Reduced Returns For Experian (LON:EXPN) Investors: A Detailed Look

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Reduced Returns for Experian (LON:EXPN) Investors: A Detailed Look

Experian (LON:EXPN), a global leader in information services, recently reported results that have left some investors questioning the company's future trajectory. While the company continues to be a major player in the credit reporting and data analytics industry, a slowdown in growth and reduced returns have sparked concerns. This article delves into the details, examining the factors contributing to the decreased profitability and exploring potential implications for investors.

Experian's Q[Quarter] Results: A Deeper Dive

Experian's latest quarterly report revealed a [Specific percentage]% decrease in [Specific metric, e.g., net income, earnings per share] compared to the same period last year. This decline, while perhaps not catastrophic, is significant enough to warrant a closer examination. The company cited several contributing factors, including:

-

Increased Competition: The information services sector is becoming increasingly competitive, with both established players and new entrants vying for market share. This heightened competition is putting pressure on pricing and margins. This is a common challenge for established companies in rapidly evolving tech-driven markets. Understanding the competitive landscape is key for any investor considering Experian.

-

Macroeconomic Headwinds: The global economy is facing various headwinds, including inflation, rising interest rates, and potential recessionary pressures. These macroeconomic factors can significantly impact consumer spending and business investment, ultimately affecting Experian's revenue streams. This highlights the importance of macroeconomic analysis when assessing a company like Experian.

-

Investment in Future Growth: Experian is investing heavily in new technologies and expanding its product offerings. While these investments are crucial for long-term growth, they can negatively impact short-term profitability. This strategic approach, while potentially beneficial in the long run, needs to be weighed against the immediate impact on investor returns.

Analyzing the Impact on Investors

The reduced returns have naturally led to concerns among Experian investors. The share price has [describe the impact on share price - e.g., experienced a slight dip, fallen significantly]. This volatility underscores the risks associated with investing in even seemingly stable companies operating in a dynamic market.

What's Next for Experian?

Experian's management has outlined strategies to address the challenges and reignite growth. These include:

- Focus on Innovation: Continued investment in research and development to enhance existing products and develop new solutions to meet evolving market needs.

- Strategic Acquisitions: Potentially acquiring smaller companies to expand their market reach and product portfolio. This is a common growth strategy within the tech sector, and one that could significantly impact Experian's future performance.

- Cost Optimization: Implementing measures to streamline operations and improve efficiency to mitigate the impact of macroeconomic pressures.

Should Investors Hold or Sell?

The decision to hold or sell Experian shares depends on individual investment goals and risk tolerance. Investors with a long-term perspective may view the current dip as a buying opportunity, believing that Experian's long-term growth prospects remain strong. However, investors seeking immediate returns might consider diversifying their portfolios. It's crucial to conduct thorough due diligence and potentially consult with a financial advisor before making any investment decisions.

Disclaimer: This article provides general information and does not constitute financial advice. Always conduct your own research and consider seeking advice from a qualified financial professional before making any investment decisions.

Keywords: Experian, LON:EXPN, stock market, investment, financial news, information services, credit reporting, data analytics, macroeconomic factors, competition, share price, investor returns, quarterly results, financial analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Reduced Returns For Experian (LON:EXPN) Investors: A Detailed Look. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Liv Golf Chicago Playoff Drama Decides Stinger Gcs Tournament Win

Aug 12, 2025

Liv Golf Chicago Playoff Drama Decides Stinger Gcs Tournament Win

Aug 12, 2025 -

Investigation Underway After Plane Crash Lands At Kalispell Airport

Aug 12, 2025

Investigation Underway After Plane Crash Lands At Kalispell Airport

Aug 12, 2025 -

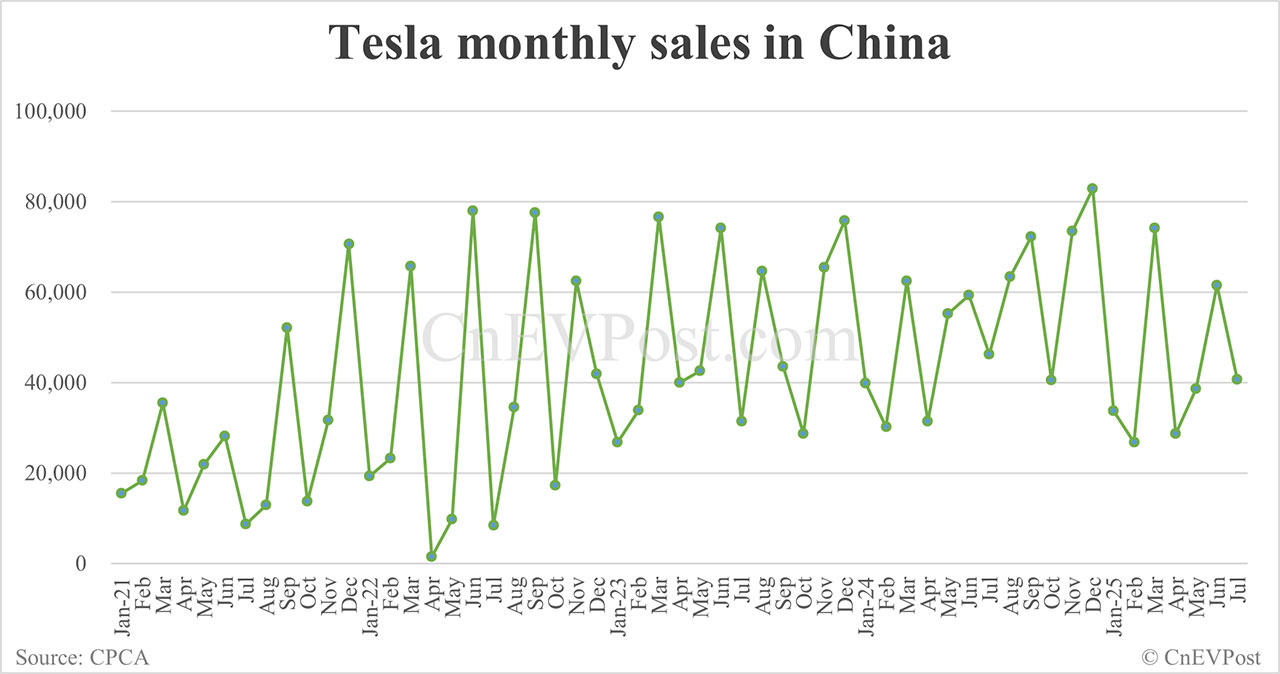

40 617 Units Sold Teslas July China Sales Reflect 12 Year On Year Decrease

Aug 12, 2025

40 617 Units Sold Teslas July China Sales Reflect 12 Year On Year Decrease

Aug 12, 2025 -

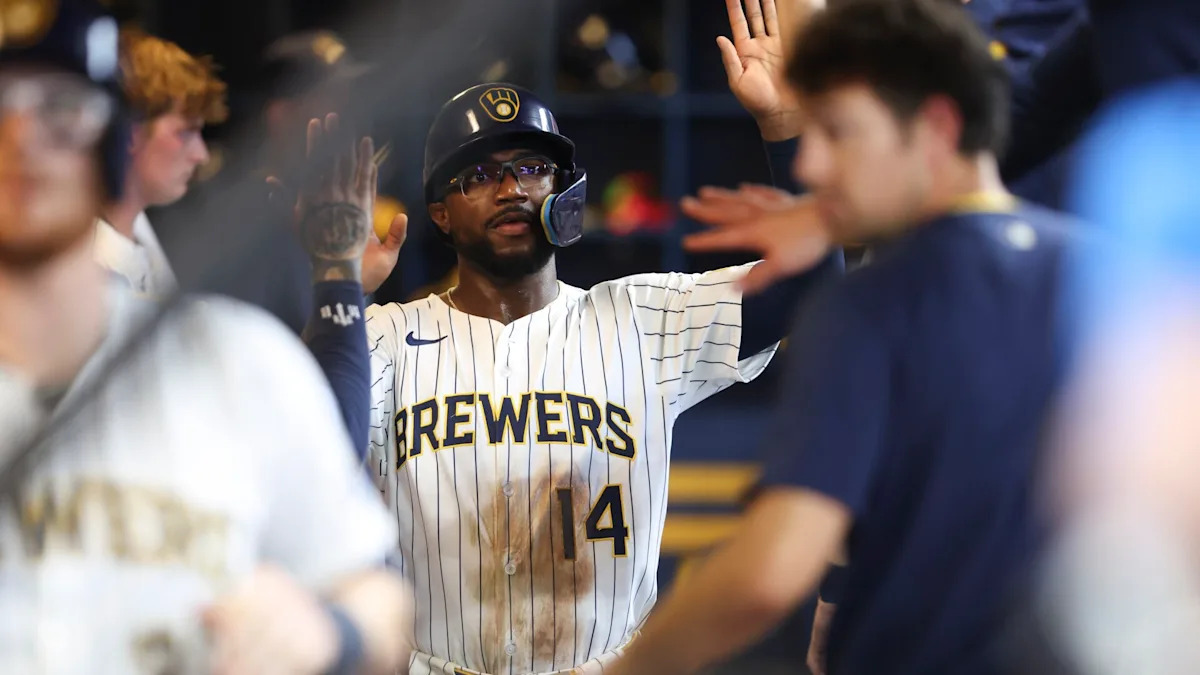

Mlb Betting Pirates At Brewers Game Prediction Odds And Stats August 11

Aug 12, 2025

Mlb Betting Pirates At Brewers Game Prediction Odds And Stats August 11

Aug 12, 2025 -

Pennsylvanias Little League World Series Victory Reagan Bills Historic Performance

Aug 12, 2025

Pennsylvanias Little League World Series Victory Reagan Bills Historic Performance

Aug 12, 2025

Latest Posts

-

Jermaine Johnsons Pup List Return A Significant Addition For The Jets

Aug 12, 2025

Jermaine Johnsons Pup List Return A Significant Addition For The Jets

Aug 12, 2025 -

Experians Share Repurchase Program A Boost After Recent Acquisition

Aug 12, 2025

Experians Share Repurchase Program A Boost After Recent Acquisition

Aug 12, 2025 -

Another Ejection For Aaron Boone Yankees Managers Season Of Controversy Continues

Aug 12, 2025

Another Ejection For Aaron Boone Yankees Managers Season Of Controversy Continues

Aug 12, 2025 -

Alex Palou The Making Of An Indycar Champion

Aug 12, 2025

Alex Palou The Making Of An Indycar Champion

Aug 12, 2025 -

Jermaine Johnson Activated Jets Boost Pass Rush Ahead Of Crucial Game

Aug 12, 2025

Jermaine Johnson Activated Jets Boost Pass Rush Ahead Of Crucial Game

Aug 12, 2025