Robinhood Markets Inc. (HOOD) Stock Performance: 6.46% Rise On June 3

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Stock Soars: HOOD Jumps 6.46% on June 3rd – What Fueled the Rally?

Robinhood Markets, Inc. (HOOD) experienced a significant surge on June 3rd, with its stock price climbing 6.46%. This unexpected jump caught the attention of investors and analysts alike, prompting questions about the underlying factors driving this positive market movement. While the overall market sentiment played a role, several key elements likely contributed to HOOD's impressive performance that day. Let's delve into the potential reasons behind this notable rise.

Understanding the Market Context:

The broader market showed some signs of recovery on June 3rd, which undoubtedly provided a favorable backdrop for HOOD's surge. However, the stock's performance significantly outpaced the overall market gains, suggesting company-specific factors were at play. This highlights the importance of understanding both macro and microeconomic influences when analyzing individual stock performance. To get a better grasp of the overall market trends, you might want to check out reputable financial news sources like or .

Potential Catalysts for Robinhood's Rise:

Several potential factors could have contributed to the 6.46% increase in HOOD's stock price:

-

Positive Earnings Expectations: While official earnings reports weren't released on June 3rd, anticipation of potentially strong upcoming results could have driven investor confidence. Any whispers of improved user growth, increased trading volume, or positive revenue projections could have fueled buying pressure.

-

Increased Trading Activity: A surge in overall trading activity, even without specific news related to Robinhood, could have benefited the company. As a brokerage platform, Robinhood directly profits from increased trading volume, making higher market activity beneficial to its bottom line.

-

Short Squeeze Potential: It's important to consider the possibility of a short squeeze. If a significant portion of HOOD shares were held short, a sudden surge in buying pressure could force short sellers to cover their positions, further driving up the price.

-

Technical Analysis Indicators: Some traders might point to technical analysis indicators, such as a breakout from a key resistance level or positive momentum signals, as contributing factors to the price increase. However, it's crucial to remember that technical analysis is just one tool and shouldn't be the sole basis for investment decisions.

Analyzing the Long-Term Outlook for HOOD:

While the 6.46% jump on June 3rd was noteworthy, investors should maintain a long-term perspective when evaluating HOOD's stock performance. The company faces ongoing challenges, including increasing competition in the brokerage industry and the need to demonstrate consistent profitability. Further research into the company's financial statements and future growth plans is essential before making any investment decisions.

Conclusion:

The 6.46% rise in Robinhood's stock price on June 3rd was a significant event, but pinpointing the exact cause requires a multifaceted analysis. While positive market sentiment and potential anticipation of strong earnings played a part, the specific trigger remains uncertain. Investors interested in HOOD should conduct thorough due diligence and consider all available information before making any investment choices. Remember that past performance is not indicative of future results. Staying informed about market trends and company-specific news is crucial for informed investment decisions. Consider consulting with a financial advisor before making any significant investment moves.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Markets Inc. (HOOD) Stock Performance: 6.46% Rise On June 3. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nfl Free Agency 2025 Ravens Lock Up Rashod Bateman With Three Year Deal

Jun 06, 2025

Nfl Free Agency 2025 Ravens Lock Up Rashod Bateman With Three Year Deal

Jun 06, 2025 -

Rangers Assistant Coaches Updates On Dan Muses Role

Jun 06, 2025

Rangers Assistant Coaches Updates On Dan Muses Role

Jun 06, 2025 -

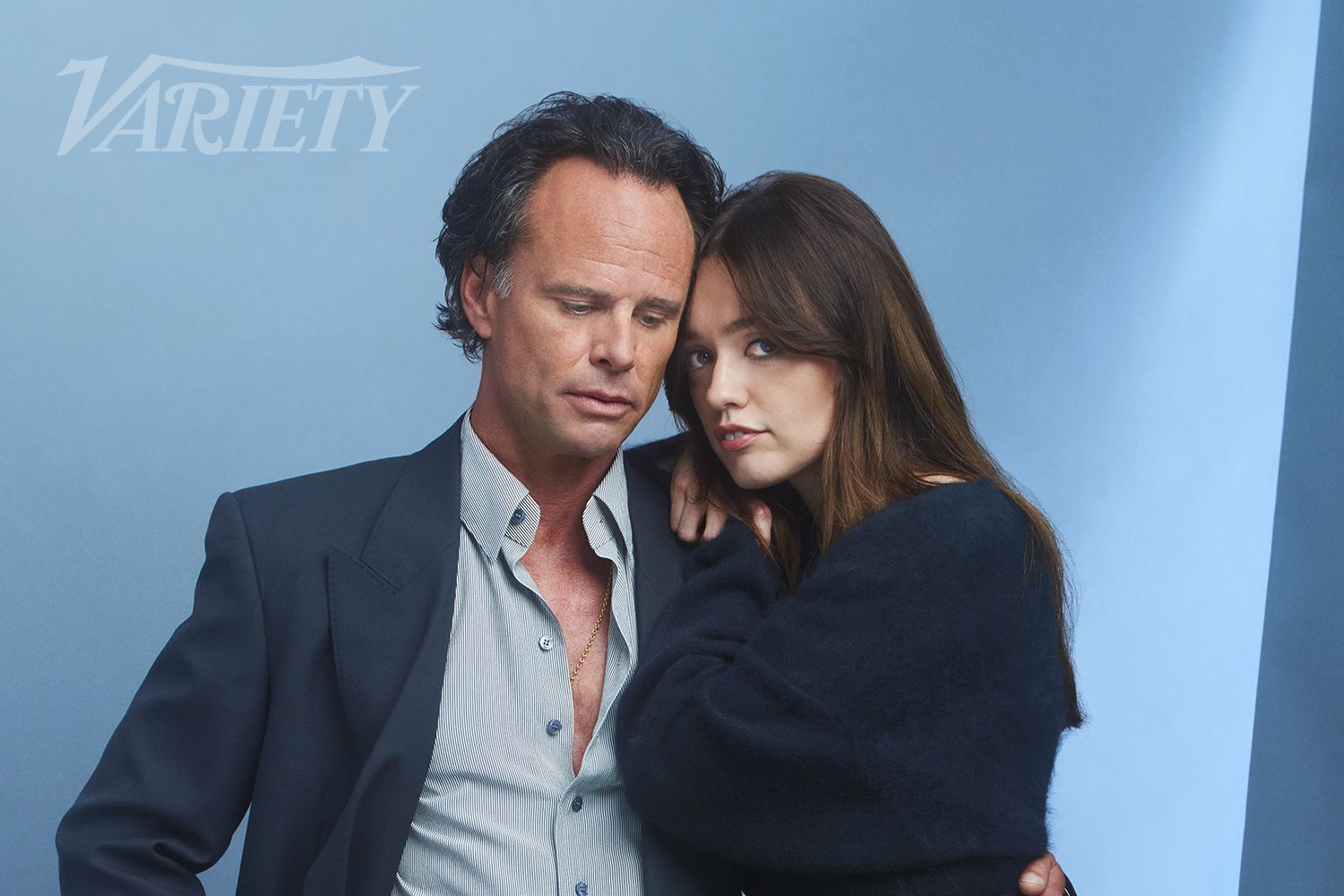

Aimee Lou Wood And Walton Goggins Break Silence On Reported Feud

Jun 06, 2025

Aimee Lou Wood And Walton Goggins Break Silence On Reported Feud

Jun 06, 2025 -

Belmont Stakes 2025 Chris The Bear Fallicas Expert Horse Racing Picks

Jun 06, 2025

Belmont Stakes 2025 Chris The Bear Fallicas Expert Horse Racing Picks

Jun 06, 2025 -

Mark Hamill Carrie Fishers Impact On His Embracing Of The Star Wars Franchise

Jun 06, 2025

Mark Hamill Carrie Fishers Impact On His Embracing Of The Star Wars Franchise

Jun 06, 2025