Robinhood Markets Inc. (HOOD) Stock Price Increase: 6.46% On June 3rd

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood (HOOD) Stock Soars: 6.46% Jump on June 3rd – What Fueled the Rally?

Robinhood Markets Inc. (HOOD) experienced a significant surge on June 3rd, with its stock price climbing 6.46%. This unexpected boost has sparked considerable interest among investors, prompting questions about the underlying factors driving this positive market movement. While the exact causes are multifaceted, several contributing elements likely played a role in this impressive rally.

This article delves into the potential reasons behind HOOD's impressive gains, examining market sentiment, recent company announcements, and broader economic factors that may have influenced investor confidence. We'll also explore the implications of this price increase and what it might mean for the future of Robinhood.

What Triggered the 6.46% Surge?

Several factors likely contributed to Robinhood's impressive 6.46% jump on June 3rd:

-

Improved Market Sentiment: The broader market experienced a period of relative stability and optimism leading up to June 3rd, which generally benefits technology stocks like Robinhood. Positive economic indicators or a decrease in market volatility can often trigger increased investment in growth sectors.

-

Positive Analyst Ratings (Potential): Although not publicly confirmed as a direct cause for this specific date, positive analyst ratings or upgrades from influential financial institutions could significantly influence investor sentiment and drive up the stock price. It's crucial to check for any relevant analyst reports released around this period.

-

Speculation and Short Covering: Short-selling, where investors bet against a stock's performance, is a common practice. If these short-sellers begin covering their positions (buying the stock to mitigate losses), it can create upward pressure on the price, accelerating the rally.

-

Increased Trading Volume: A noticeable increase in trading volume on June 3rd could indicate renewed investor interest and confidence in Robinhood's future prospects. Higher volume generally suggests stronger market forces at play.

-

Regulatory Developments (or Lack Thereof): The absence of negative regulatory news concerning the company could also be a factor. Any perceived easing of regulatory scrutiny can often lead to a positive market reaction.

Analyzing Robinhood's Recent Performance:

While a single day's performance doesn't necessarily define long-term trends, the 6.46% increase provides a valuable data point for assessing Robinhood's ongoing trajectory. To gain a comprehensive understanding, investors should consult detailed financial reports and analyses focusing on Robinhood's revenue growth, user acquisition, and overall financial health.

Looking Ahead: Future Outlook for HOOD

The June 3rd surge offers a glimpse of potential, but sustained growth requires consistent performance. Investors should carefully consider several factors before making any investment decisions regarding HOOD, including:

- Competitive Landscape: Robinhood operates in a highly competitive market, facing pressure from established players and emerging fintech companies.

- Financial Stability: Analyzing Robinhood's financial statements is critical for assessing its long-term viability and potential for continued growth.

- Regulatory Changes: The evolving regulatory landscape in the financial sector can significantly impact Robinhood's operations and future performance.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Keywords: Robinhood, HOOD, stock price, stock market, June 3rd, stock increase, investment, trading, fintech, market analysis, financial news, stock rally, analyst ratings, short covering, regulatory news.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Markets Inc. (HOOD) Stock Price Increase: 6.46% On June 3rd. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Preparing For The Unexpected A Retirement Plan Stress Test Checklist

Jun 05, 2025

Preparing For The Unexpected A Retirement Plan Stress Test Checklist

Jun 05, 2025 -

Yankees Bullpen Takes Hit Luke Weavers Hamstring Injury And Recovery

Jun 05, 2025

Yankees Bullpen Takes Hit Luke Weavers Hamstring Injury And Recovery

Jun 05, 2025 -

Wcws 2024 Texas Techs Stunning Victory Sends Them To Championship Game

Jun 05, 2025

Wcws 2024 Texas Techs Stunning Victory Sends Them To Championship Game

Jun 05, 2025 -

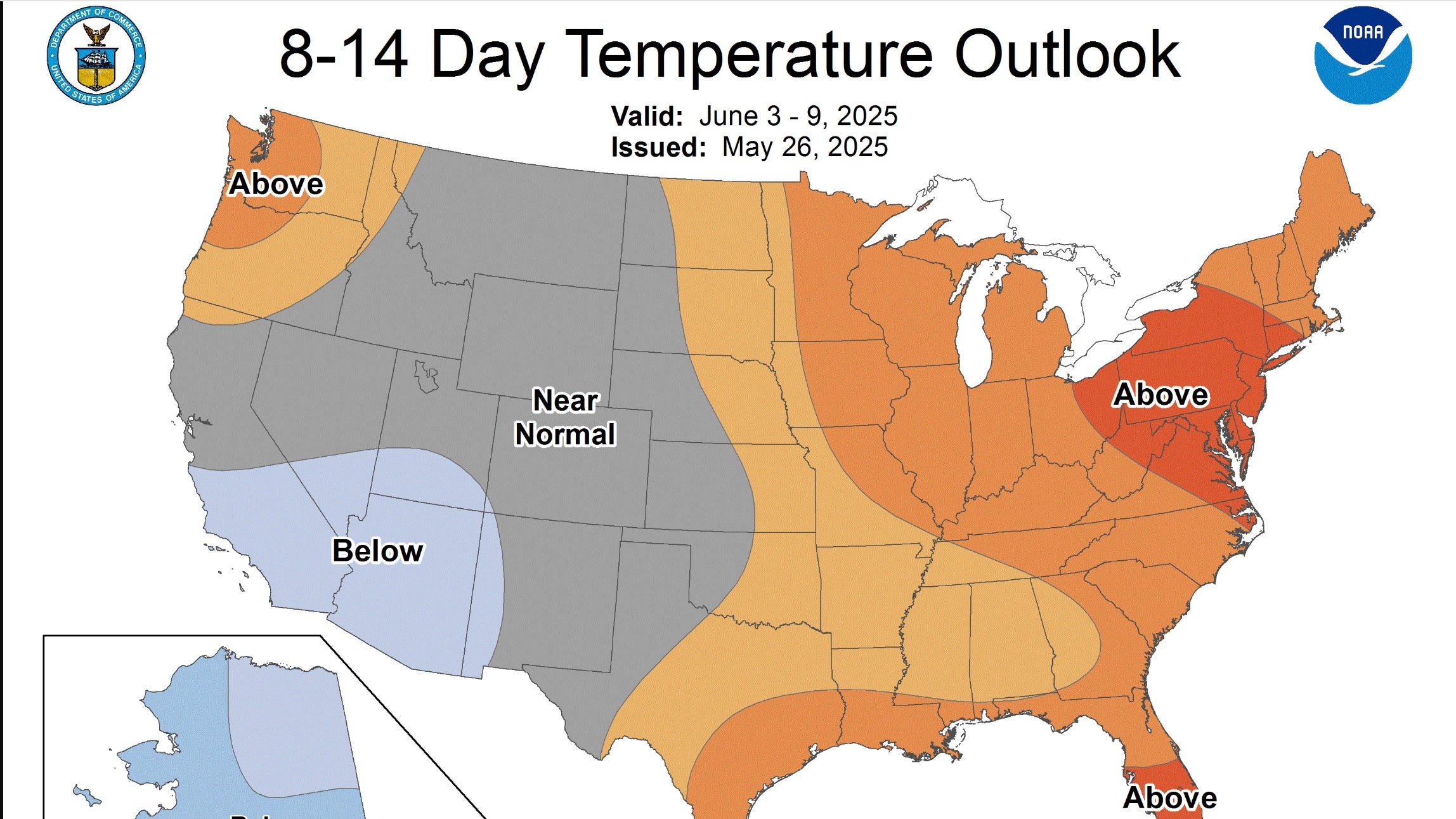

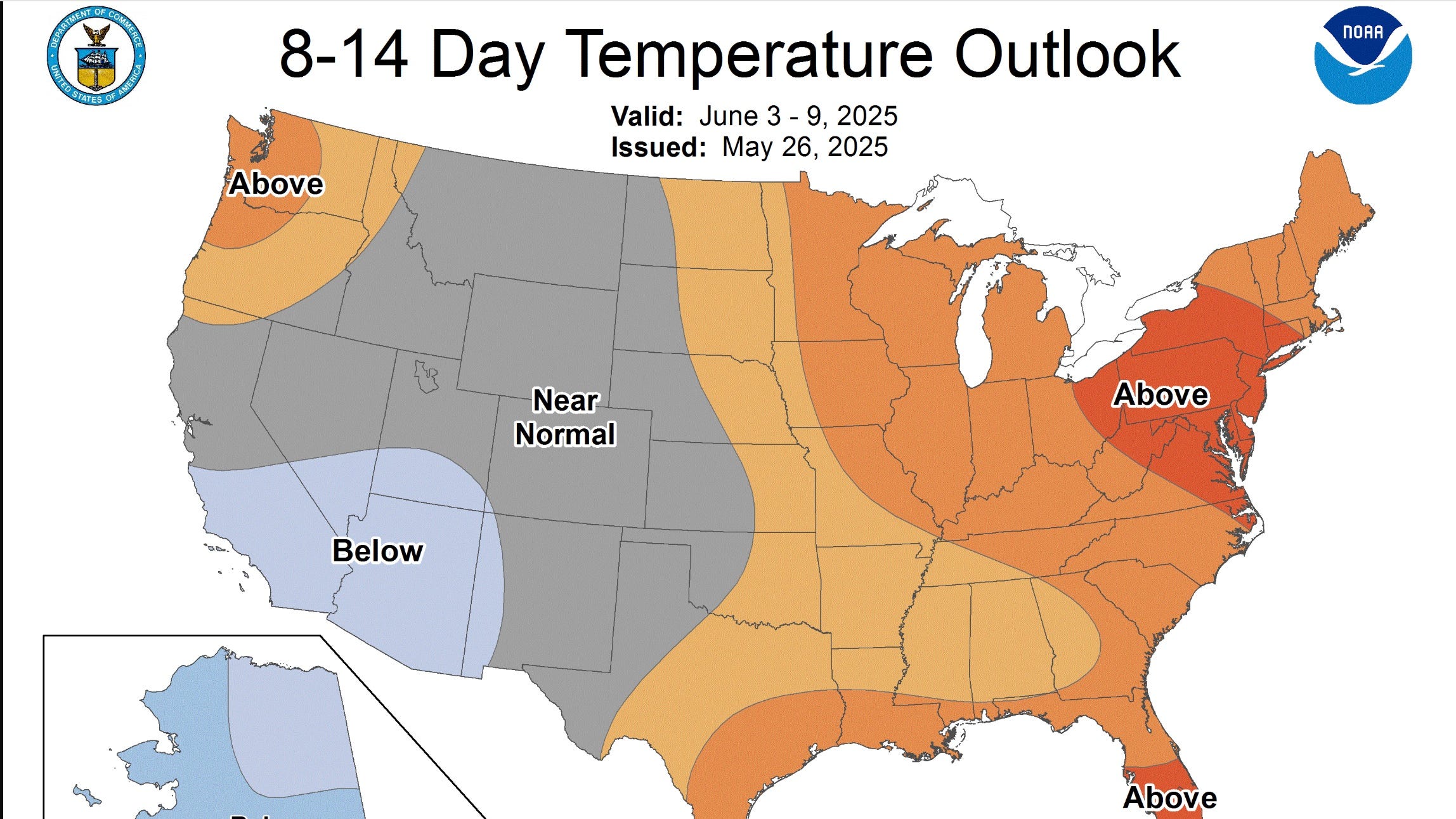

Willamette Valley Oregon Extreme Heat Warning Issued

Jun 05, 2025

Willamette Valley Oregon Extreme Heat Warning Issued

Jun 05, 2025 -

High Temperatures Predicted For Oregons Willamette Valley This Week

Jun 05, 2025

High Temperatures Predicted For Oregons Willamette Valley This Week

Jun 05, 2025