Robinhood (HOOD) Stock Performance: 6.46% Increase Analyzed - June 3, 2024

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood (HOOD) Stock Soars 6.46%: A June 3rd Market Analysis

Robinhood Markets, Inc. (HOOD) experienced a significant surge on June 3rd, 2024, with its stock price jumping 6.46%. This unexpected boost has sent ripples through the financial markets, prompting analysts to dissect the underlying factors contributing to this impressive performance. Was it a fleeting moment of market exuberance, or a sign of things to come for the controversial trading platform? Let's delve into the details.

What Drove the 6.46% Increase?

Pinpointing the exact cause of such a dramatic single-day increase is challenging, as multiple factors often interplay in the stock market. However, several key elements likely contributed to HOOD's impressive performance on June 3rd:

-

Positive Market Sentiment: The broader market showed signs of growth on June 3rd, potentially lifting many stocks, including Robinhood. A general increase in investor confidence can significantly impact even individual stocks. This positive sentiment could be attributed to various macroeconomic factors, including easing inflation concerns or positive economic data releases. [Link to relevant market news source]

-

Speculation and Analyst Upgrades: It's possible that analyst upgrades or positive commentary regarding Robinhood's future prospects fueled the stock's rise. Rumours and speculation, even without concrete evidence, can heavily influence short-term stock price fluctuations. While we await official statements, monitoring analyst reports will be crucial in understanding the long-term implications. [Link to reputable financial news site for analyst reports]

-

Improved Financial Performance (Potential): While concrete financial reports weren't released on June 3rd, speculation about upcoming positive earnings or improved user engagement could have played a role. Investors often anticipate future performance, leading to preemptive buying and pushing stock prices up. Further investigation into the company's recent activities is warranted.

Analyzing the Long-Term Outlook for HOOD

While the 6.46% increase is undoubtedly positive news for Robinhood investors, it's crucial to avoid drawing overly optimistic conclusions based on a single day's performance. The long-term outlook for HOOD remains complex, impacted by several factors:

-

Competition: Robinhood faces stiff competition from established players like Fidelity and Charles Schwab, as well as newer entrants in the online brokerage space. Maintaining a competitive edge requires constant innovation and adaptation.

-

Regulatory Scrutiny: The fintech industry, including online brokerages, operates under significant regulatory scrutiny. Changes in regulations could impact Robinhood's operations and profitability.

-

User Acquisition and Retention: Attracting and retaining users remains crucial for Robinhood's success. The platform's ability to offer compelling services and a positive user experience will dictate its future growth.

What's Next for Robinhood Investors?

The 6.46% jump provides a short-term boost, but long-term investors should maintain a balanced perspective. Careful monitoring of Robinhood's financial performance, upcoming announcements, and the broader market conditions is essential. Consider diversifying your portfolio to mitigate risks associated with individual stock performance.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood (HOOD) Stock Performance: 6.46% Increase Analyzed - June 3, 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Aimee Lou Wood And Walton Goggins Clarify White Lotus Chemistry And Social Media Drama

Jun 06, 2025

Aimee Lou Wood And Walton Goggins Clarify White Lotus Chemistry And Social Media Drama

Jun 06, 2025 -

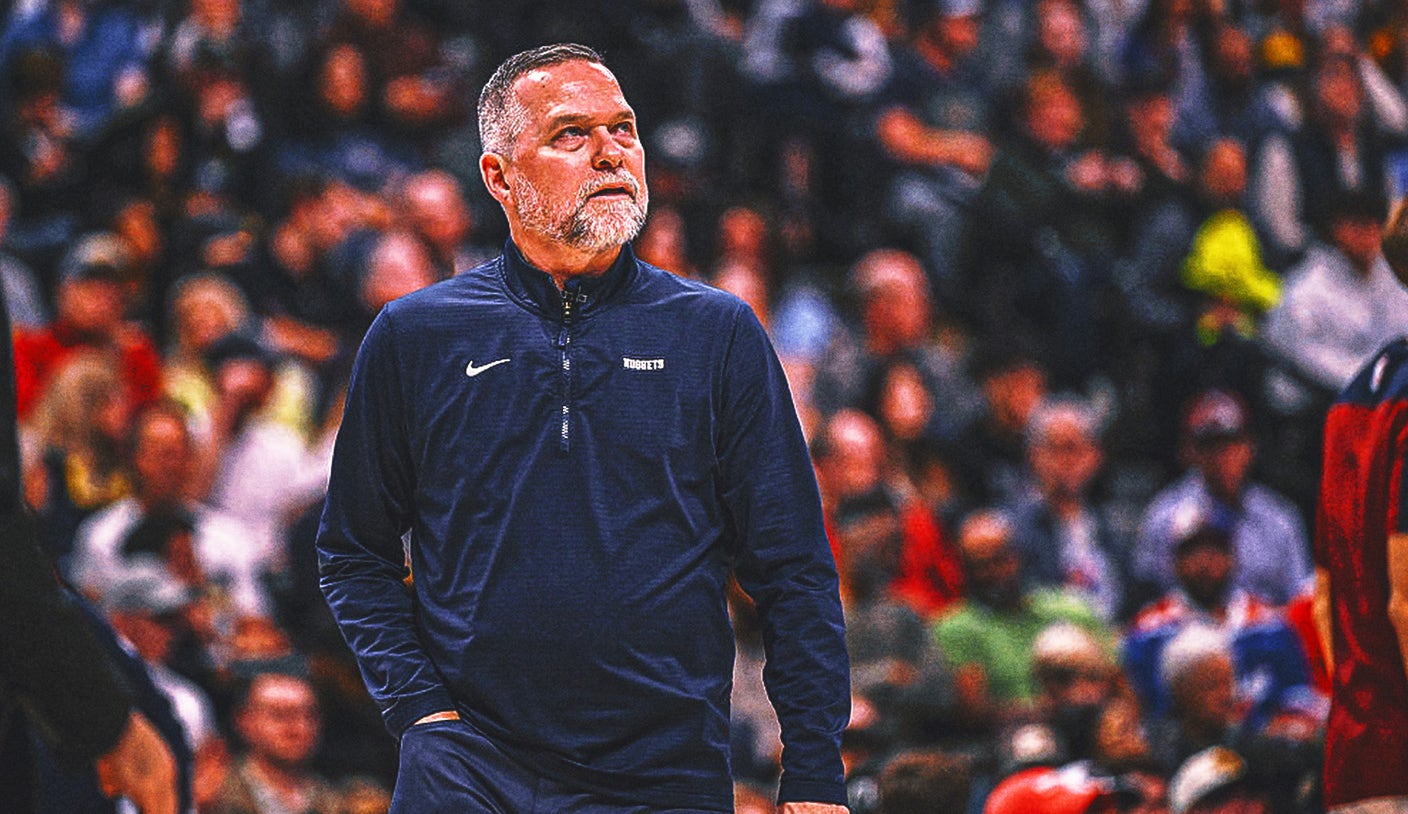

Betting Odds Favor These Coaches To Lead The New York Knicks

Jun 06, 2025

Betting Odds Favor These Coaches To Lead The New York Knicks

Jun 06, 2025 -

Ufc Fighter Maycee Barber Reveals Medical Emergency Demands More Testing

Jun 06, 2025

Ufc Fighter Maycee Barber Reveals Medical Emergency Demands More Testing

Jun 06, 2025 -

More Men Accuse Former Indiana University Team Doctor Of Sexual Misconduct

Jun 06, 2025

More Men Accuse Former Indiana University Team Doctor Of Sexual Misconduct

Jun 06, 2025 -

Mike Macdonald Defends Sam Darnolds Starting Role With Seahawks

Jun 06, 2025

Mike Macdonald Defends Sam Darnolds Starting Role With Seahawks

Jun 06, 2025