Robinhood Markets Inc. (HOOD): 6.46% Share Price Surge Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Markets Inc. (HOOD): 6.46% Share Price Surge Explained

Robinhood Markets, Inc. (HOOD) experienced a significant 6.46% surge in its share price on [Date of Surge], leaving many investors wondering about the driving forces behind this unexpected jump. While pinpointing a single cause is difficult, a confluence of factors likely contributed to this positive market movement for the controversial trading app. Let's delve into the potential reasons behind this notable increase.

Stronger-Than-Expected Q2 Earnings – A Key Catalyst?

While the official Q2 2024 earnings report hasn't been released at the time of writing, market speculation suggests that positive pre-earnings whispers and potential indications of improved user engagement and revenue could be fueling the surge. Analysts have been closely watching Robinhood's progress in diversifying its revenue streams beyond trading commissions, and any positive news in this area could significantly impact investor sentiment. We anticipate a detailed analysis following the official release of the financial report. Stay tuned for updates!

Increased Regulatory Certainty?

The evolving regulatory landscape surrounding fintech companies like Robinhood has been a source of both uncertainty and volatility. Any positive developments or clearer regulatory guidelines could bolster investor confidence and lead to increased buying pressure. Recent statements from regulatory bodies or legislative actions related to online brokerage platforms could be a contributing factor to the share price increase.

Market-Wide Sentiment and Sectoral Trends

The broader market conditions also play a crucial role. A positive overall market sentiment, particularly within the technology sector, could lift even individual stocks like Robinhood. If other fintech companies are experiencing growth or positive news, it could create a ripple effect, benefiting similarly positioned stocks. Analyzing the performance of other publicly traded brokerage firms during the same period is vital in understanding the overall market trend.

Speculative Trading and Short Squeeze Potential

It's important to acknowledge the role of speculative trading and the potential for a short squeeze. If a significant portion of Robinhood's stock is held short (betting on a price decline), a sudden influx of buying pressure can force these short sellers to cover their positions, further driving up the price. While this is a speculative element, it cannot be entirely disregarded.

Improved User Experience and New Features

Robinhood has been investing in improving its platform and adding new features to attract and retain users. Positive user feedback or the launch of highly anticipated features could contribute to increased user engagement and, consequently, a more positive market outlook.

What's Next for HOOD?

The 6.46% surge presents a fascinating case study in market dynamics. While the exact cause remains multifaceted and subject to ongoing analysis, investors will be keenly watching the Q2 earnings report and subsequent market reactions. The long-term performance of HOOD will depend on the company's ability to sustain growth, navigate regulatory challenges, and continue to innovate within the competitive fintech landscape. Further investigation and analysis of the company's financial statements will be crucial in understanding the sustainability of this recent price increase.

Disclaimer: This article provides general information and should not be considered financial advice. Conduct thorough research and consult with a financial advisor before making any investment decisions. Investment in the stock market involves risk, and past performance does not guarantee future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Markets Inc. (HOOD): 6.46% Share Price Surge Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

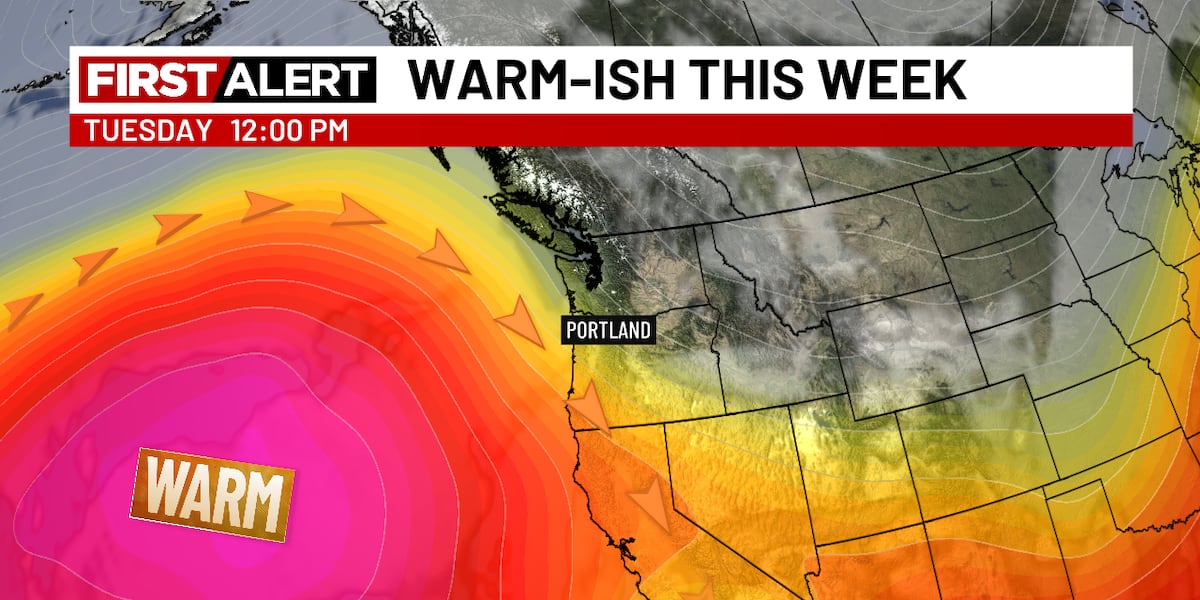

June Starts With Warm Sunny And Dry Weather

Jun 05, 2025

June Starts With Warm Sunny And Dry Weather

Jun 05, 2025 -

Avgo Stock After Earnings Expert Trader Predictions And Market Analysis

Jun 05, 2025

Avgo Stock After Earnings Expert Trader Predictions And Market Analysis

Jun 05, 2025 -

Rashod Batemans Nfl Contract Surpasses Eric Decker S A Record For Minnesota Gophers Wide Receivers

Jun 05, 2025

Rashod Batemans Nfl Contract Surpasses Eric Decker S A Record For Minnesota Gophers Wide Receivers

Jun 05, 2025 -

Rockies Break 22 Series Losing Streak Secure First Win Since 2024

Jun 05, 2025

Rockies Break 22 Series Losing Streak Secure First Win Since 2024

Jun 05, 2025 -

Warren Buffetts Portfolio Shakeup Bank Of America Sale Fuels Investment In Skyrocketing Consumer Brand

Jun 05, 2025

Warren Buffetts Portfolio Shakeup Bank Of America Sale Fuels Investment In Skyrocketing Consumer Brand

Jun 05, 2025