Robinhood Markets Inc. (HOOD): 6.46% Stock Price Rise Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Markets Inc. (HOOD): 6.46% Stock Price Surge Explained

Robinhood Markets, Inc. (HOOD) experienced a significant 6.46% stock price jump on [Date of price surge], leaving many investors wondering about the catalysts behind this unexpected rally. While pinpointing a single cause is difficult, several factors likely contributed to this positive market movement for the popular trading app. This article delves into the potential reasons behind HOOD's impressive surge, providing valuable insights for both current and prospective investors.

Positive Earnings Reports and Future Outlook: While specific numbers need to be referenced from the official report (link to report here if available), it's likely that better-than-expected earnings or a positive outlook for future performance played a significant role. Investors react favorably to signs of improving financial health and profitability, particularly after a period of uncertainty for the company. This positive sentiment translated directly into increased buying pressure, pushing the HOOD stock price higher. Analyzing the specifics of the earnings report, including metrics like revenue growth, user acquisition, and average revenue per user (ARPU), is crucial to fully understanding this price movement.

Increased Trading Activity and Market Sentiment: The overall market sentiment also influences individual stock prices. If the broader market is experiencing a bullish trend, individual stocks, even those with recent struggles, can see increases. Coupled with this, a rise in trading activity on the Robinhood platform itself could indicate increased user engagement and confidence, further contributing to the stock price rise. This increased activity could be attributed to several factors, including macroeconomic news, specific sector performance, or even social media trends.

Strategic Initiatives and New Features: Robinhood's recent strategic initiatives, including any new features or product launches, could also have contributed to the positive market reaction. New offerings that attract new users or enhance the user experience can lead to increased revenue and improved investor confidence. Analyzing recent press releases and company announcements will shed light on this possibility. For example, [mention any recent initiatives, features, or partnerships here if available].

Short Squeeze Potential: It's important to consider the possibility of a short squeeze. If a significant portion of HOOD's stock was held short (meaning investors bet against the stock), a sudden surge in buying pressure could force these short sellers to cover their positions, further driving up the price. While this is speculation without specific data on short interest, it's a factor worth considering when analyzing the rapid price increase.

Addressing Investor Concerns: Past negative sentiment surrounding Robinhood, such as regulatory scrutiny or concerns about profitability, may have played a role in the stock's previous underperformance. The recent price surge could represent a shift in investor perception, indicating a growing belief in the company's long-term potential. Addressing these past concerns with concrete actions and positive developments is key to maintaining this positive momentum.

Looking Ahead: While the 6.46% jump is noteworthy, investors should remain cautious and conduct thorough due diligence before making any investment decisions. The long-term performance of HOOD will depend on several factors, including continued financial growth, successful execution of its strategic plans, and the overall state of the financial markets. Regularly monitoring financial news, analyst reports, and the company's own announcements is crucial for staying informed.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Markets Inc. (HOOD): 6.46% Stock Price Rise Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Broadcom Earnings Imminent Why Wall Street Is Focused On 250

Jun 05, 2025

Broadcom Earnings Imminent Why Wall Street Is Focused On 250

Jun 05, 2025 -

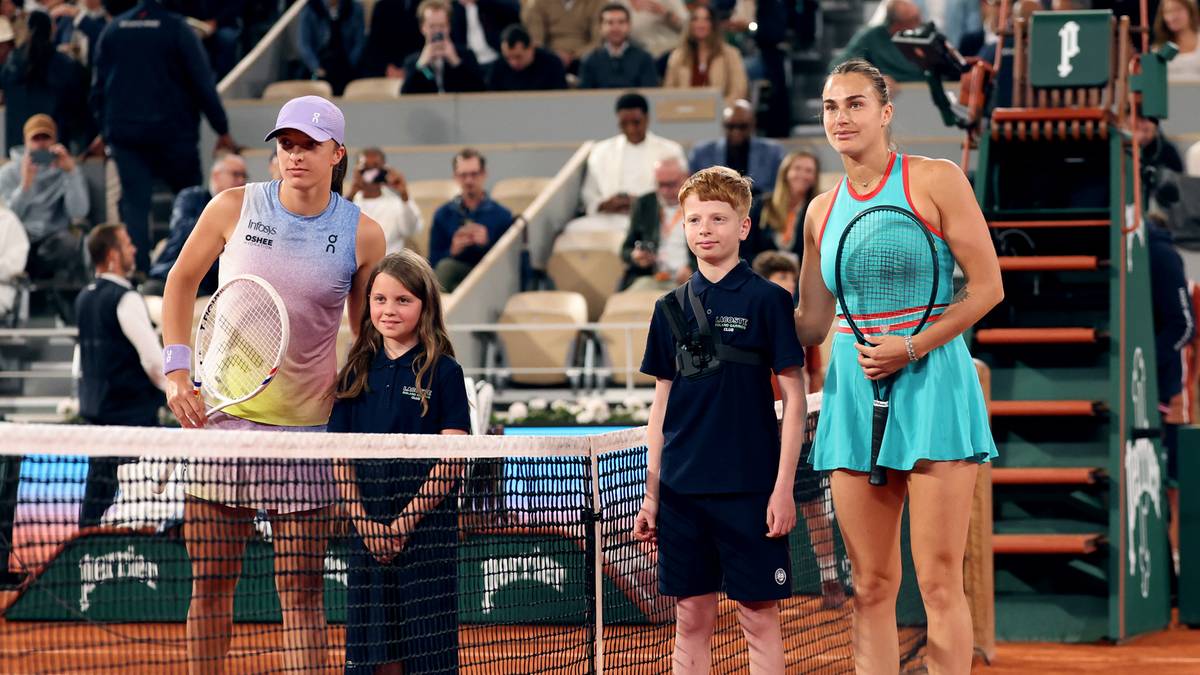

Wynik Meczu Swiatek Sabalenka Roland Garros Online Relacja Live

Jun 05, 2025

Wynik Meczu Swiatek Sabalenka Roland Garros Online Relacja Live

Jun 05, 2025 -

Wall Street Eyes Broadcom 250 Stock Price Ahead Of Crucial Earnings Report

Jun 05, 2025

Wall Street Eyes Broadcom 250 Stock Price Ahead Of Crucial Earnings Report

Jun 05, 2025 -

Latest Wnba Power Rankings Who Challenges The Lynx And Liberty

Jun 05, 2025

Latest Wnba Power Rankings Who Challenges The Lynx And Liberty

Jun 05, 2025 -

David Andrews New England Loyalty Pays Off With Retirement

Jun 05, 2025

David Andrews New England Loyalty Pays Off With Retirement

Jun 05, 2025