Robinhood Stock (HOOD) Jumps 6.46% On June 3rd: Market Reaction Analyzed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Stock (HOOD) Jumps 6.46% on June 3rd: Market Reaction Analyzed

Robinhood Markets, Inc. (HOOD) experienced a significant surge on June 3rd, with its stock price jumping 6.46%. This unexpected boost sent ripples through the market, prompting analysts and investors to dissect the underlying reasons behind this dramatic increase. This article delves into the potential factors driving this positive movement and analyzes the broader market reaction.

Understanding the Jump: Potential Catalysts

Several factors could have contributed to the impressive 6.46% rise in HOOD stock on June 3rd. While no single event definitively explains the jump, a combination of influences likely played a role:

-

Positive Sentiment Shift: The overall market sentiment might have played a significant role. A generally positive day on Wall Street could have boosted even struggling stocks like Robinhood, which has faced considerable challenges in recent times. Positive news surrounding the broader tech sector could also have indirectly impacted HOOD's performance.

-

Speculative Trading: Robinhood itself is a platform known for attracting retail investors and facilitating speculative trading. A sudden influx of buying pressure from these retail investors could easily propel the stock price upwards, especially in a volatile market.

-

Short Covering: Another possibility is short covering. If a significant number of investors had bet against Robinhood (short selling), a positive development, however minor, could trigger a wave of short covering, leading to a rapid price increase. This is a common phenomenon in highly volatile stocks.

-

Earnings Expectations (Future): While no immediate earnings announcements were made on June 3rd, anticipation of future positive earnings reports could have fueled investor optimism. Speculation about improved user growth or new revenue streams might have driven the price surge.

Market Reaction and Long-Term Outlook

The 6.46% jump in HOOD stock wasn't solely an isolated event. The broader market reacted with some degree of interest, reflecting the ongoing uncertainty surrounding the fintech sector and the volatile nature of Robinhood's stock.

-

Analyst Opinions Diverge: Analysts remain divided on Robinhood's long-term prospects. While some remain cautiously optimistic, citing potential for growth, others express concerns about the company's profitability and its ability to compete effectively in a crowded market. [Link to a relevant financial news source discussing analyst opinions on HOOD]

-

Volatility Remains a Concern: It's crucial to acknowledge the inherent volatility of HOOD stock. This significant price swing highlights the risk associated with investing in the company. Investors should exercise caution and conduct thorough due diligence before making any investment decisions.

-

Long-Term Growth Potential: Despite the challenges, Robinhood retains considerable potential for long-term growth. Its user base remains substantial, and the company continues to innovate within the fintech space. Success will hinge on its ability to adapt to market changes, improve profitability, and attract and retain users.

Conclusion: Navigating the HOOD Landscape

The 6.46% jump in Robinhood stock on June 3rd serves as a reminder of the unpredictable nature of the market and the importance of informed investment strategies. While the reasons behind the increase remain multifaceted, understanding the interplay of market sentiment, speculative trading, and potential future developments is crucial for investors seeking to navigate the HOOD landscape. Further monitoring of market trends and financial news is essential for making sound investment decisions.

Disclaimer: This article provides information for educational purposes only and should not be considered financial advice. Investing in the stock market involves inherent risks, and it's essential to consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Stock (HOOD) Jumps 6.46% On June 3rd: Market Reaction Analyzed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Clinical Uswnt Secure 4 0 Win Against Jamaica Ending Unbeaten Streak

Jun 06, 2025

Clinical Uswnt Secure 4 0 Win Against Jamaica Ending Unbeaten Streak

Jun 06, 2025 -

Sullivan Bolsters Rangers Coaching Staff With Quinn Sacco And Hennes

Jun 06, 2025

Sullivan Bolsters Rangers Coaching Staff With Quinn Sacco And Hennes

Jun 06, 2025 -

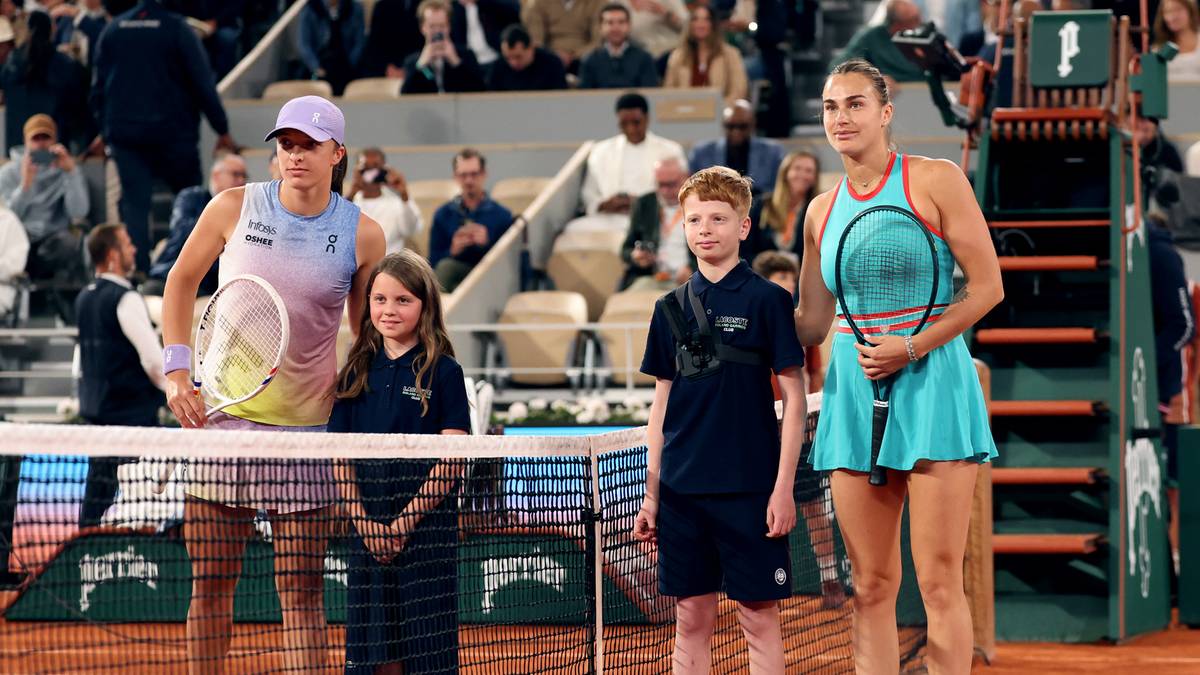

Mecz Swiatek Sabalenka Ogladaj Na Zywo Roland Garros Wynik I Relacja Online

Jun 06, 2025

Mecz Swiatek Sabalenka Ogladaj Na Zywo Roland Garros Wynik I Relacja Online

Jun 06, 2025 -

2020 Nfl Drafts Top 10 Successes Setbacks And Future Potential

Jun 06, 2025

2020 Nfl Drafts Top 10 Successes Setbacks And Future Potential

Jun 06, 2025 -

Dan Muse And Rangers Assistant Coaching Staff Latest Updates

Jun 06, 2025

Dan Muse And Rangers Assistant Coaching Staff Latest Updates

Jun 06, 2025