Robinhood (HOOD) Share Price Rises 6.46% June 3rd: Causes And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood (HOOD) Share Price Soars 6.46% on June 3rd: What Fueled the Surge and What's Next?

Robinhood Markets, Inc. (HOOD) experienced a significant boost on June 3rd, with its share price jumping 6.46%. This surge caught the attention of investors and analysts alike, prompting questions about the underlying causes and the future trajectory of the popular trading app. Understanding this price movement requires examining recent events and considering the broader context of the company's performance and the overall market sentiment.

What Triggered the 6.46% Jump?

While pinpointing the exact catalyst for such a dramatic single-day increase is difficult, several factors likely contributed to the positive market reaction:

-

Positive Earnings Expectations: While official earnings reports hadn't been released on June 3rd, positive market whispers and speculation about upcoming financial results could have fueled buying pressure. Analysts' expectations often influence investor sentiment, leading to preemptive trading activity.

-

Improved Market Sentiment Towards Tech Stocks: The broader tech sector experienced a period of relative strength in early June. This general upward trend often lifts individual tech stocks, particularly those that have been previously undervalued or underperforming. The overall improvement in investor confidence towards the tech market likely played a significant role in HOOD's price increase.

-

Increased Trading Volume: A noticeable increase in trading volume on June 3rd suggests a significant influx of buyers. This high volume confirms the market's interest in HOOD and supports the notion of a strong underlying positive sentiment.

-

Strategic Initiatives and Announcements (if applicable): Any recent news regarding new product launches, partnerships, or strategic initiatives from Robinhood would have also impacted the stock price. Check official company press releases for details on any such announcements made around this period.

Future Outlook for Robinhood (HOOD): Challenges and Opportunities

Despite the impressive June 3rd surge, investors should adopt a balanced perspective on Robinhood's future. The company faces significant challenges:

-

Increased Competition: Robinhood operates in a highly competitive market, facing pressure from established players and emerging fintech startups. Maintaining its market share requires continuous innovation and adaptation.

-

Regulatory Scrutiny: The financial technology sector is subject to intense regulatory scrutiny. Navigating these regulations effectively is crucial for long-term success.

-

Maintaining User Growth and Engagement: Attracting and retaining users in a saturated market is an ongoing challenge for Robinhood. Developing and maintaining engaging features and a user-friendly platform remains paramount.

However, Robinhood also possesses considerable strengths:

-

Brand Recognition and Wide User Base: Robinhood enjoys significant brand recognition and a large user base, providing a solid foundation for future growth.

-

Technological Innovation: The company's commitment to technological innovation allows it to adapt to changing market trends and user preferences.

-

Potential for Expansion: Robinhood has the potential to expand into new markets and offer additional financial services, thereby diversifying its revenue streams.

Conclusion:

The 6.46% jump in Robinhood's share price on June 3rd highlights the volatile nature of the stock market and the importance of conducting thorough research before investing. While positive market sentiment and speculation about future earnings contributed to the surge, investors should carefully weigh both the opportunities and challenges facing Robinhood before making any investment decisions. Keep an eye on future earnings reports and company announcements for a clearer picture of HOOD's long-term prospects. Consider consulting with a financial advisor before making any investment choices.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood (HOOD) Share Price Rises 6.46% June 3rd: Causes And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

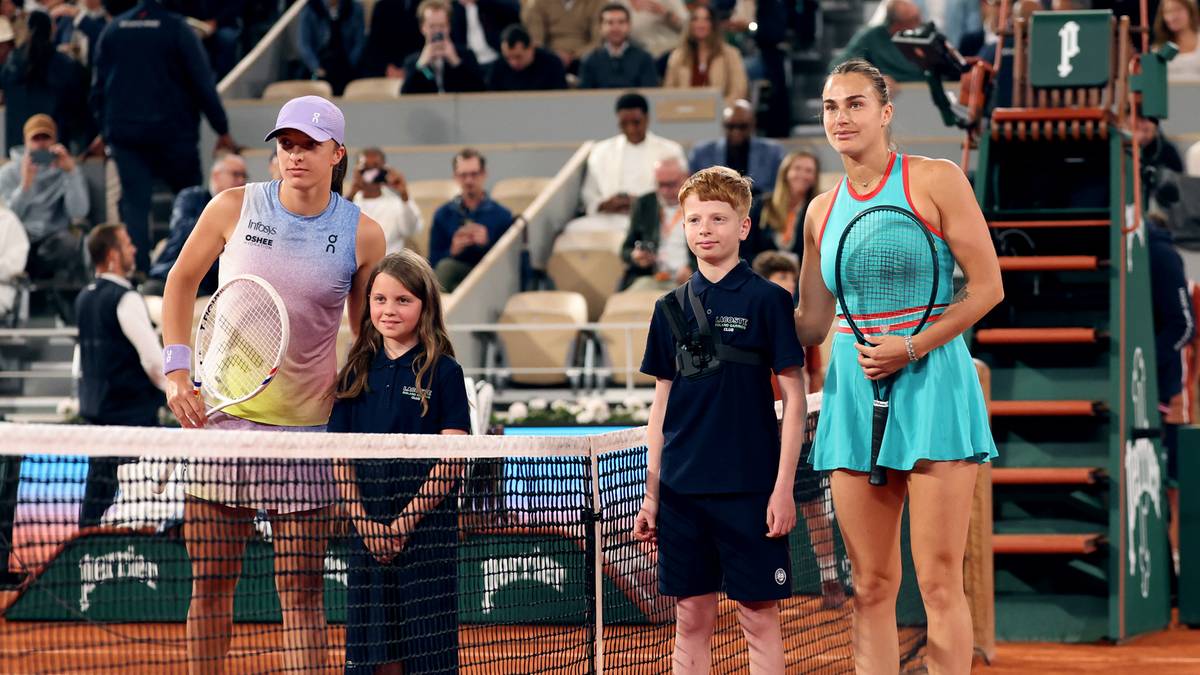

Iga Swiatek Aryna Sabalenka Live Stream I Wynik Meczu Roland Garros

Jun 06, 2025

Iga Swiatek Aryna Sabalenka Live Stream I Wynik Meczu Roland Garros

Jun 06, 2025 -

Uswnt Completes Unbeaten International Window Defeating Jamaica 4 0

Jun 06, 2025

Uswnt Completes Unbeaten International Window Defeating Jamaica 4 0

Jun 06, 2025 -

Core Weaves 7 Billion Lease Propels Applied Digital Stock 48 Higher

Jun 06, 2025

Core Weaves 7 Billion Lease Propels Applied Digital Stock 48 Higher

Jun 06, 2025 -

Marco Sturm Bruins New Head Coach

Jun 06, 2025

Marco Sturm Bruins New Head Coach

Jun 06, 2025 -

Edmonton Oilers Edge Florida Panthers In Playoff Opener

Jun 06, 2025

Edmonton Oilers Edge Florida Panthers In Playoff Opener

Jun 06, 2025