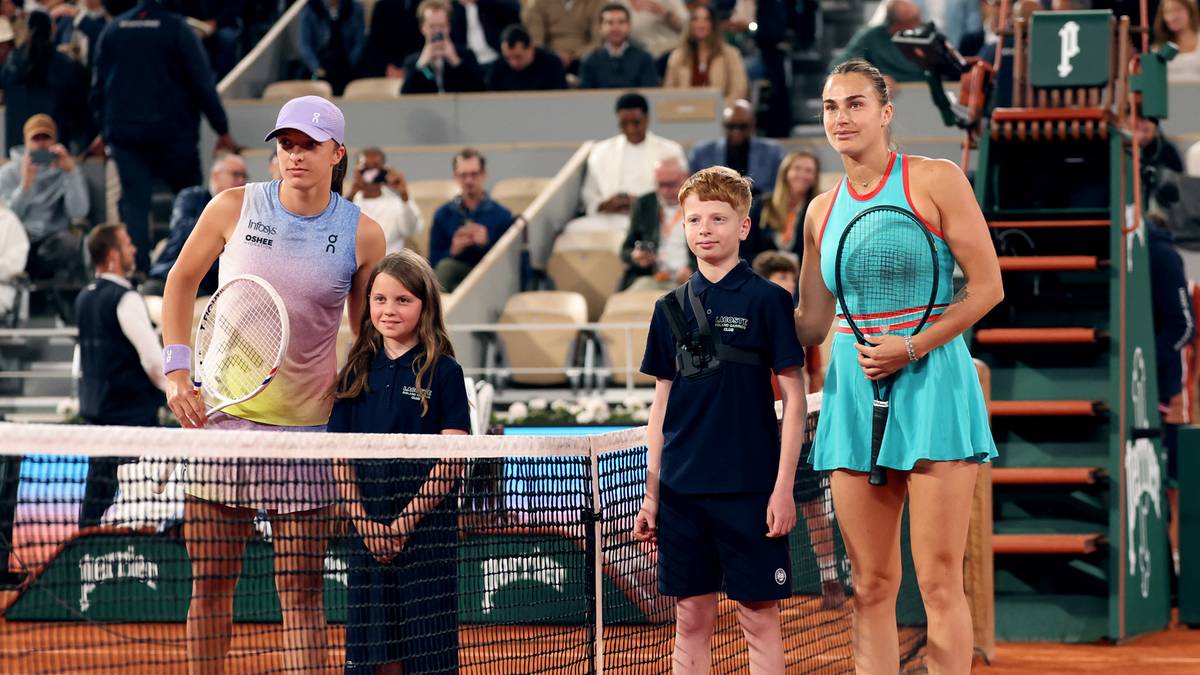

Iga Swiatek Aryna Sabalenka Mecz Na Zywo Z Roland Garros Wynik Online

Jun 06, 2025

Iga Swiatek Aryna Sabalenka Mecz Na Zywo Z Roland Garros Wynik Online

Jun 06, 2025 -

Rashod Batemans 36 75 M Contract A Breakdown Of The Ravens Deal

Jun 06, 2025

Rashod Batemans 36 75 M Contract A Breakdown Of The Ravens Deal

Jun 06, 2025 -

Karen Read Retrial Explanation For Cancelled Testimony

Jun 06, 2025

Karen Read Retrial Explanation For Cancelled Testimony

Jun 06, 2025 -

Report Joe Sacco Leaving Boston Bruins For Coaching Role

Jun 06, 2025

Report Joe Sacco Leaving Boston Bruins For Coaching Role

Jun 06, 2025